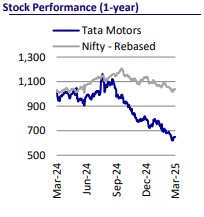

Neutral Tata Motors Ltd For Target Rs. 705 by Motilal Oswal Financial Services Ltd

Profit focus intact but global headwinds persist for JLR

SCV focus for India CVs, servicing focus in India PVs

We met with the TTMT management, and the KTAs of the same are as follows: The house of brands strategy is proving successful, with its top three models now well differentiated. It plans to position the Discovery brand accordingly. Going forward, the focus will be on profitable volume growth, without any major focus on market share. Management has maintained its FY25 guidance, unlike most other OEMs that have issued profit warnings. In the Indian CV segment, while the business has performed well across most parameters, the primary focus would be on regaining lost share in SCVs. In the Indian PV segment, apart from upcoming new launches, the company will focus on improving its service capabilities. However, we continue to remain on the sidelines regarding this company, given the uncertainties around threat from potential US tariff levies, weak global macro conditions, and the ramp-up of margin-dilutive EV business. In the absence of any triggers, we reiterate our Neutral stance with Dec’26E SOTP-based TP of INR705.

JLR Focus on house of brands pays off

* Management indicated that its house of brands strategy has yielded rich dividends, as it has successfully differentiated its key brands as premium luxury in each of the categories it operates in.

* The strategy has been particularly successful with the RR, RR Sport, and Defender. The Defender, for instance, was earlier priced at an average of GBP45k, which has now increased to GBP60k. Further, the recent differentiated offering in the model, Defender Octa, is priced at almost GBP200k and is expected to be the biggest blockbuster launch in the Middle East.

* Customers in this price segment are willing to pay a significant premium for unique products that stand out as differentiated.

* Management also mentioned that while these three brands have been successfully positioned as aspirational brands for consumers, it is working on positioning the Discovery brand in a similar manner. Additionally, once the Jaguar brand transitions to EV-only, it will be differentiated along similar lines.

* Regarding the remaining products, management indicated that Velar is likely to move to the EMA architecture in 2026. It also needs to consider a differentiated positioning strategy for Evoque.

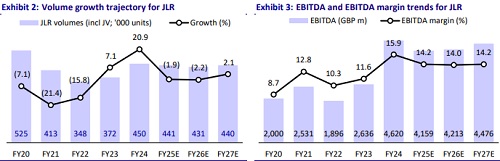

* Given this aspirational positioning, it is no longer focused on market share targets. JLR will focus on volume/revenue growth, but in a more profitable manner.

Uncertainty surrounding EV adoption in key regions

* Management has indicated that the pace of EV adoption is slowing down in its key markets. Its MLA platform is already flexible between ICE and BEV powertrains. For the Jaguar brand, it is transitioning to an EV-only positioning. Its EV-focused architecture, EMA, may need adjustments if consumer adoption of EVs slows significantly. Further, given the uncertainty around the pace of EV adoption in key markets, the company may need to extend the life of its ICE platforms beyond the originally planned timeline. It may also consider launching new ICE variants in the future. However, even if it proceeds with ICE products, they are unlikely to be capex heavy.

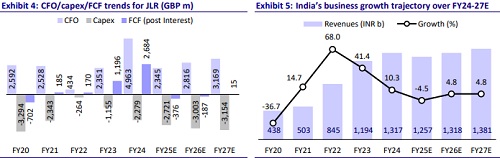

* Management has maintained that capex guidance is likely to remain at current levels going forward.

* The peak of its launch cycle is expected to occur in 2026, by which time it aims to be net debt-free.

* Uncertainty around the impact of tariff barriers persists, and the company will wait to assess whether any material changes to its current business model are necessary as a result.

Region-wise outlook

* JLR is currently experiencing decent growth in Europe, and the UK is also in recovery mode.

* The US is expected to continue witnessing healthy demand moving forward.

* China continues to remain under stress. However, JLR remains the least impacted with a decline of just 3% compared to the industry’s decline of 20%+. Its inventory in China is also well under control. Overall, management has indicated that the business has become much more resilient. Once demand in China revives, it is likely to see an improvement in market share.

* The company’s focus will be on ‘profitable growth’.

* Management has indicated that it will be able to achieve its FY25 guidance, unlike most other OEMs that have issued profit warnings.

* In terms of brands, Jaguar is expected to phase out its ICE variants next year. For Land Rover, it anticipates continued outperformance driven by strong demand for its top three models.

Higher operational costs likely to normalize

* Management indicated that the key reason for the rise in VME has been the high discounts currently offered on Jaguar. The VME for its top three models is just 2-3% of revenues, which is substantially lower than peers. However, the VME for Jaguar and other LR models is much higher. Additionally, given that Jaguar’s ICE will be discontinued soon in its ICE avatar, it expects VME to start normalizing in the coming quarters.

* Warranty costs have inched higher and have been disappointing, according to the management. One reason for this is the delay in merging its parts warehouse division, which took much longer than expected. This delay led to the unavailability of spares with dealers, causing customers to wait. Warranty costs were also higher due to the increased mix from the US. In the US, labor costs are on an uptrend, which tends to increase warranty provision costs. Moreover, quality-related issues are more prevalent in models produced before 2021, as the company is seeing minimal issues with models produced after 2021. Further, with the rising mix of software-defined vehicles, warranty provisioning has started to rise, as skilled manpower is required to address issues when they occur.

Update on Indian CVs

* Management has indicated that the CV business has done an excellent job improving market share in key segments, as well as enhancing profitability and returns.

* It has seen strong market share growth in the bus segment, a category it previously did not focus on, and expects the bus business to continue performing well.

* Additionally, the spare parts and digital businesses are on the right track.

* However, the SCV division performance has been disappointing, and the company is now focused on getting it back on track by FY26. Management indicated that it has been losing share in this segment due to the poor execution of its plans. It intends to appoint a new leader for this business soon, who will be responsible for turning around this segment going forward.

Update on Indian PVs

* TTMT has indicated that it will look to relaunch/reposition Currv during the upcoming IPL. It acknowledged that it has not communicated the brand’s positioning effectively in this case.

* It is also looking to launch a variant of Altroz to help reverse the declining sales of the model.

* Soon, it will begin branding campaigns around the Harrier EV launch.

* Beyond this, the Sierra is expected to be launched during the upcoming festive season, which management anticipates will be one of its most exciting launches of the fiscal year.

* Management has indicated that it is not concerned about the rising number of EV launches in the market. In fact, it expects EV adoption to pick up, with many large OEMs preparing to launch EVs. According to management, the only EV that appears to be standing out as key competition is Windsor, whose positioning is seen as highly competitive.

* Management has also indicated that it expects TTMT’s EV contribution to increase to 20% in the coming fiscal year, with further growth to 30%. However, it believes that an EV contribution of around 15% will be sufficient to meet the upcoming CAFÉ norms.

Key focus remains on bringing service capabilities up to par

* Management indicated that while most of its products are well positioned, there is a need to enhance the service capabilities of its outlets.

* Given the rise in its market share without a corresponding increase in servicing throughput, customers are now facing challenges in receiving timely service.

* It plans to encourage dealers to invest in service capabilities, emphasizing that it aligns with their long-term interests.

* Additionally, it may consider separating the channels between mass market and premium brands at a later stage.

Other highlights

* PV demand remains weak, primarily due to the high base of the industry.

* Management has indicated dissatisfaction with the PV contribution margin, indicating that its EBITDA margin is at least 300bp lower than its desired level.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412