Buy Jindal Stainless Ltd for the Target Rs. 810 by Motilal Oswal Financial Services Ltd

Expansion underway to cater to robust demand

We initiated coverage on Jindal Stainless (JSL) on 13th May’25 at a price of INR610 for a target price of INR770. The stock has gained 20% after our report in one month and we believe there is further steam left. The company’s expansion projects and cost-saving initiatives would ensure stable earnings growth ahead. We retain our positive stance on the stock with a TP of INR810.

Strategic expansions to propel growth:

* JSL is investing INR57b to expand its upstream capacity, enhance downstream operations and diversify its product mix via 1.2mtpa steel metal shop (SMS) JV in Indonesia, which will increase its total capacity by 40% to 4.2mtpa by FY27E.

* JSL is expanding its downstream operation in Jajpur and has acquired JUSL (hot 3.2mtpa and cold 0.2mtpa rolling capacity) to cater to 1.2mtpa incremental upstream capacity in Indonesia JV.

* For product diversification, JSL has acquired Rathi Super Steel (RSSL) and Rabirun Vinimay (RVPL) to cater to infra demand. It has also acquired Chromeni Steels (0.6mtpa with plan to expand till 4mtpa) to increase CR share to 75% (vs. 45% currently).

Focus on cost savings via backward integration:

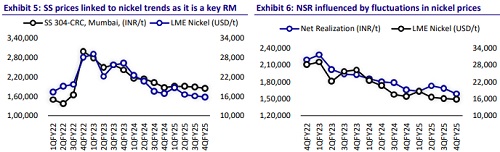

* Nickel accounts for ~50% of its input costs, making it a critical raw material for stainless steel (SS) production. India lacks domestic reserves and mainly relies on imports (ferronickel/SS scrap).

* JSL has entered into a JV with New Yaking Pte Ltd for a nickel pig iron (NPI) smelter in Indonesia (49% stake) to secure long-term supply. This will ensure annual supply of 0.2mt NPI with 14% nickel content and reduce its exposure to nickel price fluctuations.

Volume growth with enhanced margins to drive earnings

* The merger with promoter holding company, strategic JVs, and acquisition of key assets have resulted in increased capacity, enhanced backward integration, and downstream product diversification/value addition.

* We believe these measures will help JSL deliver a 10% CAGR in volumes and 4% CAGR in NSR over FY25-27, driving a similar 14% CAGR in revenue. With a better cost structure and higher share of value-added products (VAP), we anticipate EBITDA/t of INR20,500 to INR22,000 over FY26-27E.

* With stable capex intensity and healthy OCF of INR62b during FY26-27E, we believe JSL’s net debt will remain at a comfortable level and JSL would comfortably fund the ongoing capex.

Valuation and view

* The SS industry is poised for strong growth as India’s SS consumption is expected to reach 7.3mt by FY31 and 12.5-20mt by 2047, backed by rising adaptability across sectors like infrastructure projects, manufacturing, automotive, consumer durables, and growing new-age sector. We believe JSL is well placed to realize this robust demand outlook, with higher VAP supporting margins.

* From being solely a flat SS producer to a diversified long SS player, JSL has expanded into rebar, wire rods, and others, unlocking significant infrastructure opportunities. Additionally, its focus on value-added CR SS has strengthened its position in both domestic and export markets.

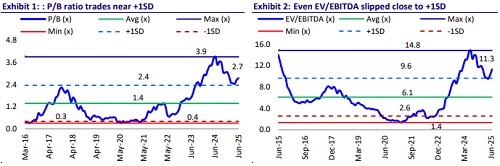

* At CMP, the stock trades at 9.6x EV/EBITDA and 2.5x P/BV on FY27E. We maintain our BUY rating with a revised TP of INR810 (premised on 11x FY27E EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)