Buy Adani Ports & SEZ Ltd for the Target Rs. 1,700 by Motilal Oswal Financial Services Ltd

Logistics business set for exponential growth

* We attended the Adani Logistics Day event and visited the Tumb Inland Container Depot (ICD) in Gujarat. The Tumb ICD highlights the company’s strategic efforts to enhance logistics efficiency, reduce costs, and promote sustainability. In the next few years, Adani Ports & SEZ (APSEZ) is targeting a robust 50% revenue CAGR in its logistics vertical.

* The Tumb ICD, operated by Adani Logistics Ltd. (ALL), is strategically positioned as a critical logistics hub with robust infrastructure, connectivity, and cargo handling capabilities. With an annual capacity of 0.5m TEUs, it handled 0.3m TEUs in FY25 and is targeting 0.4m TEUs in FY26. Located near key consumption and industrial centers, Tumb ICD benefits significantly from its direct linkage to Jawaharlal Nehru Port Trust (JNPT), which enables a swift 18-hour turnaround—nearly 50% faster than traditional road transit. The facility supports a wide range of cargo types— chemicals, electrical goods, marbles, and apparel—demonstrating operational flexibility.

* APSEZ expects its overall logistics business to grow multifold over FY25-29, with revenue surging 5x to INR140b (INR28b in FY25) and generating an EBITDA of INR35b in FY29. The integration of the logistics business with the ports business is enhancing APSEZ’s service offerings and transforming the company into a transport utility. We reiterate our BUY rating with a revised TP of INR1,700 (implying 19% potential upside)

Tumb ICD visit – a strategic MMLP catering to JNPT in Maharashtra and Hazira port in Gujarat

* Tumb ICD, operated by ALL, is a key hub for EXIM container traffic, with 95% of its cargo bound for JNPT. ALL holds a strong market position, managing 30% of JNPT’s overall volumes and 70% of JNPT-bound cargo near the Tumb area, with one in every three containers from Nava Sheva originating here.

* The ICD demonstrates operational versatility by handling a wide mix of cargo, including chemicals, stones and marbles, electrical goods, and apparel.

* Further, ALL is strategically leveraging Dedicated Freight Corridor (DFC) connectivity to position Tumb ICD as one of India's most efficient cargohandling hubs, offering faster, more sustainable transport.

* A key client, Waree Energies, operates a 5.4GW cell manufacturing plant nearby and depends heavily on ALL for supply chain support, underlining the strategic relevance of Tumb ICD in regional logistics. Its partnership with clients like Waree underscores its value proposition, with API-led tech integration streamlining supply chains, reducing inventory days, and facilitating a 400% volume growth over three years for Waree.

Building infrastructure for strong future growth in the logistics business

* As APSEZ aims to become India's largest integrated transport utility company by 2029, it is strengthening its capabilities in all logistics segments (ports, CTO, warehousing, last-mile delivery, ICDs, etc). Hence, it offers end-to-end services to its customers, thereby capturing a higher wallet share and making the cargo sticky in nature.

* ALL expanded its services to cover container train operations, container handling in logistic parks, and warehouses offering storage and trucking solutions. With 12 multi-modal logistics parks, 132 trains, 3.1m sq. ft. of warehousing space, and 1.2mmt of grain silos, ALL aims to establish a nationwide presence by further developing logistic parks and warehouses.

* With significant capital investments planned for the trucking operations— INR10–15b in FY26 and INR50b by FY30—APSEZ maintains a hybrid model, owning 937 trucks but operating over 26,000 via third parties. It is also expanding value-added services like freight forwarding to improve RoCE.

Port volumes – Targets to double volumes by 2029

* ADSEZ handled 450mmt (+9% YoY) of cargo volumes in FY25. The growth was supported by containers, which rose 19% YoY, followed by liquids & gas (+9%). Management has projected to handle 505-515MMT of cargo in FY26.

* Further, ADSEZ targets to double its volumes handled to 1b tons by 2029. This would be mainly driven by domestic port volumes (850m tons) and does not include any inorganic growth.

* ADSEZ is expected to record volume growth driven by market share gains and increased capacity at existing ports. The logistics business will serve as a value addition to the domestic port business with a focus on enhancing last-mile connectivity.

Valuation and view

* The Tumb ICD visit showcased how the overall logistics business of APSEZ is poised for robust growth, driven by increasing adoption of rail-based logistics, rising EXIM volumes, and ALL’s strategic focus on multimodal infrastructure. Upcoming investments in fleet expansion and value-added services such as freight forwarding are expected to improve asset utilization and returns.

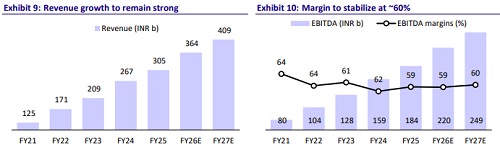

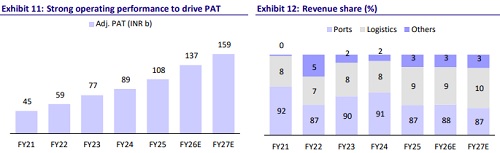

* APSEZ’s diversified cargo mix and ongoing infrastructure investments are expected to support its target of 505–515MMT cargo handling in FY26. We expect APSEZ to report 10% growth in cargo volumes over FY25-27. This would drive a CAGR of 16%/16%/21% in revenue/EBITDA/PAT over FY25-27. We reiterate our BUY rating with a TP of INR1,700 (premised on 16x FY27E EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)