Buy HDFC AMC Ltd For Target Rs.4,800 by Motilal Oswal Financial Services Ltd

Large headroom for growth ahead!

We attended an analyst meet hosted by the management team of HDFCAMC, focusing on macro trends and the company’s initiatives to maintain its top position and profitability. The following are the key takeaways from the meet:.

* The SIP monthly flow of INR264b is currently being directed to AMCs. This run rate could slow down if there is an extended weak sentiment in equity markets. Nevertheless, structurally, given the stark under penetration with only 53m unique MF investors and the push from fintech players, the industry’s momentum is expected to sustain over the long term.

* HDFCAMC’s strategy has been focused on growing its SIP book through a strong fund performance, wide product basket including 100+ schemes (across active and passive funds), and a strong distribution reach.

* HDFC Bank continues to demonstrate strong performance, with its incremental SIP market share higher than the overall flow market share, which, in turn, is higher than the overall AUM market share.

* Alternates is another area of focus, with dedicated investment teams in place. Moreover, the new product offering (INR1-5m) is a good proposition that aligns well with the affluent segment needs.

* Cost optimization is at the core of HDFCAMC’s long-term strategy, making it best-in-class in terms of margins. Calibrated investments will continue to expand its presence and enhance the customer experience.

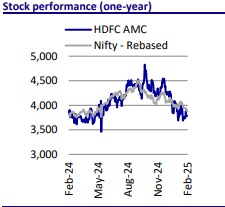

* We have cut our EPS estimates by 6% each for FY26/27 to factor in the recent weakness in markets, by lowering our equity AUM growth and cutting yields on the investment book. We reiterate our BUY rating on the stock with a TP of INR4,800 (premised on 38x FY27E Core EPS).

Long-term industry growth drivers intact

* The industry has grown over the years, driven by a strong track record of AMCs, high transparency ensured by the regulator, robust technology, and continued investments in training and awareness. However, key risks include prolonged weakness in the markets and the challenge of maintaining profitability, as evidenced by 21 AMCs that have been unable to make operating profits.

* Customer behavior is shifting, with a focus on long-term value creation rather than quick profits from MF investments. This is reflected in the increased net inflows during market corrections observed over the past five years. In addition, the younger generation’s aspiration for long-term wealth creation is making the customer base more sticky.

* AMFI’s marketing campaign, ‘Mutual Fund Sahi Hai’, has been ramped up to encourage individuals to stay focused on long-term investments and not be swayed by weak market sentiments.

* The industry has spent INR14b (~2bp of AUM as of 31 Jan’25) on various campaigns to raise awareness, enhance investor knowledge on various aspects of mutual fund investing, and promote long-term investing behavior. These efforts will be tested if the market continues to remain weak for a prolonged duration.

* The industry’s SIP book has more than doubled from Jan’22 to Jan’25, growing consistently and achieving a new peak almost every month. The explosive growth trajectory has been a positive surprise as well, benefitting AUM with fresh inflows in the bank each month (INR264b in Jan’25).

* While weak market sentiments may lead to a slight decline in SIP flows from the current levels, they are still expected to remain high compared to historical trends, making significant contribution to the industry’s AUM.

* Management expects the MF industry to be the biggest beneficiary of the tax slab change introduced in the Union Budget 2025-26.

* The threat from new entrants in the industry, particularly large fintechs, is not significant for experienced players like HDFCAMC, as a strong performance track record is essential to gain clients’ trust.

* Most retail customers are currently investing in fixed-income asset class through hybrid schemes. Increased efforts are required to raise awareness and drive growth in fixed-income AUM.

HDFCAMC’s strategic initiatives to help maintain its top position

* HDFCAMC’s growth is expected to be driven by enhancing its core capabilities – investment management, risk management, and product management– complemented by investments in its sales network relationship, service capabilities, and content.

* The company has a diverse product book with 100+ product offerings and only a few products in the pipeline for launch.

* The company’s priority is to drive the growth of the systematic book by expanding channel presence, marketing passives, and enhancing digital platforms.

* In the fast-growing alternates space, the company has introduced new schemes and formed a dedicated team for private credit. The new product category approved by the regulator with minimum ticket size of INR1-5m presents a great opportunity to cater to the affluent class.

* Growth across the industry and the entry of new players have increased competition in terms of talent. The company’s talent retention strategy is focused on: 1) compensation at par with industry standards and wealth creation; 2) providing growth opportunities at all levels (analysts transitioned to the FM role); and 3) maintaining a good working culture.

* HDFCAMC has been one of the most profitable AMCs with a largely consistent opex trajectory, despite witnessing significant growth in the last few years with respect to AUM, capabilities, and talent. Its calibrated approach towards spending has resulted in stable cost structures.

* The company may consider an M&A opportunity if the deal is beneficial for its growth, adds value, and benefits stakeholders.

Maintains healthy relations with all channel partners

* Discussions with various MFDs have been largely focused on methods to achieve business growth moving forward, rather than on ways to address the weak market performance.

* The extensive experience of MFDs across multiple market cycles facilitates the company’s efforts in this channel compared to others.

* In the HDFC Bank channel, the flow market share is higher than the book market share, and the new SIP creation market share is higher than the flow market share. This is due to investments in the salesforce and engagement at various levels. HDFC Bank’s 100m customer base presents a large growth opportunity for HDFCAMC.

* Fintechs like Groww and Zerodha have witnessed exponential growth over the years, from 0.4m SIPs in FY20 to 25-30m SIPs in FY24. Only two players–Groww and Zerodha–have an AUM of INR1.5t, reflecting the rising financial inclusion across younger tech-savvy investors.

* All channels are witnessing growth, with fintech channel partners growing through new investors and other channels growing through rising investments from existing investors.

Valuation and view

* HDFCAMC has been one of the top-performing players in the industry, benefitting from an experienced team with a strong track record, best-in-class cost management, upside from the HDFC channel, and continued investments to enhance capabilities. The company’s wide expertise in the industry provides it with an edge over many peers who have recently entered the industry.

* We have cut our EPS estimates by 6% each for FY26/27 to account for the impact of weak market performance on MTM and slower growth of equity AUM. We reiterate our BUY rating on the stock with a TP of INR4,800 (premised on 38x FY27E Core EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412