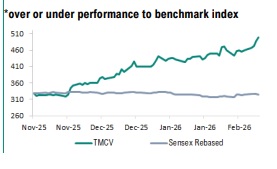

Buy Tata Motors Ltd for Target Rs. 550 by Geojit Investments Ltd

New launches fuel expansion

Tata Motors Ltd (formerly TML Commercial Vehicles Ltd), a leading automobile manufacturer in India, designs, manufactures and sells commercial vehicles (CVs).

* In Q3FY26, revenue grew 16.1% YoY to Rs. 21,847cr, driven by higher volume, improved realisations, and strong domestic and export demand.

* CV revenue grew 16.5% YoY to Rs. 21,534cr, supported by higher wholesale across the HCV, ILMCV and SCV segments amid post-monsoon demand recovery.

* Total CV sales rose 21% YoY to 1,15,577 units, led by a rebound in construction and mining activity, festive demand, and infrastructure sector momentum.

* EBITDA grew 26.3% YoY to Rs. 2,585cr, with margin expanding 90bps YoY to 11.8%, driven by higher sales and a larger revenue base.

* The company recognised a one-time statutory impact from new labour codes, including gratuity of Rs. 508cr and absences of Rs. 95cr, due to revised wage definition requirements.

* Management expects exports to deliver strong double-digit growth next year, driven by robust demand and expansion into new international markets

Outlook & Valuation

The company delivered strong double-digit performance, driven by resilient demand conditions and effective execution across key categories. Management highlighted stable demand visibility, supported by healthy channel orders, portfolio refreshes and focused market activations. Strategic priorities include new product launches, premiumisation, expansion into adjacent segments and deeper rural penetration. Continued focus on operational efficiencies, supply-chain optimisation and disciplined cost management is expected to support business stability amid competitive intensity. While margin pressures remain monitorable, execution-led initiatives are expected to aid medium-term performance. Given these factors, we assign a BUY rating on the stock with a target price of Rs. 550 based on 25x FY28E adjusted EPS.

Key concall highlights

* The Iveco acquisition is progressing as planned, with regulatory approvals expected by end-March and deal closure targeted for Q1FY27, which would expand the company’s global presence.

* In Q3FY26, the company won multiple government bus tenders, totalling ~6,000 units, with deliveries expected over the next 10-12 months, strengthening its public transport footprint.

* The company launched 17 next-generation trucks, including electric models in the range of 7-55 ton, built on an intelligent modular electric vehicle architecture for future scalability.

* For Q4FY26, management expects improved demand and sales momentum across all segments, with trucks continuing their strong growth and market momentum.

* It plans to bid for Convergence Energy Services Ltd’s new tender for 6,300 electric buses, building on its earlier participation in the 10,000-unit tender opportunity.

* The company introduced Ace Pro and Ace Gold with Lean NOx Trap technology, driving SCV retail volumes to 45,000 units in Q3FY26, the highest since Q1FY24.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH20000034