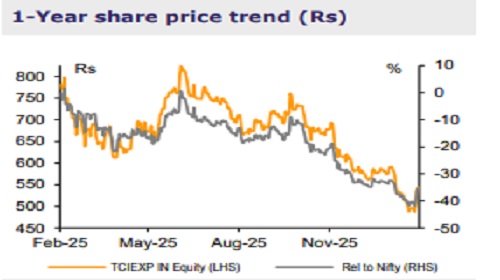

Reduce TCI Express Ltd for the Target Rs. 630 by Emkay Global Financial Services Ltd

TCIE’s revenue growth turned positive in Q3FY26 (+6% YoY), following an extended period of subdued performance (volumes declining over 8 consecutive quarters). While headwinds and elevated competitive intensity persisted in the B2B Express industry, higher share of wallet and new customer wins have led to the surface segment posting 3% YoY growth. The management’s efforts toward diversifying business beyond Surface seem to be fructifying, as the international air express/rail/C2C segments logged 28%/24%/32% YoY growth. We view the management strategy—of growing multimodal services toward contributing 20-22% of overall revenue in coming 2-3 years—positively, given the diversification benefits. The mgmt expects overall revenue to grow 17-18% in FY27, primarily driven by volumes. However, given the challenging external environment, we remain conservative in our expectations—5% revenue CAGR over FY25-28E. We believe TCIE’s investments in automation are likely to be beneficial in the long term, as and when the volume trajectory improves. Factoring in the Q3 miss on margins, we cut FY27E/28E EBITDA by 5% each, while retaining REDUCE. Dec-26E TP of Rs630 (basis DCF method) is unchanged, implying FY28E P/E of 21x

Subdued performance persists TCIE posted revenue growth of 6% YoY in Q3FY26. Festive season demand drove strong sales, whereas on the modal front, the International Air segment expanded 28% YoY. The top-five sectors (Auto, Pharma, Engineering, Electronics, and Textile) contributed 55% to the total revenue, with SMEs contributing 49%. Given the muted growth, gross margin declined marginally to 27.9%. EBITDA margin however expanded by ~59bps YoY to 10.3% YoY, as employee costs grew 3% while other expenses declined 2% YoY. Rise in ‘other income’ by 36% YoY more than offsets the rise in depreciation and interest costs (up 14% and 19% YoY, respectively). PAT was up 15% YoY. 9M capex stood at Rs450mn. The company declared an interim dividend of Rs7/share in Q3.

Call highlights 1) The management has given guidance for FY27 revenue growth of 17-18%, mainly driven by 15% volume growth and a 2% hike in rates. The management also gave guidance for PAT growth of 20%. 2) It remains optimistic about improving the margin trajectory by 100-300bps by FY27, with better utilization (Q3: 83.25%; volume handled: 2.5L MT) and higher focus on expanding SME share. 3) The management aims to return to >15% margin levels by FY28/29. This recovery relies on the new services (Rail, Air, C2C) maturing and achieving higher utilization. 4) In the last 3Y, TCIE spent Rs2.5bn of its planned 5Y capex of Rs5bn (now, Rs4bn); it expects spending Rs1.5bn by FY27, mainly on automated centers. 5) TCIE added 5 new branches in Q3. The mgmt does not see any need for more branches in the balance year. 6) SME mix was stable (Q3: 49%), inching closer to the LT goal of 50%. 7) Staff costs appeared elevated due to the addition of >300 employees for network expansion and sales, as well as a one-time gratuity impact of Rs6mn. The company plans increasing its sales force to 500 by Mar-27.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354