Neutral Alkem Lab Ltd for the Target Rs.525 by Motilal Oswal Financial Services Ltd

Expanding scope of business in the Medtech segment

Widening reach; product approval to drive profitable growth

* Alkem Lab (ALKEM) is advancing its MedTech strategy through the acquisition of up to a 55% stake in Occlutech for ~EUR99m (~INR10.6b), gaining control of a specialist in minimally invasive devices for congenital heart disease, stroke prevention, and heart failure.

* Occlutech is a leading structural heart and closure device company with over 10 product lines, presence in more than 70 countries, manufacturing in Germany and Turkey, and over 200,000 devices sold; it ranks as the thirdlargest player in the global occluder segment.

* The company has delivered ~17% revenue CAGR over CY22–24 (EUR43m in CY24; ~EUR49m est. CY25), with CY25 revenue/EBITDA/loss at ~EUR49m/EUR2m/EUR6.8m; margins remain in single digits (~5%), with the company targeting expansion to ~23–24% over the next 3–4 years.

* The transaction aligns with ALKEM’s broader MedTech focus on musculoskeletal and cardiovascular segments within a large global opportunity (USD680b MedTech; USD87b Cardiovascular), where it has already established a base in orthopedics through a hybrid entry model and the Bombay Ortho acquisition.

* For ALKEM, acquiring an R&D-focused company with a presence in developed markets is strategic move to scale its MedTech business. Occlutech’s profitability has yet to improve despite over 15 years of presence in this space, primarily due to an enhanced focus on R&D. ALKEM intends to drive profitability by expanding its reach and accelerating product approvals/launches. The valuation appears decent, provided performance progresses in line with guidance.

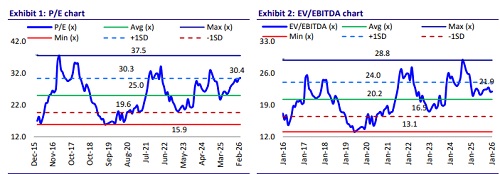

* ALKEM is diversifying its growth levers into the MedTech and CDMO space, in addition to its domestic formulations segment. On an overall basis, we expect 10.5%/12% CAGR in revenue/EBITDA over FY26-28. Earnings are expected to remain stable over FY26-28 due to a step-up in tax rate. The valuation adequately factors in the upside. Reiterate Neutral on the stock

Occlutech acquisition strategically compelling; profitability execution key monitorable

* Occlutech is a leading specialist provider of minimally invasive structural heart occlusion devices, with presence across the congenital heart disease, stroke prevention, and heart failure segments. The company has commercialized its products in over 70 countries, with manufacturing facilities in Germany and Turkey.

* Its portfolio comprises over 10 product lines across three therapeutic areas, with over 200,000 devices sold since inception.

* It has delivered ~17% sales CAGR over CY22-24 to EUR43m and is estimated to reach EUR49m (~INR4.9b) in CY25, implying ~16.5% CAGR over CY22-25. Over the next five years, ALKEM intends to scale revenue to INR10b+ and expand EBITDA margin from ~5% currently to ~20-25%.

* This implies EV/EBITDA of ~15x/~7x on CY28E/CY30E EBITDA. The acquisition is 3.6x CY25 sales.

* ALKEM plans to leverage Occlutech as a global MedTech entry platform across Japan, the US, and Europe.

Highlights from the management commentary

* ALKEM has guided for overall MedTech revenue to reach INR15b, with an EBITDA margin of 22-25% over the next five years.

* Occlutech has been focusing on R&D, with INR1.2b spent in CY24. The R&D spend may rise to INR1.5b, including the development of the LAA product.

* Investment related to Patent Foramen Ovale (PFO) is largely complete, and the company expects US approval by Jun'27.

* Launching existing products in different markets (LATAM, APAC), securing PFO approval for the US market (Jun’27; the US has better pricing than EU), and cost optimization are expected to drive overall profitability for Occlutech.

* Occlutech has a field strength of 65 to cater to the western EU market.

* ALKEM expects 45-46% of sales from EU and 20% from US in the occlutech business over the next five years, from the current 71%/14% from EU/US.

* As part of MedTech, ALKEM will focus on load-bearing large joints in the orthopaedic and cardiovascular segments.

* For products like occluders, management highlighted that the interoperative procedure is as critical as the product itself in influencing a surgeon’s choice for treating patients

* Within the musculoskeletal space, ALKEM has set a target of 250k implants over the next five years and a 10% market share in India.

* As part of its global expansion, CE approval for the knee/hip products is expected in 4QFY28.

* ALKEM indicated that the knee/hip products will be launched in 2Q/4QFY27, respectively, in the Indian market.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412