Buy EFC Ltd For Target Rs. 465 By Choice Broking Ltd

Business Overview: EFC Limited (EFCIL) operates in the flexible workspace and commercial real estate sector with three main verticals- Office Rental, Design & Build (D&B) and Furniture Manufacturing, contributing 57%,40% and 3% respectively to FY25 revenue. The D&B and Furniture Manufacturing segment is leveraging internal synergies by supplying products to its Office Rental segment through backward integration, while also fulfilling third-party orders.

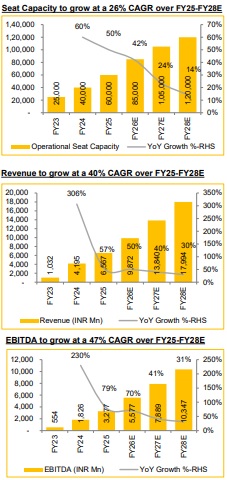

Expansion of Seat Capacity to 1,20,000 Set to Propel Revenue Growth in the Office Rental Segment: To cater to the increasing demand from GCCs, start-ups, hybrid work models, and businesses opting for Opex-based cost structures, EFCIL is set to ramp up its seating capacity at a CAGR of 26% between FY25 and FY28E, with a goal of reaching 1,20,000 seats by FY28E. This expansion is projected to drive a 27% CAGR in revenue during the same timeframe

What makes EFCIL a strong investment opportunity in the Flexible Workspace Sector?

1) 20k seat addition in FY26/27/28E taking the total stock of seats leased under management to 120k by FY28E (doubling from FY25 end). EFCIL provides cost-effective pricing (?6,500–?7,500 per seat per month) while maintaining strong utilization levels of approximately 90%, giving it a competitive edge. 2) EFCIL’s strategic backward integration into the Design & Build (D&B) and Furniture Manufacturing segments has been key to maintaining healthy EBITDA margins of around 30%. By managing critical aspects of the value chain—such as interior design, fit-outs, and furniture production in-house—the company reduces reliance on external suppliers, cuts costs, and enhances operational efficiency. This integration not only supports strong profitability but also allows EFCIL to offer competitive pricing (?6,500–?7,500 per seat per month) while sustaining high utilization levels of ~90%, reinforcing its competitive advantage. 3) D&B segment is expected to grow at a CAGR of 50% over FY25-28E given EFCIL’s first mover advantage and years of experience in executing turnkey projects in a profitable manner (FY26-28E EBITDA margin of 20%). Current orderbook for this segment is INR 2,000 Mn and no capex is to be incurred in the D&B vertical in FY26. 4) Furniture Manufacturing is expected to grow at a CAGR of 40% (on a very low base) over FY25-28E with an EBITDA margin guidance of 30%.This unit went alive at the onset of Q3FY25 and has a revenue potential of INR 2,750- 3,000 Mn at full capacity. Management is targeting 50-60% capacity utilization going forward.

Overall, we anticipate Revenue/EBITDA/PAT CAGR of 40%/47%/64%, supported by our assumptions as discussed in the above 4 points. Any gains from REIT IPO launch would be an additional bonus that we don’t factor into our numbers.

Valuation: We arrive at a 1 year forward (FY27E-28E blended) TP of INR 465/share for EFC. We now value EFC on our EV/EBITDA framework, where we assign an EV/EBITDA multiple of 10x/10x for FY 27E/ 28E (consolidated basis), which we believe is reasonable given the growth rate and margin profile. On our target price of INR 465, FY27E implied P/BV multiple translates to 3.5X.

Key Risks: A broad based slowdown in the domestic economy, cold startup funding, abating offshoring/GCC trend, predatory pricing by larger competitors remain risks to our BUY rating.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131