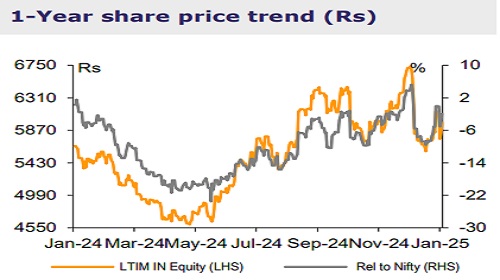

Reduce LTIMindtree Ltd For Target Rs. 6,000 By Emkay Global Financial Services

LTIM reported a mixed performance in Q3FY25; revenue growth of 1.8% QoQ CC was in line with our estimate, while EBITM of 13.8% fell slightly short of our expectations. Deal wins of USD1.7bn (book-to-bill: ~1.5x) was the highest ever, supported by large deals, vendor consolidation, and deal renewals, particularly in BFSI. The deal pipeline continues to be dominated by cost reduction and vendor consolidation. The management expects growth momentum to sustain in Q4 on the back of deal ramp-up, partial reversal of furloughs, and continued strength in BFS, though partly offset by near-term headwinds from AI-driven productivity in the top client and lesser working days. Discretionary spending has improved in select pockets of BFS (regulatory space), though broad-based spends are yet to rebound in a secular manner. Based on recent deal-wins and pipeline, FY26 is expected to be better than FY25, with focus maintained on profitable growth. We tweak FY25-27E EPS by 1.2-1.8%, considering the Q3 performance; retain REDUCE and TP of Rs6,000 at 28x Dec-26E EPS.

Results Summary

Revenue grew 1.1% QoQ (1.8% CC) to USD1.14bn, similar to our estimate of 1.8% CC growth. EBITM declined by 170bps QoQ to 13.8%, slightly lower than our estimate of 14%. EBITM was negatively impacted by wage hikes (-220bps) and partially offset by ongoing efforts on cost optimization (50bps). All industries saw decline in their operating margins sequentially. Ttop-5 clients’ revenue declined 0.7% QoQ, while the top 6-10 clients saw growth of 1.1% QoQ. North America and ROW saw growth of 0.7% and 9% QoQ, respectively, in USD terms, while Europe declined 2.7% (CC 3% growth). Among verticals, BFSI and Manufacturing & Resources saw growth of 3.4% and 8.1% QoQ, while CMT, Consumer, and Healthcare, Lifesciences & Public Services declined 5.8%, 0.7%, and 0.2% QoQ, respectively. TTM attrition – saw a marginal dip to 14.3% from 14.5%, in Q2FY25. Total headcount grew 2.8% QoQ to 86,800. Utilization (excl trainees) declined from 87.7% in Q2 to 85.4% in Q3. What we liked: Strong deal intake, healthy cash conversion (OCF/EBITDA 86%). What we did not like: Margin miss, weakness in top client.

Earnings Call KTAs

1) LTIM won record deal wins (worth USD1.68bn, up 29% QoQ), which include a new logo worth over USD50mn in Manufacturing, and two large deals in the BFSI vertical. 2) Technology declined 5.5% CC QoQ due to pass-through of AI-driven productivity benefit at the top client. The mgmt indicated that this caused an impact for 2 months in Q3, and that the full-quarter impact will reflect in Q4 numbers. The mgmt stated that impact on margin will be neutral from passing-on of productivity benefits. 3) It expects margins to improve in Q4, though full impact of absorbing the wage hikes may take longer in the current growth environment. Margin improvement continues to be a growth factor. 4) AI spends have started shifting from proof of concept to scale projects in select areas as well as foundational data and infrastructure. Savings from cost reduction and vendor consolidation programs are being deployed in pilot programs and for scaling AI initiatives. 5) Utilization comfort-range remains at 85-86%. Q4 would see improvement in utilization which should aid margin. Ahead, utilization and hiring should remain a function of market conditions and demand environment. 6) Manufacturing has seen good momentum, with LTIM signing a couple of large deals. It has lower exposure to Auto, and is considerably engaged in Industrial Manufacturing. 7) LTIM added 1,400 freshers in Q3.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)