Buy Ellenbarrie Industrial Gases Ltd for the Target Rs.350 by Motilal Oswal Financial Services Ltd

Near-term challenges, but structural growth drivers intact

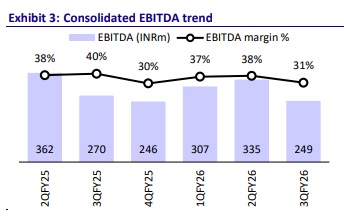

EBITDA below our est., while adj. PAT in line due to higher other income

* Ellenbarrie (ELLEN) delivered a weak performance in 3QFY26 as its EBITDA declined 8% YoY to INR249m. The dip was mainly due to the price declines of key industrial gases – argon, oxygen, and nitrogen – led by muted demand in the steel industry.

* We expect the growth momentum to accelerate, driven by the ramp-up of the Uluberia-II (220 TPD) facility and the commissioning of the East India Onsite Plant (320 TPD) in 1QFY27. It will also be supported by margin expansion as the company intensifies its focus on power-cost optimization.

* Though we retain our FY26E earnings, we cut our FY27E/FY28E earnings by 8%/ 9% due to slower-than-expected recovery in the prices of key industrial gases and the weak operating performance in 3QFY26.

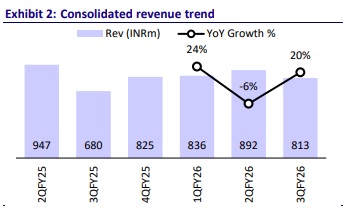

Revenue growth offset by EBITDA weakness

* ELLEN reported a total revenue of INR813m (in line) in 3QFY26, up ~20% YoY. EBITDA margin stood at 30.6% (est. 35.3%) vs. 39.7% in 3QFY25. EBITDA declined 8% YoY to INR249m (est. INR293m). Adj. PAT grew 36% YoY to INR261m (est. INR248m), led by higher other income (up 71% YoY).

* Gases, related products & services revenue grew 17% YoY to INR792m, EBIT grew 24% YoY to INR274m, and EBIT margin was 35% (vs. 33% in 3QFY25).

* Project engineering revenue stood at INR22m (up 3.8X YoY), EBIT stood at INR2.3m (up 11% YoY), and EBIT margin was 11% (vs. 37% in 3QFY25).

* For 9MFY26, revenue/EBITDA/adj. PAT grew 10%/5%/25% to INR2.5b/ INR890m/INR815m.

Highlights from the management commentary

* Expansion plans: ELLEN is on track to expand pan-India, with the Uluberia-2 merchant plant now operational, and the North India bulk plant (220 TPD) is targeted for commissioning in 2HFY27. However, the East India onsite plant (320 TPD) is now slated for commissioning in 1QFY27 (vs. 4QFY26).

* New-age industries: The solar cell segment is witnessing strong traction, while competitors already hold some legacy contracts in the solar space. ELLEN is in key discussions for the same. As the domestic solar cell capacity scales up, the opportunity pool is expected to expand for all industry participants.

* Outlook: The company has reiterated its long-term EBITDA margin guidance of ~40%, led by the ramp-up of cost-efficient plants and normalization of argon prices. The revenue CAGR guidance remains unchanged at 20-25%.

Valuation and view

* Going forward, the company’s strategic efforts towards power-cost optimization, along with higher contributions from argon, green energy initiatives, and capacity ramp-up, will lead to operating leverage of the newly commercialized plants.

* ELLEN’s growth story will be led by 1) capacity expansion across India, 2) normalization of argon prices, 3) increasing traction in the solar cell segment, 4) the growing semiconductor value chain, 5) stable demand from well-diversified core industries, and 6) recovery in the steel sector.

* We build in a CAGR of 29%/34%/36% in revenue/EBITDA/adj. PAT over FY25- 28E. We maintain our FY26 earnings estimates and reduce our FY27/FY28 earnings estimates by 8%/9% due to slower than expected recovery in prices of key industrial gases and the weak operating performance in 3QFY26, and reiterate our BUY rating with a TP of INR350 (based on 27Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412