Buy Westlife Foodworld Ltd For Target Rs. 900 By Yes Securities Ltd

Industry momentum key for robust SSSG

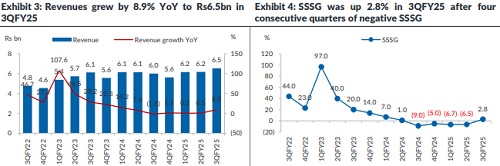

Westlife Foodworld Ltd. (WFL) 3QFY25 topline was only slightly below our subdued expectations for the quarter keeping in mind the tough operating environment. Samestore sales growth (SSSG) was up 2.8% YoY (vs est. of +4%), led by guest count (especially in dine-in) while average check remained stable. Management believes growth is coming back but gradually. Company reported QoQ improvement in gross margin led by 50bps price hike in portfolio in November’24. YoY growth will continue to look better on account of low base. We continue to remain cautious about full demand recovery especially in urban markets but are also confident that Westlife will rebound to earlier margin profile (even with increased royalty rate) once industry volume recovers. We assign a target multiple of ~25x on our March’27E EBITDA and arrive at a revised target price (TP) of Rs900 (Rs985 earlier). Maintain BUY.

3QFY25 Result Highlights

* Headline performance: Topline grew by 8.9% YoY to Rs6.5bn (vs. est. Rs6.7bn) led by SSSG of 2.8% YoY (vs. our est. 4%). This represents a 5-year SSSG CAGR of ~4%. EBITDA came in at Rs916mn (vs. est. Rs869mn). Adjusted profit stood at Rs102mn vs our est. profit of Rs77mn.

* Off-Premise and On-Premise business, both grew by ~9% YoY.

* Gross margin was down ~20bps YoY to 70.1% (but up 40bps QoQ led by 50bps portfolio level price hike). Rise in employee cost as a % of revenue (up 80bps YoY) along with higher other expenses as a % of revenues (up 140bps YoY) was partially offset by lower royalty cost (due to reconciliation of incentives from parent). EBITDA margin thus came in at 14% (down 200bps YoY; vs our est. of 13%). Pre-INDAS Op. margin stood at 9.1%.

* Restaurant operating margin (ROM) came in at 20.6% versus 22.5% in base quarter impacted by operating deleverage and higher A&P spends.

* 9MFY25 revenue is up 3.2% while EBITDA & APAT are down 16.9% and down 76.3% YoY, respectively. Gross margin stood flattish at 70.2% while EBITDA margins is down 320bps at 13.2%.

* Store additions: Added 15 stores and closed 2 in 3QFY25; total store count now 42

Key Conference Call/PPT Highlights .

(1) Company expects gradual recovery in eating out trends.

(2) 50bps price increase at portfolio level was executed in November’24. Intends to maintain quarterly improvement in EBITDA margin in the near-term.

(3) On track for store opening guidance..

View & Valuation

With gradual improvement in growth, we are now building ~4% SSSG CAGR over FY24-27E. This, along with aggressive store expansion (to open 200+ new restaurants in the next 3-4 years) should lead to 10.8% revenue CAGR over FY24-27E. Growth going forward will be driven transactions without any impact on average check size. The margin profile which had improved for WFL as AUV crossed the Rs60mn+ mark, has taken a hit in last 1.5-2 years due to difficult operating environment. As volume recover for the industry, operating leverage will rebound for the company. This, along with cost savings and consistent but modest gross margin improvement (led by stable input costs and mix+pricing), will support EBITDA margin expansion (building ~220bps expansion over FY24-27E). EBITDA thus expected to grow at 15.7% CAGR over FY24-27E. At CMP, the stock is trading at ~35x/25x/20x FY25E/FY26E/FY27E EBITDA (post IND-AS 116). In a normal environment, aggressive store expansion, market share gain focus, improving return ratios and a formal dividend policy in place, should command better valuation than earlier years, we believe. We continue to remain cautious about full demand recovery especially in urban markets but are also confident that Westlife will rebound to earlier margin profile (even with increased royalty rate) once industry volume recovers. We assign a target multiple of ~25x on our March’27E EBITDA and arrive at a revised target price (TP) of Rs900 (Rs985 earlier). Maintain BUY.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632