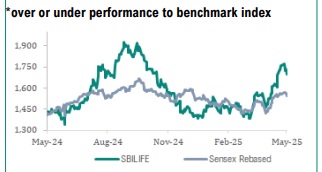

Buy SBI Life Insurance Company Ltd for Target Rs. 2,048 by Geojit Financial Services Ltd

Non-ULIP driving growth

SBI Life Insurance Company Ltd, a leading life insurance company in India, was incorporated in October 2000. It offers individual and group insurance plans, covering life and health, and annuity, pension and variable products. It also has unit-linked plans.

• In Q4FY25, net premium income declined 5.0% YoY to Rs. 23,861cr, driven by a substantial 42.1% YoY reduction in single premium income to Rs. 4,463cr.

• In FY25, new business premium (NBP) stood at Rs. 35,580cr, with a private market share of 20.8%. Individual NBP reached Rs. 26,360cr, reflecting an increase of 11% YoY and a private market share of 25.3% driven by growing demand for individual life insurance products.

• In FY25, gross written premium came in at Rs. 84,980cr, up 4% YoY, driven by consistency in policy renewals and moderate growth in both new and existing business.

• In FY25, VoNB rose 7.2% YoY to Rs. 5,950cr, with VoNBV margin at 27.8% (vs 28.1% in FY24), driven by volume growth, though partially offset by a slight shift in the product mix towards lower-margin offerings.

• Profit after tax (PAT) slightly increased 0.3% YoY to Rs. 814cr in Q4FY25, driven by operational efficiencies.

Outlook & Valuation

In Q4FY25, SBI Life reported a decline in both net premium and total income. Despite this, the company remains strategically focused on long-term growth through strengthening its agency and bancassurance channels, improving the product mix with increased emphasis on non-ULIP and protection products, advancing digital capabilities, and expanding its presence in underserved regions. These initiatives reflect management’s commitment to sustainable and profitable growth. Therefore, we maintain our BUY rating on the stock, based on 2x FY27E EV, with a revised target price of Rs. 2,048.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345