Buy Shriram Finance Ltd For Target Rs.700 by Motilal Oswal Financial Services Ltd

Healthy quarter despite minor asset quality deterioration

Earnings in line; NIM contracts due to negative carry from excess liquidity

* Shriram Finance (SHFL)’s PAT in 3QFY25 rose ~14% YoY to ~INR20.8b. Post-tax gain on the sale of Shriram Housing was ~INR14.9b. Reported PAT (including exceptional gain) stood at INR35.7b.

* PPoP grew 11% YoY to ~INR40.8b (in line). NII in 3QFY25 grew ~14% YoY to INR55.9b (in line). Credit costs of ~INR13.3b translated into annualized credit costs of ~2.1% (PQ: 2.1% and PY: 2.4%).

* Yields (calc.) rose ~15bp QoQ while CoB rose ~10bp QoQ to 8.8%, resulting in spreads rising ~5bp QoQ to ~7.8%. Reported NIM declined ~25bp QoQ to ~8.5%, primarily because of negative carry from excess liquidity on the balance sheet. NIM will exhibit improvement once the excess liquidity normalizes within two quarters.

* Management continued to guide for mid-teen AUM growth and a cost-toincome ratio of ~28% in FY26.

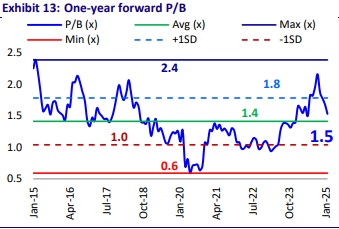

* SHFL has positioned itself to capitalize on its diversified AUM mix, improved access to liabilities, and enhanced cross-selling opportunities. The company has yet to fully utilize its distribution network for nonvehicle products. SHFL is our Top Idea (refer to the report) in the NBFC Sector for CY25, given that we find its valuations of 1.3x FY27E P/BV attractive for a strong franchise that can deliver a ~18%/~19% AUM/ PAT CAGR over FY24-27 and a RoA/RoE of ~3.2%/~16% in FY26. Reiterate BUY with a TP of INR700 (premised on 1.7x FY27E BVPS).

Minor deterioration in asset quality; higher PCR on standard loans

* GS3/NS3 deteriorated ~5bp each QoQ to ~5.4%/2.7%. PCR on Stage 3 was largely stable QoQ at ~52%. Asset quality exhibited minor deterioration in CE, CV, and MSME while it improved in PV and tractors.

* SHFL again increased the PCR on S1/S2 loans by ~5bp each QoQ. Writeoffs stood at INR4.4b, translating into ~0.8% of write-offs as % of TTM AUM (PQ: ~1% and PY: ~1.2%).

* Management guided credit costs of less than ~2%, while our credit cost estimates are marginally higher at ~2.3%/2.4% for FY26/FY27.

AUM rises 19% YoY; disbursement growth healthy at ~16% YoY

* Disbursements in 3QFY25 grew ~16% YoY to ~INR438b, and AUM rose ~19% YoY to INR2.54t. AUM growth of ~5% QoQ was driven by healthy growth across 2W (+18% QoQ), farm equipment (+7% QoQ), MSME (+7% QoQ), and PV (+6% QoQ).

* Gold Loan AUM has declined for two consecutive quarters. However, the company expects Gold AUM to grow in 4QFY25, followed by double-digit growth in gold loans going ahead.

* Management shared that CV utilization levels are good and the freight rates are also stable. We model an AUM CAGR of ~18% over FY24-27E.

NIM to benefit from product mix improvement and expected cut in repo rates

* A shift in the product mix to high-yielding non-CV products will be marginally accretive to the blended yields. A large proportion of this improvement in yields is expected to be driven by a higher proportion of gold loans and MSME loans in the AUM mix.

* With repo rate cuts expected in 1HCY25, SHFL is well-equipped to reap the benefits of a declining interest rate environment. We model NIMs of 9.1%/9.3% in FY26/FY27 (FY25E: ~9%).

Highlights from the management commentary

* The growth in used vehicle financing has primarily been driven by an increase in average ticket size, as the market supply of used vehicles remains constrained. However, over the next 3-5 years, SHFL is well-positioned to capitalize on this segment, as the supply of used vehicles in the market is expected to improve, creating new opportunities for financing.

* Liquidity on the balance sheet increased to ~INR270b from ~INR170b; which is equal to the next six months of liability repayments. This liquidity will moderate over the next two quarters, and it will go back to keeping liquidity equivalent to three months of liability repayments.

Valuation and View

* SHFL reported an operationally healthy quarter with strong AUM and disbursement growth. Minor deterioration in asset quality was likely because of a slowdown in economic activity, but the management was confident of seeing some positive momentum in asset quality in the seasonally stronger 4Q of this fiscal year.

* SHFL is effectively leveraging cross-selling opportunities to reach new customers and introduce new products, leading to improved operating metrics and a solid foundation for sustainable growth. The current valuation of ~1.3x FY27E BVPS is attractive for a ~19% PAT CAGR over FY24-27E and RoA/RoE of ~3.3%/16% in FY27E. Reiterate BUY with a TP of INR700 (based on 1.7x FY27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)