Buy Larsen & Toubro Ltd for the Target Rs. 4,300 by Motilal Oswal Financial Services Ltd

Execution momentum to continue

Our recent meeting with LT reinforces our thesis that execution growth will remain strong for the company over the next few years, driven by a strong order book. The company is selectively eyeing projects from domestic markets and expects international ordering to keep supporting growth. Though lower oil prices can impact decision-making in international projects in the near term, LT’s focus on gas, renewable and maintenance capex of existing oil fields will keep driving the inflows. LT is also focusing on next phase of Lakshya for FY26-31 and while remaining focused on EPC, company is focusing on growing these four new businesses which were seeded during Lakshya 2026 – real estate, semiconductor, green energy and data centre and will grow these in future. We maintain our estimates for LT and reiterate our BUY rating with an SoTP-based TP of INR4,300, valuing core E&C at 28x Sep’27E EPS.

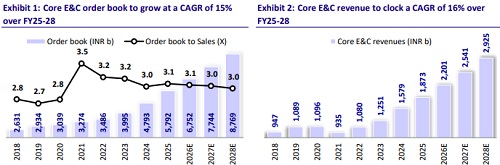

Strong order book to sustain execution growth

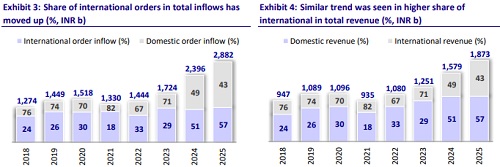

LT has an order book of INR6.1t as of 1QFY26. Core E&C revenue growth over the last three years and in 1QFY26 was largely driven by international projects, and we expect a similar trend to continue in the future too, as execution is ramping up across mega projects in the Middle East. We expect that strong execution growth in international projects will more than compensate for weaker growth in domestic revenue. We bake in core E&C revenue growth of 17%/15%/15% for FY26/27/28E

Opportunities from domestic and international

LT’s international order inflows have more than compensated for the flat trend in domestic inflows. With an overall prospect pipeline of INR15t for the remaining fiscal, the company is eyeing projects across thermal, nuclear, hydroelectric, renewable, urban infra, buildings and factories, state irrigation projects and defense in the domestic segment and gas, renewable and maintenance capex of existing oil fields in the international segment. The recent order inflows of INR230b in thermal from Adani, a significant order in nuclear from NPCIL, and other large orders in power T&D, heavy civil, high speed rail, renewable, and metals and minerals indicate momentum in these segments in domestic markets. International inflows so far in 1HFY26 have come from hydrocarbon, gas and power T&D.

Defense segment to grow at a faster pace

LT’s defense vertical is housed in the hi-tech manufacturing segment and has a prospect pipeline of INR215b. The company focuses on Naval systems, weapon systems, engineering and ground systems and sensors and communications. LT is eyeing projects across platforms and is collaborating with technology startups to strengthen its portfolio. LT has also entered into a strategic partnership with BEL to respond to the EoI issued for the AMCA project. L&T will bring its expertise in aerospace structures and systems integration, while BEL will contribute for avionics and defence electronics. During FY23-25, LT’s defense order inflows stood at INR121b/INR103b/INR133b and the revenue CAGR stood at 36%. This segment, though still small, is expected to grow much faster than the core E&C division.

Prospect pipeline and win rate remain strong

The company has a prospect pipeline of INR15t spread across international (INR9t) and domestic (INR6t), and this pipeline has seen some adjustments after 4QFY25 due to the deferment of some prospects in international markets and some waterrelated projects in domestic markets. However, with a win rate of 18-20% in the prospect pipeline, the company can target inflows of INR3-3.2t, translating into 10% YoY growth in total inflows in FY26. LT’s win rate in thermal power projects is much higher than its overall business as it is largely a two-player market. Its win rate is also higher in defense as the company works with clients for specific requirements in defense tendering.

Future focus areas of growth beyond core E&C

* Real Estate: In the Realty business, the company is primarily focusing on Tier-1 cities and has been actively scaling up its presence through a mix of land acquisitions and joint development projects. The company has around 75mn sq ft under development (launched + to be launched) and it intends to maintain a ratio of 25% for commercial and 75% for residential going forward. LT is scaling up its operations in this segment and plans to consider its IPO by FY27 end or early FY28.

* Green Hydrogen: L&T Energy GreenTech (LTEG) recently secured a major order from IOCL to set up India’s largest green hydrogen plant at Panipat, with a capacity of 10,000 TPA, supported by in-house electrolyser manufacturing at Hazira. With potential export opportunities, LT intends to expand its electrolyser manufacturing facility at Hazira to 1 GW from the current capacity of 400 MW. The company has also partnered with Japan’s ITOCHU to develop a 300 KTPA green ammonia project at Kandla and announced plans for an even larger 1.8 MTPA facility at Paradip.

* Semiconductor: In semiconductors, LT is primarily into the designing of analog semiconductors, which is mainly for industrial applications. The company acquired a 100% stake in SiliConch Systems to strengthen its presence in fabless semiconductors. Further, the company has allocated USD100m for this segment.

* Data centers: The company has acquired a stake in E2E Networks to strengthen its entry into the data center business, with a focus on accelerating cloud and AIled innovations for Indian enterprises. Till date, it has commissioned 32 MW of data center capacity and aims to scale this up to 100 MW over the years. Importantly, the company intends to operate and manage these assets inhouse, with no plans for divestment.

Financial outlook

We expect a CAGR of 11% in core EPC order inflows over FY25-28. With a strong track record of execution, we expect a 16% CAGR in core EPC revenue over the same period, with core EPC margin assumption of 8.5-8.8% for FY26-FY28. We thus expect a CAGR of 18%/21% in core EBITDA/PAT over FY25-28

Valuation and view

At the current price, LT is trading at 29x/24x/20x P/E on FY26/27/28E earnings of core E&C. We maintain our estimates for core E&C and continue to value the company at 28x P/E two-year forward earnings for core business and a 25% holding company discount for subsidiaries. We maintain BUY with a revised TP of INR4,300, rolling forward to Sep’27E EPS (INR4,200 earlier).

Key risks and concerns

A slowdown in order inflows, geopolitical issues, delays in the completion of mega and ultra-mega projects, a sharp rise in commodity prices, an increase in working capital, and increased competition are a few downside risks to our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412