Buy Container Corporation Ltd for the Target Rs. 980 by Motilal Oswal Financial Services Ltd

Market leadership to continue; DFC commissioning to drive volume growth ahead

CCRI will be the key beneficiary of DFC

* Market leadership and strong positioning: CCRI holds a dominant position with a ~58% market share at JNPT and a 56% pan-India share as of Mar’25, complemented by a significant presence at Mundra (37.7%) and Pipavav (48.4%) ports.

* Dedicated freight corridor (DFC) is a growth catalyst: The Dadri-to-Mundra DFC route, operational since May’23, has shifted CCRI’s business toward rail, enhancing efficiency. The full DFC commissioning by FY26 is expected to redirect northern hinterland volumes to JNPT, leveraging CCRI’s strong foothold.

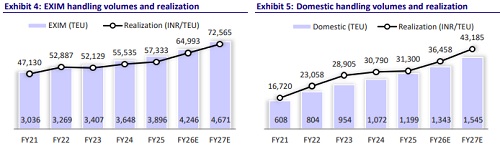

* Volume growth to improve: CCRI achieved a record 5.1m TEUs in FY25 (up 8% YoY), with domestic volumes rising 12% and EXIM volumes growing 7% despite global trade challenges. For FY26, CCRI targets total volume growth of 13% (10% EXIM, 20% domestic), driven by new services, high-margin sectors like FMCG, and DFC benefits.

* Infrastructure and long-term expansion: With FY25 capex of INR8.1b and FY26 capex target of INR8.6b, CCRI aims to expand its fleet to 500+ rakes (from 388 currently) and 70,000 containers (from 53,000+) by 2028 at 100 terminals. Four new terminals in FY26 will unlock additional freight corridors. With total container volumes at Indian ports estimated at 23m TEUs annually, CCRI’s extensive network and infrastructure investments position it well to capture incremental share. The full DFC commissioning, increasing adoption of double-stacked rakes, strategic focus on first-mile last-mile (FMLM) integration, and customer-centric innovations should drive volume growth and margin expansion.

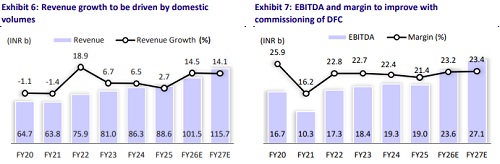

* We expect a 10% CAGR in blended volumes and EBITDA margin of 23-24% over FY25-27. The stock trades at ~16x FY27E EV/EBITDA. Reiterate BUY with a revised TP of INR980 (based on 20x EV/EBITDA on FY27E).

Strong volume growth and leadership in key markets

* In FY25, CCRI achieved a record container throughput of 5.1m TEUs, up 8% YoY. Domestic volumes grew ~12% YoY on the back of expanded services and its entry into new commodity segments, while EXIM volumes increased ~7% YoY, showcasing resilience despite global trade headwinds.

* The company has set a target of 13% volume growth for FY26, including 20% growth in domestic and 10% in EXIM volumes. CCRI’s strong network of terminals and growing traction in high-margin sectors like FMCG and solar 500 logistics are expected to help the company achieve this target.

* Market share gains across major ports in FY25 further reinforce CCRI’s dominance: JNPT improved to 58.4%, Mundra to 37.7%, and Pipavav to 48.4%. Despite rising competition, CCRI maintained pan-India leadership with a ~56% market share.

Strategic new initiatives to boost volumes

* The company operated 6,302 double-stacked rakes in FY25, up 16% YoY, which led to improved capacity utilization and lower per-unit transportation costs.

* Rail freight margins expanded by 55bp to 25.7%, aided by pricing discipline and cost optimization. Moreover, the FMLM cargo movement mix increased to ~60% in FY25 from 30-35% in FY23, and management plans to push this figure to 80- 85% in the coming years. This enhancement in end-to-end logistics capability supports margin improvement and strengthens CCRI’s value proposition for customers seeking integrated logistics solutions.

Aggressive capex to support long-term growth

* To sustain its growth momentum, CCRI invested INR8.1b in FY25 for the procurement of rakes, containers, and terminal modernization.

* The company has earmarked a higher capex of INR8.6b for FY26, which will be utilized for the expansion of its container and rake fleet, development of new terminals, and IT system upgrades.

* As of FY25, the company operated 388 rakes and over 53,000 containers. CCRI has ambitious expansion plans through FY28, including scaling up to 100 terminals, more than 500 rakes, and 70,000 containers.

* Additionally, four new terminals—Talabad (Jodhpur), Patri (Haridwar), Mandalgarh (Bhilwara), and Chunar (Varanasi)—are slated to be commissioned in FY26, enabling CCRI to tap into regional freight corridors and unlock incremental volumes.

Valuation and view

* In FY25, CCRI reinforced its logistics capabilities by expanding its double-stack rail operations, leveraging the DFC to boost efficiency, and enhancing its integrated logistics network. CCRI remains focused on scaling up its rail freight services and infrastructure, with an increased capex outlay for the commissioning of new terminals, fleet expansion, and the strengthening of multimodal connectivity.

* We expect a 10% CAGR in blended volumes and EBITDA margin of 23-24% over FY25-27. The stock trades at ~16x FY27E EV/EBITDA. Reiterate BUY with a revised TP of INR980 (based on 20x EV/EBITDA on FY27E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)