Buy Birla Corporation Ltd for the Target Rs.1,700 by Motilal Oswal Financial Services Ltd

Weak profitability; but long-term outlook intact

Strategic focus on value share improvement and expansion plans

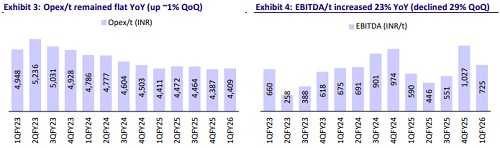

* Birla Corporation (BCORP)’s 1QFY26 EBITDA increased ~34% YoY to INR3.5b (~8% miss due to lower-than-estimated realization). EBITDA/t was up ~23% YoY to INR725 (est. INR838), and OPM surged 2.3pp YoY to~14% (est. ~16%). PAT rose 3.7x YoY to INR1.2b (~11% below estimate due to higher ETR).

* Management highlighted that profitability was adversely impacted by the extended shutdown at the Maihar and Mukutban plants, forcing BCORP to make clinker purchases from the market. This resulted in increased costs and a lower margin. Another factor was subdued pricing in the central region (a core market; BCORP sold ~50% of its volumes in this market). It is focusing on improving value share through premiumization and stronger brand positioning rather than chasing volume share. It is also focusing on its next phase of growth plan (both brownfield and greenfield expansions), targeting stronger performance going forward.

* We cut our EBITDA estimate by ~5% for FY26 while maintaining it for FY27. We also introduce our FY28 estimates with this note. The stock trades inexpensively at 8x/6x FY26E/FY27E EV/EBITDA and USD64/USD61 EV/t. We value the stock at 8x Jun’27E EV/EBITDA to arrive at our TP of INR1,700. Reiterate BUY.

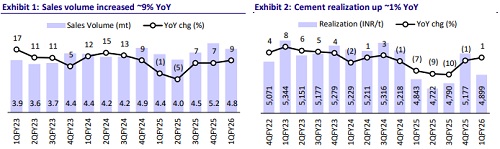

Volume up 9% YoY (6% beat); cement realization/t up 1% YoY (5% miss)

* Consol. revenue/EBITDA/Adj. PAT stood at INR24.5b/INR3.5b/INR1.2b (up 12%/34%/3.7x YoY and +1%/-8%/-11% vs. our estimates) in 1QFY26. Sales volumes increased 9% YoY to 4.8mt (+6% vs. our estimate). Cement realization inched up 1% YoY (down 5% QoQ) at INR4,899 (-5% vs. estimate).

* Opex/t remained flat YoY (-3% below our estimates). Variable/freight cost per ton increased ~7%/2% YoY, while employee cost/other expenses per ton declined ~6%/12% YoY. OPM expanded 2.3pp YoY to ~14%, and EBITDA/t increased ~23% YoY to INR725.

* Depreciation/interest costs declined 10%/18% YoY, whereas ‘Other income’ increased ~87% YoY. ETR stood at 32.6% vs. 25.9% in 1QFY25.

Highlights from the management commentary

* The temporary clinker shortfall will be resolved when the Maihar and Mukutban plants are back to normal operations. Further, debottlenecking initiatives and capacity optimization are likely to add incremental volumes.

* Fuel consumption costs were INR1.46/kcal vs. INR1.39/Kcal in 4QFY2. The green power share was ~27% vs. ~25% in 4QFY25. It is doing some modernization works to increase the total WHRS capacity by 10MW.

* Capex of INR1.0b was incurred in 1QFY26, and capex is pegged at INR9.0- 10.0b in the remaining 9MFY26 (guidance maintained).

Valuation and view

* BCORP’s 1QFY26 operating performance was below our estimates due to lowerthan-estimated realization. The subdued realization growth was due to weak pricing in the company’s core market (Central India). We estimate a moderate volume growth of ~6% YoY in FY26, focusing on increasing premium cement share to support realization improvement (estimated ~3% growth YoY). Progress on the company’s capacity expansion plans needs to be closely monitored.

* We estimate BCORP’s revenue/EBITDA/PAT CAGR of ~8%/18%/33% over FY25- 28. Estimate EBITDA/t at INR803/INR853/INR903 in FY26/FY27/FY28 vs. INR672 in FY25 (five-year average INR820). BCORP trades inexpensively at 8x/6x FY26E/FY27E EV/EBITDA and EV/t of USD60/USD57. We value the stock at 8x Jun’27E EV/EBITDA to arrive at our TP of INR1,700. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412