Buy Dalmia Bharat Ltd for the Target Rs. 2,660 by Motilal Oswal Financial Services Ltd

Profitability in line; lower opex/t drives better margin

GST rate cut passed on; capacity expansions on track

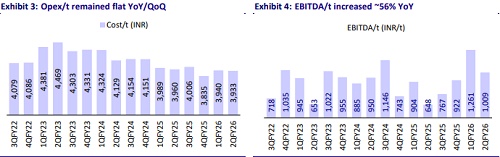

* Dalmia Bharat’s (DALBHARA) 2QFY26 operating performance was broadly in line with estimates. EBITDA grew ~60% YoY to INR7.0b (in line). EBITDA/t increased 56% YoY to INR1,009 (vs. estimate of INR980). OPM expanded 6.3pp YoY to ~20% (1pp above our estimate). PAT grew ~329% YoY to INR2.4b, albeit on a low base (~11% above our estimate, aided by higher other income and lower ETR).

* Management indicated that the GST rate cut has been passed on to consumers and remains optimistic about pricing stability going forward. Demand in 1H was soft due to heavy rains and the GST transition, which led to deferred purchases. However, the company expects demand to recover in 2H. On the cost front, the recent rise in petcoke prices and INR depreciation are expected to exert some cost pressure. However, the company remains focused on reducing variable costs. Capacity expansion at Belgaum and Kadapa is progressing as planned, supporting future growth.

* We have maintained our EBITDA estimate for FY26-28. However, our EPS estimate is raised by ~6% for FY27 due to lower depreciation and interest estimates, while it is maintained for FY26 and FY28. We value the stock at 13x Sep’27E EV/EBITDA to arrive at our TP of INR2,660. Reiterate BUY.

EBITDA/t increases ~56% YoY to INR1,009 (est. INR980)

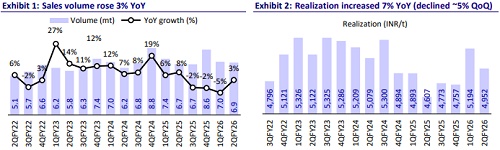

* DALBHARA’s consolidated revenue/EBITDA/PAT stood at INR34.2b/INR7.0b/ INR2.4b (+11%/+60%/+329% YoY and -1%/+4%/+11% vs. our estimate) in 2QFY26. Sales volume increased ~3% YoY to 6.9mt. Realization surged ~7% YoY (declined 5% QoQ) to INR4,952/t.

* Opex/t remained flat YoY/QoQ, as the impact of higher variable cost/t (up 3% YoY) was offset by lower other expenses/t (down 3%) and freight cost/t (down 4%). Employee cost/t remained flat YoY. OPM surged 6.3pp YoY to ~20%, and EBITDA/t increased ~56% YoY to INR1,009. Depreciation declined ~4% YoY, whereas interest cost increased ~24% YoY. Other income declined ~10% YoY. ETR stood at 24.8% vs. 20.5% in 2QFY25.

* In 1HFY26, revenue/EBITDA/PAT increased ~5%/43%/118% YoY. Volume remained flat YoY. Realization/t grew ~7% YoY, driving EBITDA/t to INR1,136 (up ~45% YoY). OPM expanded 6pp YoY to ~22%. OCF stood at INR7.4b vs. INR2.1b in 1HFY25. Net cash outflow stood at INR4.5b vs. INR11.8b in 1HFY25. In 2HFY26, we estimate revenue/EBITDA/PAT growth of ~11%/29%/61% YoY.

Highlights from the management commentary

* The decline in realization is partly attributed to the regional and segment mix. Directionally, the company is on track, steadily improving its price positioning across markets.

* The blended fuel consumption cost stood at INR1.38/kcal vs. INR1.33/kcal in 1QFY26. Renewable energy share on a consumption basis stood at ~48% vs. 39%/41% YoY/QoQ.

* Capex was pegged at INR30.0b for FY26E (vs. earlier guided of INR40.0b). Lower capex was attributed to credit terms negotiated with equipment suppliers and the deferral of certain non-budgeted projects to next year.

Valuation and view

* DALBHARA’s profitability was in line with our estimates. Margin was slightly better-than-estimates, led by strong cost control. Variable costs are likely to increase in the coming quarters due to higher petcoke prices. However, its higher green power share and alternative fuel mix are estimated to partly offset the impact. Our channel checks suggest a marginal correction in cement prices in the company’s core market in Oct’25. However, management estimates price stability in the near term alongside a demand recovery.

* We estimate a revenue/EBITDA/PAT CAGR of 9%/21%/32% over FY25-28. We estimate a volume CAGR of ~6% over FY25-28 and an EBITDA/t of INR1,090/ INR1,170/INR1,211 in FY26/FY27/FY28E vs. INR820 in FY25E (avg. EBITDA/t of INR1,013 over FY21-25). At CMP, the stock is trading attractively at 11x/10x FY27E/FY28E EV/EBITDA and USD88/USD83 EV/t. We value DALBHARA at 13x Sep’27E EV/EBITDA to arrive at our TP of INR2,660. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412