Buy Cholamandalam Inv. & Finance Ltd For Target Rs. 1,770 by Motilal Oswal Financial Services Ltd

Earnings in line; higher credit costs offset by lower opex

Healthy AUM growth; CIFC launches gold loan business

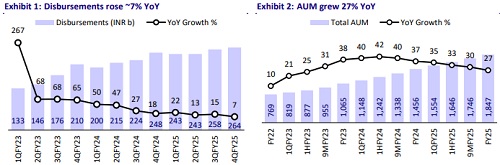

* Cholamandalam Inv. & Finance’s (CIFC) 4QFY25 PAT grew ~20% YoY to INR12.7b (in line). FY25 PAT grew ~24% YoY to INR42.6b.

* 4Q NII grew ~30% YoY to ~INR30.6b (in line). Other income grew ~26% YoY to ~INR7b (~9% beat), primarily driven by an upfront assignment income of ~INR940m.

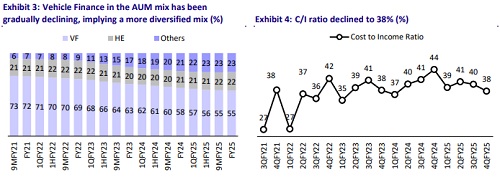

* Opex rose ~11% YoY to ~INR14.3b (~9% lower than MOFSLe) and the costincome ratio declined ~2pp QoQ to ~38% (PQ: ~40% and PY: ~44%). PPoP grew ~43% YoY to INR23.3b (~7% beat). Management guided for an opex-toassets ratio of ~3.0%-3.1% in FY26, given that the opex will remain elevated, driven by investments in branch expansions of the gold loan business.

* Yields (calc.) declined ~15bp QoQ to ~14.5%, while CoF (calc.) declined ~20bp QoQ to ~7.9%. NIM was stable QoQ at ~6.8%.

* Management expects stronger demand for LCVs and SCVs, supported by a favorable monsoon. CIFC guided for total AUM growth of ~20-25%, driven by ~20% growth in the vehicle finance (VF) segment and ~30% growth in the non-auto segments. The company guided for a ~10bp expansion in NIM in FY26, driven by a drop in CoF in a declining interest rate environment. We expect NIM to expand to ~7.0%/7.1% in FY26/FY27 (vs. ~6.9% in FY25). We estimate a CAGR of 18%/22%/30% in disbursement/AUM/PAT over FY25-27.

* CIFC will have to utilize its levers on NIM (and fee income) to offset the impact of moderation in AUM growth and elevated opex/credit costs. We estimate RoA/RoE of ~2.7%/21% in FY27. Reiterate BUY with a TP of INR1,770 (premised on 4x Mar’27E BVPS).

* Key risks: 1) weak macros translating into weaker vehicle demand and sustained lower capacity utilization; and 2) sustained deterioration in asset quality, particularly in the new businesses, which could keep the credit costs high for longer than estimated.

AUM rises ~27% YoY; share of new business loans at ~13% of total AUM

* Business AUM grew 27% YoY/6% QoQ to INR1.85t, with newer businesses now forming ~13% of the AUM mix. Total disbursements in 4QFY25 grew ~7% YoY and ~2% QoQ to ~INR264b. New lines of businesses contributed ~17% to the disbursement mix (PQ: ~21% and PY: ~23%), with the decline primarily attributed to the winding down of the CSEL business originated through partnerships. VF disbursements in 4QFY25 grew ~11% YoY.

* CIFC has launched its gold loan business, with plans to open 120 dedicated branches across southern and eastern India during the current quarter. The company will pilot the offering initially and will target gold AUM of ~INR10- 20b by Mar’26.

* Management also highlighted that the company has outperformed the industry in both PV and LCV segments, resulting in meaningful market share gains. We model AUM CAGR of ~22% over FY25-27E.

Asset quality deterioration in new businesses; GS3 declines ~10bp QoQ

* GS3/NS3 improved ~10bp/9bp QoQ to 2.8%/1.55%, while PCR on S3 rose ~120bp QoQ to ~45.3%. ECL/EAD declined to 1.84% (PQ: ~1.86%). GS3 in new businesses rose ~25bp QoQ to ~2.2% (PQ: 1.9% and PY: 1.1%).

* CIFC’s 4Q credit costs stood at ~INR6.3b (vs. MOFSLe of INR5.2b). This translated into annualized credit costs of ~1.4% (PY: 0.5% and PQ: ~1.6%). Stage 2 + Stage 3 (30+ dpd) declined ~30bp QoQ to ~5.3%.

* Write-offs in 4Q stood at ~INR4.9b, translating into ~1.35% of TTM AUM (PY: ~1.4% and PQ: 1.3%). Management guided for credit costs of ~1.3% in FY26 (vs. ~1.4% in FY25). We estimate credit costs of ~1.3%/1.2% in FY26/FY27.

Key highlights from the management commentary

* Management highlighted that credit costs in CSEL are expected to remain elevated through 1HFY26 and may begin to decline from 3Q/4QFY26 onward.

* CIFC has decided to exit its fintech partnerships within the CSEL segment. The impact of this exit is expected to be offset by growth in its in-house digital lending platform, consumer durable financing business, and the newly launched gold loan segment.

* The non-starter and early default rates declined in 4QFY25 but were still slightly above Mar’24 levels. CIFC guided for a YoY reduction in VF credit costs in 1QFY26.

Valuation and View

* CIFC reported healthy loan growth, supported by strong performance in Home Loans and LAP. While overall asset quality showed slight improvement, new business segments continued to see asset quality deterioration. Credit costs in CSEL remained elevated.

* The stock trades at 3.4x FY27E P/BV. In order to sustain this premium valuation multiple, CIFC will have to maintain its execution capabilities in new product lines and showcase a trajectory to bring down its credit costs. Further, it will have to navigate any cyclicality (if at all) in vehicle demand to deliver healthy AUM growth and asset quality through its diversified product mix. We estimate a CAGR of ~22%/30% in AUM/PAT over FY25-27 for RoA/RoE of 2.7%/21% in FY27E. Reiterate BUY with a TP of INR1,770 (premised on 4x Mar’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412