Neutral Aditya Birla Fashion and Retail Ltd for the Target Rs. 100 by Motilal Oswal Financial Services Ltd

Improved execution remains key to a sustained rerating

We interacted with the management of Aditya Birla Fashion and Retail (ABFRL) to discuss the growth prospects and profitability outlook for the company’s various segments and other focus areas. The key takeaways are as follows:

* Pantaloons is focusing on revamping its retail identity while focusing on improving margins by ~300bp over the next five years through improved SSSG and higher own-brand salience.

* The value retail format OWND! is breaking even on the store level and would be scaled up to 100 stores by the end of FY26, with an accelerated ramp-up from FY27.

* Designer-led ethnic brands are highly profitable (~20%+ margin). ABFRL’s target is to increase revenue contribution to ~INR20b from ~INR8b over the next few years, with further margin improvement to ~25%.

* The store rationalization and old inventory clearance in TCNS are largely behind, with store additions likely from 2HFY26. Management expects losses to reduce by ~50% in TCNS in FY26, with break-even targeted in FY27.

* TASVA is currently in the build-out phase and will target the top 200-250 wedding markets in India. Management believes TASVA can scale up to become an ~INR5b brand, which will achieve break-even in the next three years.

* The growth in TMRW will be funded by its ongoing fundraising activities. ABFRL is well capitalized (~INR24b gross cash) to fund its growth initiatives, primarily across value retail (~INR4b each for OWND! and TASVA) and luxury retail (~INR3b).

* Further, management indicated that ABFRL’s losses on a pre-IND-AS basis, exTMRW, will be marginal in FY26; losses are likely to further reduce from FY27.

* We reiterate our Neutral rating on ABFRL with a revised TP of INR100, as we await improvement in execution towards consistent growth and sustained profitability before we turn more constructive on the stock.

Pantaloons: Retail identity revamp underway; focus on improving margins

* Pantaloons is revamping its retail identity to a mid-premium brand, in line with the evolving lifestyle of its target customers.

* The identity revamp has enabled the improvement in product quality by raising the fashion quotient with a faster product refresh cycle (new drop every fortnight) and enhanced in-store customer experience, which has led to lower inventory and reduced markdowns, thereby boosting profitability. We note Pantaloons delivered ~400bp margin expansion in FY25.

* It is looking to prioritize profitability by strengthening the overall health of its retail network and is targeting ~300bp EBITDA margin improvement over the next five years through improved SSSG and higher own-brand salience.

* It closed over 50 stores in the last 18 months and is present in ~185 cities. Management indicated that store rationalization could continue in FY26, with focus primarily on the top 150 cities. We note Westside is present in ~90 cities.

* Management indicated that Pantaloons will focus on adding 15-20 new large-format stores (~15-20k sqft size) annually in metro, mini metros, and Tier 1 cities, with a clear focus on achieving store-level profitability in the first year and store payback in about four years.

* We build in a modest ~4% revenue CAGR for Pantaloons over FY25-28E, mainly led by mid-to-high single-digit SSSG amid continued store rationalization. However, we expect its margins to improve to ~20% by FY28.

OWND!: Rebranding of Style-Up to cater to Gen Z

* In FY25, Style-Up delivered ~70% YoY revenue growth to reach ~INR2b revenue, driven primarily by store additions.

* Management aims to double the revenue for the format every year in the near term, with a focus on reaching 100 stores by the end of FY26, primarily in South and West India, with a further ramp-up from FY27.

* Management indicated that Style-Up follows a much faster product refresh cycle, and typical store break-even timelines are lower (vs. Pantaloons).

* ABFRL has recently announced the launch of OWND!, a new fashion brand to cater to Gen Z and youth. The company plans to convert its existing value fashion brand Style-Up stores (49 as of 1QFY26) to OWND!.

Ethnics: Profitability to improve with the reduction in TCNS losses

* ABFRL’s ethnic portfolio is a mix of highly profitable designer-led brands and premium ethnic brands such as TCNS (currently in a turnaround phase) and TASVA (currently in a build-out phase).

*ABFRL’s overall Ethnic revenue jumped 49% YoY to ~INR20b in FY25, driven by strong LTL growth and a wider portfolio with expanding reach. Further, EBITDA margin improved to ~5% (vs. 1% in FY24), driven by lower losses in TCNS.

* Management indicated that ABFRL’s designer-led brands contributed ~INR8b in revenue in FY25 (~35% YoY growth), with a pre-IND-AS margin of ~11-12% (reported margin at ~19-20%).

* The focus in the designer-led portfolio is to ramp up the sales to ~INR20b while expanding the reported margins from ~20% to ~25% in the next 2-3 years.

* TASVA currently has a presence through 70 stores, with plans to open ~25 stores in FY26 and ultimately reach 250+ stores by FY30.

* TASVA delivered ~44% YoY revenue growth to reach ~INR1.45b revenue in FY25, driven by ~12% retail LTL. Management believes that TASVA can reach ~INR5b in revenue while achieving breakeven and cash profitability in the next three years.

* TCNS experienced a dip in revenue in FY25 due to distribution rationalization (~150+ store closures since acquisition). However, LTL growth was resilient at ~4%, which reflects improving consumer acceptance of its new product lines.

* Management indicated that the network rationalization phase for TNCS is complete, and the brand is witnessing strong ~20% LTL growth, which should lead to a reduction in losses by ~50% in FY26, with breakeven expected by FY27.

* TCNS has forayed into the occasion wear market and continues to premiumize the W and Aurelia brands. Management aims to double its store network over the next five years, with a target to reach ~INR13b revenue with a high singledigit pre-IND-AS EBITDA margin.

* We now value ABFRL’s ~51% stake in its designer-led portfolio at 12.5x Sep’27 EV/sales (implying ~3x EV/sales) and the premium branded Ethnic at 0.9x EV/sales to arrive at an overall valuation of ~INR34b for its overall Ethnics portfolio (vs. the earlier methodology of 1x EV/sales to the overall Ethnics portfolio).

TMRW: Separate fundraising to accelerate growth and fund acquisitions

* ABFRL has built a portfolio of digital-first brands under a subsidiary, Aditya Birla Digital Fashion Ventures (or TMRW). Revenue for TMRW grew ~55% YoY to ~INR6.5b (excluding Wrogn) in FY25.

* TMRW remains in investment mode, with plans to raise ~USD100-150m equity in its current funding round. Recently, TMRW raised ~INR4.4b from ServiceNow by selling ~11% stake.

* The fundraising will be used to accelerate growth across the online platform and expand the physical store network for select brands, and acquire a controlling stake in Wrogn and other digital-first brands.

* Management expects TMRW’s revenue to rise to ~INR13.5b, including Wrogn (vs. ~8.9b in FY25), in the near term, but break-even is only expected to be achieved by FY29 (at ~INR25b revenue base).

* On our estimates, TMRW has invested ~INR7.1b so far to acquire and raise stakes in nine digital-first brands such as Wrogn, TIGC, Bewakoof, et al. Based on the valuations in the latest fundraising rounds, the brands are currently valued at ~INR14.2b (~1.6x FY25 revenue).

* We now value ABFRL’s stake in TMRW at ~0.75x Sep’27 EV/sales (vs. ~1x EV/sales earlier) to arrive at an INR11b valuation (implies ~1.5x investments in TMRW), which is significantly lower than the implied ~INR4b valuation based on the recent stake sale.

Luxury retail: Profitable and growing portfolio of premium high-end brands

* ABFRL’s luxury retail portfolio consists of ‘The Collective’ and select mono brands such as Ralph Lauren, Fred Perry, Ted Baker, and Hackett London, along with its partnership with Galeries Lafayette (GL).

* Together, The Collective and Mono brands (TCMB) surpassed ~INR5b in revenue during FY25, with consistent double-digit revenue growth, along with steady profitability improvements.

* In FY25, ABFRL’s super-premium and luxury retail segment grew 13% YoY, driven by strong e-commerce momentum (15%+ growth) and expansion into new cities and markets.

* ABFRL is focusing on deepening market penetration and expanding the presence of ‘The Collective’ in metro and tier-1 cities.

* GL’s first flagship store will be launched in Mumbai during FY26 and will house 200+ luxury brands. Following the launch of its flagship Mumbai store, GL will open additional flagship stores in key metro cities.

* We value ABFRL’s luxury retail segment at 1.5x Sep’27 EV/sales (vs. 1.0x earlier) to arrive at a valuation of INR12b.

Valuation and view

* ABFRL provides a diversified play across several high-growth segments in apparel retail, such as ethnic wear, D2C online-first brands, and luxury retail. However, over the last few years, ABFRL’s profitability and valuations have been hurt by investments in several businesses, which are currently in the build-out/ turnaround phase and are loss-making.

* After the recent fund raise, debt-related concerns have been addressed, and management has indicated that focus would be on turning around the existing formats, rather than acquisitions.

* Growth recovery in Pantaloons and profitable scale-up of value fashion and branded ethnic wear, along with a turnaround in TMRW, remain key mediumterm monitorables.

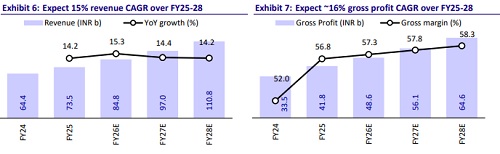

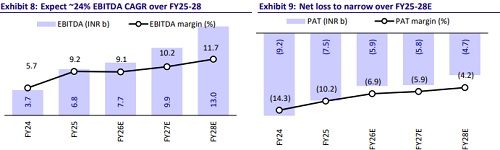

* We raise our FY26-27E revenue by 5-8%, driven by higher growth in TMRW (potential consolidation of Wrogn), luxury retail, and OWND!. Our FY26/27E EBITDA increases 12%/26%, driven by margin improvement in Pantaloons and Luxury Retail. However, we expect ABFRL to remain in losses over FY25-28, due to the drag from TMRW.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412