Buy Godrej Agrovet Ltd for the Target Rs. 2,300 by Motilal Oswal Financial Services Ltd

Operating performance a mixed bag, below our est.

* Godrej Agrovet (GOAGRO) reported a subdued operating performance (EBIT marginally down 2% YoY) in 4QFY25, primarily due to a sharp 68%/ 66% YoY decline in Dairy/Poultry EBIT, while Animal Feed (AF)/Crop Protection (CP) EBIT dipped ~4%/2% YoY. These were partly offset by Palm Oil EBIT, which doubled YoY, fueled by higher realization.

* Revenue remained flat YoY mainly due to a significant decline in AF/ Poultry business revenue (volume-led decline), offset by higher revenue in Palm Oil (realization-led growth).

* Management has guided to achieve a revenue growth of ~16-18% in FY26, led by CP, AF, and Astec. Similar growth in EBITDA is anticipated, largely led by lower losses in the Astec business and improving margins in Palm Oil. However, we factor in lower-than-expected performance in 4QFY25 and reduce our FY26E EBITDA by 8%, while largely maintaining our FY27E EBITDA. We reiterate our BUY rating on the stock with an SOTP-based TP of INR840.

Higher input costs hurt margins of the Dairy and Poultry business

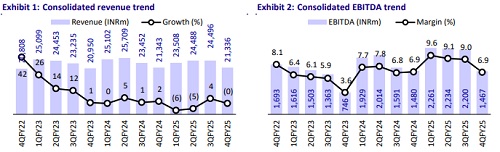

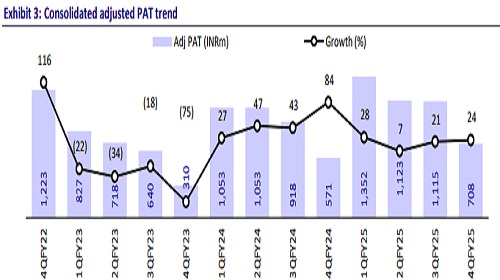

* Consolidated revenue remained flat YoY at INR21.3b (est. in-line). EBITDA margins also remained flat at 6.9% (est. 9%), led by flattish gross margins at 25.9%. EBITDA stood at INR1.5b, flat YoY (est. INR2b). Adjusted PAT grew 24% YoY to INR708m (est. of INR1.1b).

* AF: Revenue reduced by 4% YoY to INR11.4b, led by a volume growth of ~2% YoY to 370kmt. Margins remained flat, primarily led by a decline in average realization.

* Palm Oil: Revenue grew ~30% YoY to INR2.4b, led by higher realizations in crude palm oil (CPO) and palm kernel oil (PKO), as realizations improved ~55% and ~72%, respectively. FFB arrivals rose 10% YoY, resulting in an EBIT margin expansion of 260bp YoY to 7.5% and an EBIT growth of ~2x YoY to INR184m.

* CP: Consolidated CP revenue increased 6.4% YoY to ~INR2.7b led by a 28.6% YoY growth in standalone CP revenue. Standalone CP segment results witnessed strong growth in 4Q on account of higher volumes of in-house categories of products. Astec witnessed a 13% YoY dip in revenue to INR1.17b due to lower CDMO business. Consolidated CP EBIT declined 2.4% YoY to INR457m, led by an EBIT loss of INR83m in Astec, offset by a 32% YoY rise in standalone CP EBIT to INR540m.

* The Dairy business dipped ~2% YoY to INR3.8b, while EBIT declined ~68% YoY to INR66m, led by an increase in procurement prices. Poultry and Processed Food business revenue declined ~17.4% YoY to INR1.8b, primarily due to lower volumes in the live bird business, while EBIT stood at INR41m (down 65.9% YoY) and EBIT margin contracted 323bp YoY to ~2.3%.

* In FY25, GOAGRO reported a revenue decline of 2% to INR93.8b, while EBITDA/Adj. PAT grew 16%/20% to INR8.2b/INR4.3b.

Highlights from the management commentary

* Crop protection (standalone): The management is guiding over 30% revenue growth and margins led by the launch of new molecules and a good macro environment. One in-licensing product is slated for launch in FY26. Five molecules and one to two mixtures (sourced from Japan) are currently under development. Most of the launches are planned over the next 8–10 quarters, primarily in FY27.

* Palm Oil: Crude Palm Oil (CPO) and Palm Kernel Oil (PKO) prices are moderating, with CPO prices now at INR115,000–118,000/MT, down from INR130,000/MT. In contrast, PKO prices remain strong at INR215,000–230,000/MT, offering competitiveness in coconut oil (positive for margins). Management is expecting a healthy FFB arrival volume growth of ~18% in FY26.

* Astec: The management is guiding over 35% revenue CAGR for the next couple of years, largely led by the CDMO business. The CDMO business is recovering and is expected to contribute 70–75% of total Astec revenue by FY26 (vs. ~60% currently). The enterprise business is coming out of the woods, with volume-led improvement expected going forward (largely in old molecules).

Valuation and view

* GOAGRO reported flat revenue growth in FY25, but margins expanded 140bp due to strategic initiatives by the management. Going forward, with an improving outlook for Astec and volume-led growth in CP standalone, AF, and palm oil, we expect the company to see healthy revenue growth in the near term. Margins are anticipated to further expand going forward, fueled by continued strategic interventions across segments and recovery in Astec.

* We expect a revenue/EBITDA/Adj. PAT CAGR of 13%/22%/30% over FY25-27. We reiterate our BUY rating on the stock with an SOTP-based TP of INR840.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412