Neutral United Spirits Ltd For Target Rs.1,650 by Motilal Oswal Financial Services Ltd

Festive- & AP-led volume surge; in line margin

* United Spirits (UNSP) reported revenue growth of 15% YoY (est. 13%) in 3QFY25, along with total volume growth of 10% (est. 8%). The Prestige & Above (P&A) segment clocked volume and value growth of 11% and 16%. The Popular segment posted 6%/10% YoY volume/value growth. Andhra Pradesh (AP) saw a quick ramp-up after the policy change and contributed 6% to the overall revenue in 3Q.

* Positive consumer sentiment during the festive period, along with higher wedding counts, sustained healthy demand for liquor throughout the quarter. However, the benefits from AP channel filling will narrow down from 4Q onwards. As a result, we will need to track the underlying demand trend, which appears weaker for many categories in the near term (particularly in urban).

* The company remains committed to achieving double-digit P&A growth, including AP in FY25 (9% in 9MFY25). We model a 10% P&A growth in FY25.

* Gross margin expanded 130bp YoY to 44.7% (est. 44.6%), driven by pricing and soft glass prices. EBITDA margins expanded 70bp YoY to 17.1% (est. 17.0%), partially offset by the increasing expenses in AP. We estimate a 17% EBITDA margin in FY25 (16% in FY24).

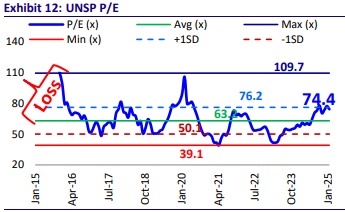

* We value UNSP at 60x Dec’26E standalone EPS and include INR250/share for its RCB+ non-core assets to arrive at a TP of INR1,650 and maintain our Neutral rating on the stock.

Strong volume-led performance; in-line margin

* Double-digit volume growth: Standalone net sales grew 15% YoY to INR34.3b (est. INR33.7b) in 3QFY25. P&A revenue (90% revenue mix) was up 16% YoY and Popular revenue grew 10% YoY. Sales growth was driven by resilient consumer demand in the peak festive season and a fast scale-up in AP. Total volume rose 10%, with P&A volume up 11% YoY to 14.9m cases (est. 14.6mn cases) and Popular volume up 6% YoY to 3.2m cases (est. 3.2m cases). AP contributed 6.1% to the overall revenue growth in 3QFY25 and 2.4% on a YTD basis. The price mix for the quarter stood at 4.6%, and 5.2% excluding AP.

* GM expansion continues: Gross margin expanded 130bp YoY to 44.7% (est. 44.6%) on the back of sustained revenue growth and improved productivity. A&P spend was up 16% YoY, employee costs rose 23% YoY, and other expenses grew 17% YoY. EBITDA margin expanded 70bp YoY to 17.1% (est. 17.0%).

* Double-digit profit growth: EBITDA grew 20% YoY to INR5.9b (est. INR5.7b). PBT rose 24% YoY to INR5.7b (est. INR5.2b) and APAT grew 21% YoY to INR4.2b (est. INR3.9b).

* There is an exceptional charge of INR650m related to severance costs for a closed unit.

Highlights from the management commentary

* The demand environment for the company shows sequential improvement. Management anticipates a stable demand situation, with P&A showing a positive trend (slight weakness at the premium end).

* This quarter marked the transition of AP alcobev retail operations from government control to private retailers, leading to a retail pipeline filling and a significant scale-up. AP contributed 6.1% to overall revenue in 3QFY25 and 2.4% on a YTD basis.

* Inventory levels are at ~60 days, with retailers holding 30-35 days of inventory and corporation deposits holding 20-25 days of inventory.

* ENA prices continue to face inflationary pressures, and this trend is expected to persist for the next couple of quarters. However, glass cost has been stabilized.

* The company has expanded its portfolio with X Series, a new non-whiskey offering under McDowell's brand, now launched in five key markets: Maharashtra, Goa, Uttar Pradesh, Rajasthan, and Madhya Pradesh.

Valuation and view

* There are no changes in our EPS estimates for FY25 and FY26.

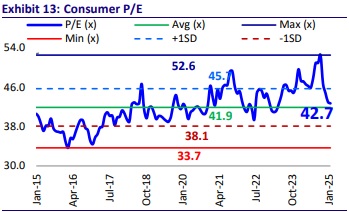

* UNSP sold a large part of its Popular portfolio to focus on its global strategy for the premium portfolio. The liquor industry is currently experiencing an upgrading trend, which aligns well with UNSP’s renewed emphasis on P&A, supporting the long-term liquor upgrading narrative in India.

* Liquor policies in many states are becoming more favorable, driving consumer upgrades and increased frequency. UNSP is well-positioned to capitalize on this large opportunity. Operating margins remain healthy and EBITDA margin is expected to sustain in the 17%-17.5% range.

* We value UNSP at a 60x Dec’26E standalone EPS and include INR250/share for its RCB + non-core assets to arrive at a TP of INR1,650. With the limited upside, we maintain our Neutral rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412