Buy Endurance Technologies Ltd for the Target Rs. 2,617 by Motilal Oswal Financial Services Ltd

Solid performance in a tough macro

Healthy order wins to continue to drive outperformance

* Endurance’s (ENDU) 4QFY25 adjusted PAT at INR2.4b came in ahead of our estimate of INR2b, led by better-than-expected performance across all segments. Its EU business outperformance vs. core over the last few quarters has truly been commendable, especially given the adverse macro.

* We remain optimistic about ENDU’s strategic push into the 4W segment, targeting 45% of sales by FY30. A steady recovery in 2W demand, an expanding presence in PVs, and a robust EU order backlog are key growth drivers. Reiterate BUY with a TP of INR2,617 (32x FY27E EPS).

Europe business performance continues to impress

* Adjusted 4Q PAT at INR2.4b came in ahead of our estimate of INR2b, led by better-than-expected performance across all segments.

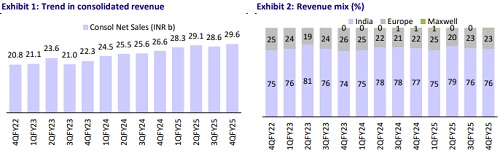

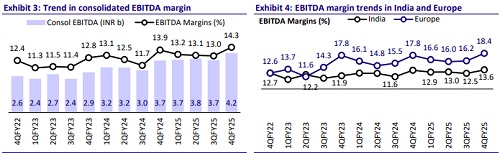

* Standalone performance: Revenue grew 9% YoY to INR22.5b (in line). This is compared to auto industry volume growth of 5% YoY in 4Q. EBITDA margin remained stable YoY at 13.6% (+110bp QoQ) – better than our estimate of 12%. Standalone performance was ahead of our estimates due to the INR380m incentive booked in 4Q. As a result, standalone PAT grew 12% YoY to INR1.9b – beating our estimate of INR1.5b.

* Europe performance: Europe revenue grew 17% YoY to EUR80m. This compares to volume decline of 2% YoY in car registrations in EU. ENDU has continued to outperform industry growth for the last few quarters. Margins improved 60bp YoY to 18.4%, ahead of our estimate of 18%.

* Maxwell performance: Maxwell revenue grew 91% YoY over a low base to INR210m, but down 20% QoQ and below our estimate of INR300m. Maxwell has posted EBITDA break-even for the first time since acquisition.

* For FY25, ENDU posted 21.5% YoY earnings growth, led by revenue growth of 13% and margin expansion of 40bp to 13.4%. ENDU delivered FCF of INR5.2b in FY25 after capex of INR10b.

Highlights from the management commentary

* New orders: In FY25, ENDU won orders worth INR11.99b, of which INR10.82b of orders were new and the balance were replacement orders. Of the cumulative INR46.9b worth of order wins over the last three years, new orders accounted for INR37.3b. Of this, ENDU has started SOP for INR14b of orders till FY25 and expects to start SOP for another INR11b of orders in FY26.

* Expansion plans: The Auric Shendra 4W casting plant’s SOP is planned for Jun’25. The plant has secured a machine casting order from Valeo, with peak annual sales of INR730m, and a couple of export orders from premium global OEMs. The AURIC Bidkin 2W alloy wheel plant is on schedule, and will help ENDU expand its OEM customer base.

* Tie-ups to enhance presence in 4Ws: ENDU is entering the 4W suspension segment via a tech tie-up with a leading Korean firm, initially as a second source but is aiming for the primary supplier status in new platforms. Strong OEM interest is driving ongoing discussions, with a planned greenfield facility. In 4Ws, ENDU also plans to enter the braking business through a technology tie-up with BWI and targets commercialization in the coming quarters.

* Management had recently announced that ENDU would establish a new facility to manufacture and design lithium-ion battery packs for mobility applications and battery energy storage systems with an initial outlay of INR473m. It has already won an order worth INR3b in Apr’25 from a large 2W OEM for the supply of battery packs.

* Europe update: ENDU booked new business worth EUR40.2m in FY25. While the macro remains challenging, management continues to be positive about the outlook for Europe given its healthy order backlog. Management has completed the acquisition of Stoferle and would consolidate its financials from 1QFY26.

Valuation and view

ENDU is now focusing on increasing the 4W revenue contribution to 45% by FY30 from 25%, and this will remain a key growth driver in the coming years. A stable recovery in underlying 2W demand, a strong focus on ramping up its presence in the PV segment, and a strong order backlog in EU in FY25 are the potential catalysts for the stock. We reiterate our BUY rating with a TP of INR2,617 (based on 32x FY27E consolidated EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412