Neutral KEI Industries Ltd for the Target Rs. 3,400 by Motilal Oswal Financial Services Ltd

Growth continues; C&W margin remains flat

Guides for ~18% growth in FY26 and ~20% thereafter

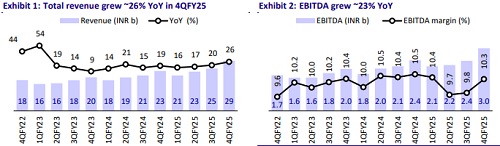

* KEII’s 4QFY25 revenue increased ~26% YoY to INR29.1b (~10% beat, led by higher-than-estimated revenue in C&W). EBITDA grew ~23% YoY to INR3.0b (~12% beat). OPM contracted 20bp YoY to 10.3% (+20bp vs. our estimate). PAT grew ~34% YoY to INR2.3b (~22% beat, aided by higher other income).

* Management indicated that the demand outlook remains positive, aided by infrastructure expansion in power, data center, EVs and transportation. The company has guided for ~17-18% growth in FY26, which should accelerate to ~20% from FY27 after the commissioning of its Sanand plant. EBITDA margins are expected to remain in the range of 10.5-11.0%, with a 50bp improvement by FY27-28 on better operating leverage.

* We raise our FY26-27 EPS estimates by ~6-7% as we factor in higher revenue and slight improvement in margin vs. previous estimates. We estimate an EPS CAGR of ~16% over FY25-27. We value KEII at 35x FY27E EPS to arrive at our TP of INR3,400. Reiterate Neutral.

C&W revenue up 35% YoY; EBIT margin flat YoY at ~11%

* KEII’s revenue/EBITDA/adj. PAT stood at INR29.1b/INR3.0b/INR2.3b (+26%/ +23%/+34% YoY and +10%/+12%/+22% vs. our est.) in 4QFY25. OPM dipped 20bp YoY to 10.3%. Depreciation rose 23% YoY, whereas interest costs declined ~16% YoY. Other income increased ~145% YoY.

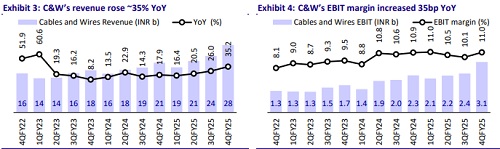

* Segmental highlights: a) C&W revenue was up ~35% YoY at INR28.0b, EBIT rose ~36% YoY to INR3.1b, and EBIT margin remained flat YoY to 11%. b) EPC business revenue declined ~34% YoY to INR2.2b, EBIT declined 60% YoY to INR170m, and EBIT margin contracted 4.8pp YoY to 7.6%. c) Stainless steel wires (SSW) revenue declined 19% YoY to INR462m, EBIT increased 91% YoY to INR25m, and EBIT margin was up 3.1pp YoY at 5.4%.

* In FY25, revenue/EBITDA/PAT grew 20%/18%/20% YoY. OPM was flat YoY at ~10%. C&W revenue/EBIT grew 25%/29% YoY and EBIT margin was up 30bp YoY at 10.6%. Despite higher EBITDA, KEII posted operating cash outflow of INR322m vs. OCF of INR6.1b in FY24, due to higher working capital (surged by INR8.23b in FY25). Capex stood at INR7.0b vs. INR4.0b in FY24 (incl. land purchase). Net cash outflow stood at INR8.3b vs. FCF of INR2.1b in FY25.

Key highlights from the management commentary

* C&W volume growth was ~21% in 4Q. C&W domestic institutional sales stood at INR7.6b, up 12% YoY. EHV domestic institutional sales were at INR1.2b, down ~48%. Sales through dealers/distributors increased 42% YoY and contributed 51% (vs. 45% in 4QFY24).

* Pending order book stands at INR38.4b vs. INR38.7b in 3QFY25. In the EHV division, the company has an order book of INR6.0b and it is targeting to utilize 100% capacity of EHV.

* The Sanand project’s first phase of expansion is expected to be commissioned by 1QFY26 and the entire project will be completed by FY26- end

Valuation and view

* We estimate KEII’s total revenue CAGR at ~15% over FY25-27, driven by ~17% growth in the C&W segment and ~7% growth in the SSW segment, while EPC’s revenue is projected to decline ~10% annually. EBITDA is estimated to clock a CAGR of ~19%, with margin expansion of 80bp to 11.0% by FY27 (10.0% in FY25). Margin expansion is likely to be driven by positive operating leverage and improved contribution from dealer/distribution sales and exports. Adjusted PAT is estimated to post a ~16% CAGR over FY25-27.

* In the near term, there would be a risk to revenue growth due to RM cost volatility. Competitive intensity in the long run may rise due to the entry of new players. Increased competition is likely to keep valuation in check. We believe the stock is trading fairly at 39x/34x FY26E/FY27E EPS. We value KEII at 35x FY27E EPS to arrive at our TP of INR3,400. Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412