Sell Deepak Nitrite Ltd for the Target Rs. 1,650 by Motilal Oswal Financial Services Ltd

Miss on core and rich valuation prompt a downgrade

* Deepak Nitrite (DN) reported a disappointing quarter (ex-government incentive income) in 4QFY25. EBITDA was 68% above our estimate and stood at INR3.2b (+5% YoY), while EBITDA adjusted for government incentive income was INR1.6b (18% below). EBITDAM was 14.5% (+40bp YoY), while adj. PAT was INR2b (estimate of INR1.1b, +3% YoY). EBIT margin contracted 13.1pp YoY for the AI segment, while the same expanded 160bp YoY for DPL.

* In FY25, DN faced global demand softness and pricing pressure from Chinese competition, which weighed on realizations. However, strong domestic demand and volume-led growth helped offset margin pressures. The company expanded its product portfolio, signed new contracts, and expects normalized profitability in FY26. Government incentives from the DPL Dahej project are expected to contribute INR600–700m annually until Dec’28.

* Advanced intermediates grew sequentially, aided by better demand in dyes and pigments, though agrochemicals remained weak. DPL volumes increased due to capacity additions, but prices were hit by higher imports. The commissioning of the Acetophenone asset will aid internal consumption and improve efficiency. Debottlenecking and new SKUs added in FY25 will continue into FY26.

* Several key projects are lined up in FY26—CNA, WNA, Hydrogenation, and Nitration in 2Q, and MIBK/MIBC in 3Q. DN’s INR85b investment in Phenol, Acetone, and Polycarbonate Resin capacities is backed by technology tie-ups. Renewable energy is expected to meet 60% of power needs by the end of FY27, enabling a 60% CO? reduction for DN. While no quarterly guidance has been given, management remains cautiously optimistic for FY26.

* Due to the underperformance and weak guidance, we cut our EBITDA/EPS estimates by 10%/8% for FY26 and by 12%/11% for FY27. Our EBITDAM stands at 14.9%/15.6% for FY26E/27E. There is a risk of further downgrades in our estimate going forward. The stock trades at ~32x FY27E EPS of INR66.1 and at ~21x FY27E EV/EBITDA. Given the expensive valuation for a commodity chemicals company, we downgrade our rating for DN to Sell, valuing the stock at 25x FY27E EPS to arrive at our TP of INR1,650.

Miss on EBITDA (excluding govt. incentive income)

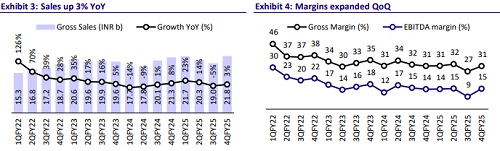

* Revenue stood at INR21.8b (our est. INR19.2b, up 3% YoY). This included a government incentive income of INR1.6b. EBITDA stood at INR3.2b (our est. of INR1.9b, up 5% YoY). EBITDA adjusted for government incentive income was INR1.6b (18% below our estimate). Gross margin came in at 30.6% (down 10bp YoY), while EBITDAM stood at 14.5% (vs. 14.2% in 4QFY24). Adj. PAT stood at INR2b (our est. of INR1.1b, up 3% YoY).

* In FY25, revenue was at INR82.8b (+8% YoY), EBITDA at INR10.9b (-2% YoY), and reported PAT at INR7b (-14% YoY). EBITDAM was at 13.2% (-140bp YoY).

* The BoD approved a final dividend of INR7.5/share for FY25. It also approved the appointment of Shri Subimal Mondal as Group CHRO w.e.f. 28th May’24 for a period of three years. He has 39 years of experience and was last associated with IOCL, where he retired as the ED (HR).

Segmental details

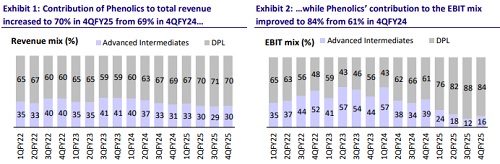

* Phenolics’ EBIT margin stood at 15.6%, with EBIT at INR2.4b. Advanced Intermediates’ (AI) EBIT margin was at 6.9%, with EBIT at INR449m. The revenue mix of Phenolics stood at 70% in 4QFY25, with the Advanced Intermediates share at 30%. The EBIT mix for AI was down to 16% from 39% in 4QFY24. Contribution from Phenolics stood at 84% (vs. 61% in 4QFY24).

* In FY25, AI’s revenue stood at INR25.3b (-7% YoY), while DPL’s revenue stood at INR58.1b (+16% YoY). AI’s EBIT was at INR1.8b (-61% YoY), while DPL’s EBIT was at INR7.8b (+22% YoY). AI’s EBIT margin was at 7% (-940bp YoY), while DPL’s EBIT margin was at 13.5% (+60bp YoY).

Valuation and view

* DN aims to become the largest player in the solvent market by focusing on import substitution. It is foraying into PC (165ktpa), Methyl Isobutyl Ketone (MIBK, 40ktpa), Methyl Isobutyl Carbinol (MIBC, 8ktpa), and Sodium Nitrite/ Nitrate, among other products. These products are taking shape and are likely to be commissioned in FY26. Some other previously announced capex projects have already been commissioned (fluorination plant, specialty salts unit).

* DN is aggressively pursuing both backward and forward integration projects to de-risk its business model and expand its product portfolio. However, its entire product portfolio consists of commodities and does not warrant such a high valuation. The stock trades at expensive valuations of ~32x FY27E EPS of INR66.1 and ~21x FY27E EV/EBITDA. Hence, we downgrade the stock to Sell with a TP of INR1,650 (premised on 25x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412