Stocks in News & Key Economic Updates 09th January 2026 by GEPL Capital Ltd

Stocks in News

* VOLTAS: The company has approved a long-term incentive scheme (LTIS 2024) and extended its tenure by one year, with the end date now revised to FY28 from FY27.

* BAJAJ FINSERV: The group has completed the acquisition of a 23% stake in its insurance businesses from Allianz for Rs 21,390 crore, the largest deal in India’s insurance sector, raising Bajaj Finserv’s stake to 75.01% in both companies and increasing promoter holding to 97% in Bajaj General and Bajaj Life.

* RVNL: The company has received a Rs 201 crore Letter of Acceptance from East Coast Railway for setting up a Wagon POH workshop at Kantabanji.

* VEDANTA: The company has filed a writ petition in the Delhi High Court challenging the rejection of its request to extend the Production Sharing Contract for Block CB-OS/2, with the Court issuing notice and directing all parties to maintain status quo.

* ASTRA MICROWAVE: JV Astra Rafael Comsys has secured an order worth Rs.275 crore from the Indian Air Force.

* WAAREE RENEWABLE: Subsidiary Waaree Forever Energies has received a revised LoA cutting project capacity to 704 MWac/1,000 MWp and reducing the order value to Rs 1,040 crore from Rs 1,252 crore.

* HIGHWAY INFRA: The company has secured a Rs 329 crore order from NHAI.

* DEVYANI INTERNATIONAL: Subsidiary Swara Baby has completed the acquisition of a 100% stake in Solis Hygiene.

* VENUS REMEDIES: The company has received marketing authorisation in Indonesia for its antibiotic combination Ceftazidime and Avibactam.

* BHARAT ELECTRONICS: The company has received additional orders worth Rs 596 crore since January 1.

* AB INFRABUILD: The company has secured a Rs.54 crore order from East Coast Railway.

Economic News

* CPSE Capex reached 74.5% of target by December, set to exceed annual target by fair margin: The Capex for the month of December alone increased by 9.28% to Rs 70,000 crore, with many enterprises exceeding their annual budget target. The growth was led by the Railway board and National Highway Authority of India(NHAI) as they remained the highest spenders.

Global News

* China’s inflation rises modestly as weak demand and producer deflation persist, prompting renewed policy support: China’s consumer inflation picked up to a 34-month high of 0.8% YoY in December, driven mainly by sharp food price increases, but full-year inflation stayed flat its weakest in 16 years highlighting persistently weak demand. Core inflation remained muted at 1.2%, while producer prices stayed in deflation for a third straight year, with PPI falling 1.9% in December and 2.6% for 2025. A prolonged property downturn, weak jobs, and excess capacity continue to suppress consumption, limiting the impact of stimulus measures. While China likely met its 2025 growth target, markets are watching for stronger policy support in 2026, with the government extending trade-in subsidies and signaling flexible monetary easing to revive demand and stabilize prices.

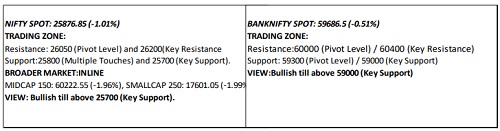

Technical Snapshot

Key Highlights:

Government Security Market:

* The Inter-bank call money rate traded in the range of 4.50%- 5.53% on Thursday ended at 4.90%.

* The 10 year benchmark (6.48% GS 2035) closed at 6.6290% on Thursday Vs 6.6105% on Wednesday .

Global Debt Market:

U.S. Treasury yields moved marginally higher on Thursday as investors looked ahead to key jobs data and continued to monitor geopolitical developments. At 4:48 a.m. ET, the 10-year Treasury yield was up more than 1 basis point to 4.159%. The 2-year Treasury note was little changed at 3.467%. Meanwhile, the 30-year bond yield rose 3 basis points to 4.846%. Investors are anticipating more economic data: Thursday morning brings the weekly initial jobless claims, and the Bureau of Labor Statistics’ nonfarm payrolls report is expected on Friday at 8:30 a.m. ET. Regarding jobless figures, Ian Lyngen, BMO Capital Markets head of US Rate Strategy, said in a note: “We’re cautious of the potential for seasonal distortions resulting from the holidays, but nonetheless with the Fed’s January FOMC decision approaching, it will be useful to have any additional context on the state of the labor market as 2026 gets underway.” Data gathering by the BLS has been impaired by the 43-day U.S. government shutdown last year. This will be the first on-time payrolls report since the shutdown. Economists surveyed by Dow Jones are expecting the economy to have added 73,000 new jobs for the month, up from 64,000 in November, and the unemployment rate to go down to 4.5%. Elsewhere, investors are keeping an eye on geopolitical developments, including the ongoing Venezuela situation, as well as U.S. President Donald Trump’s stated desire to take over Greenland.

10 Year Benchmark Technical View :

The 10 year Benchmark (6.48% GS 2035) yield likely to move in the range of 6.6150% to 6.63% level on Friday

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer