Buy Kotak Mahindra Bank Ltd For Target Rs. 2,150 By Yes Securities Ltd

Our view – Over-capitalisation, digital ban and Activmoney dependence can be overcome

Asset Quality –Gross slippages declined on sequential basis, with management making reasonably comforting comments in the context of the environment:

Gross NPA additions amounted to Rs 16.57bn for 3QFY25, translating to an annualized slippage ratio of 1.6% for the quarter. Gross NPA additions had amounted to Rs 18.75bn during 2QFY25. In unsecured small ticket lending, personal loan slippages have declined on sequential basis, whereas credit card slippages have remained similar and microfinance slippages have risen. The rise in microfinance slippages have been more than offset by the decline in secured retail loan slippages. Retail microfinance is a small book of about Rs 80bn in an overall book of about Rs 4000bn and hence, cannot move the needle materially. Provisions were Rs 7.94bn, up by 20.2% QoQ and 37.1% YoY, translating to calculated annualised credit cost of 78bps. Annualised credit cost based on specific provisions alone was 68bps, up by 3bps QoQ.

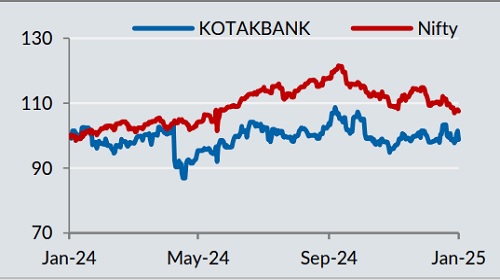

Stock performance

Net Interest Margin – Margin inched up on sequential basis, which is a reasonably creditable outcome, again, given the environment:

NIM was at 4.93%, up 2bps QoQ but down -29bps YoY. Cost of funds has declined about 8-9 bps on sequential basis. Cost of funds has benefited from (1) A savings account interest rate cut effected on 17th October 2024 (2) Healthy traction for current account deposits (3) CASA balance being aided by IPO money, custody business and FPI flows, among other factors (4) Activmoney balance rising 36% YoY, since its cost is lower than normal term deposits.

Balance sheet growth – Advances growth was healthy in the context of banking system growth trend:

The advances for the bank stood at Rs 4,138bn, up by 3.6% QoQ and 15.1% YoY. The growth has been despite the RBI embargo causing the credit card book to de-grow and microfinance disbursement being slow due to caution. The bank guided that it will grow at 1.5x-2.0x of nominal GDP growth.

We upgrade KMB to BUY with an unchanged price target of Rs 2150:

We value the standalone bank at 2.2x FY26 P/BV for an FY26/27E RoE profile of 14.1%/14.2%. We assign a value of Rs 736 per share to the subsidiaries.

Result Highlights (See “Our View” above for elaboration and insight)

* Opex control: Total cost to income ratio was at 47.2% down -22/-117bps QoQ/YoY and the Cost to assets was at 2.9% down -6/-23bps QoQ/YoY.

* Fee income: Core fee income to average assets was at 1.5%, down -1bp/- 9bps QoQ/YoY.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632