Buy Allied Blenders & Distillers Ltd for Target Rs. 525 by DAM Capital

A Strong Base, Ready for the Next Phase

Allied Blenders and Distillers (ABDL) is India’s largest homegrown IMFL company by volume and one of only four spirits players with a pan-India distribution network. The company boasts a diverse brand portfolio, led by Officer’s Choice, the world’s thirdlargest whisky brand, along with ICONiQ White, its newest millionaire brand and the fastest-growing whisky globally. With a strengthened balance sheet post-IPO and enhanced financial flexibility, ABDL is entering a new phase of growth. It is undergoing a strategic shift towards premiumisation—underpinned by supply-chain efficiencies and disciplined cost management—positioning it to deliver volume-led expansion and sustained margin accretion. We had initiated coverage on Alcobev Sector (link) in October 2024. With visible operational turnaround, renewed focus on profitability, and an expanding premium portfolio, we now initiate coverage on ABDL with a Buy rating.

Accelerating premium portfolio expansion: ABDL’s premiumization strategy is a longterm structural shift, aligning with evolving consumer preferences and the industry's increasing premium-mix trajectory. ABDL is strategically repositioning its portfolio to increase the P&A contribution. This transition is underpinned by high-growth premium brands like ICONiQ White, Sterling Reserve, and Zoya Gin, complemented by strategic acquisitions (Woodburns, Rock Paper Rum) and the establishment of ABD Maestro —a dedicated luxury spirits platform. We expect P&A volume growth of ~14% CAGR with ~volume/value saliency increasing to 44%/53% in FY27E (37%/47% in FY24).

Strengthening supply chain for margin gains: ABDL has earmarked a Rs 5.25 bn capex plan (FY25–27) to fortify supply chain security with backward integration. It has acquired a distillery in Maharashtra (11MLPA), with plans to expand capacity to 61MLPA within three years, taking total ENA capacity to ~120MLPA—adequate to meet around two-thirds of its captive requirement—incrementally covering 2/3rd of its ENA needs. Additionally, ABDL is investing in a 4MLPA malt maturation unit and a 615 mn PET bottle facility. These investments, funded through internal accruals and debt, will enhance cost efficiencies, margin resilience, and competitive strength.

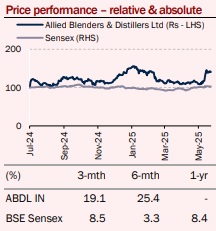

Valuation and recommendation: ABDL’s profitability had been subdued over the past five years due to higher saliency of mass-premium brands, persistent input cost inflation, and elevated debt. However, FY25 has marked a sharp turnaround, with EBITDA and PAT surging ~78% and 105x YoY, driven by premiumization, cost efficiencies, and debt restructuring. Looking ahead, ~14% P&A volume growth is set to drive revenue growth, while a favourable product mix and cost efficiencies will support ~120 bps EBITDA margin expansion. PAT likely to grow by ~28% CAGR over FY25-27E. We value the stock on DCF methodology with WACC assumption of 9% and terminal growth of ~5% to arrive at a target price of Rs 525/share.

Above views are of the author and not of the website kindly read disclaimer

.jpg)