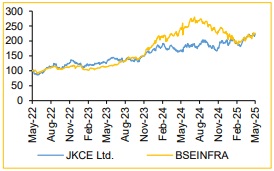

Buy JK Cement Ltd For Target Rs. 6,750 - Choice Broking Ltd

JK Cement would continue to fire on multiple cylinders

We maintain our BUY rating on JK Cement Ltd (JKCE) with an increased TP if INR 6,750 (from INR 5,532 earlier) as we factor in 1) Capacity addition of 8.0 MTPA in FY26, taking the total consolidated capacity to 32.4 MTPA by FY26 end, 2) Volume growth of 10% in FY26, driven by asset sweating and some incremental volumes from the capacity addition in FY26, 3) Improving cement sector tailwinds like better demand and higher pricing, 4) Benefit from cost reduction due to logistics cost optimisation and premiumization, and consequently, 5) Higher EBITDA and EBITDA/t, and finally 6) A robust EV to CE (Enterprise Value to Capital Employed) based valuation framework (Exhibit 3) which allows us a rational basis to assign a valuation multiple that captures improving fundamentals (ROCE expansion by 670 bps over FY 25- 28E).

We forecast JKCE EBITDA to grow at a CAGR of 24.1% over FY25-28E, supported by our assumptions of volume growth at 10%/15%/15% and realisation growth of 2.5%/1.0%/0.0% in FY26E/FY27E/FY28E, respectively. We remain positive on JKCE India capacity mix skewed to North & Central India, while maintaining some exposure (upside optionality) to the South. We also like management’s execution track record.

We arrive at a 1 year forward TP of INR 6,750 /share for JKCE. We now value JKCE on our EV/CE framework, where we assign an EV/CE multiple of 3.75 x/ 3.75x for FY27E/FY28E, which we believe is conservative given the increase of ROCE from 11.2% in FY25 to 17.9% in FY28E under reasonable operational assumptions. This valuation framework gives us the flexibility to assign a commensurate valuation multiple basis an objective assessment of the quantifiable forecast financial performance of the company. We do a sanity check of our EV/CE TP using implied EV/EBITDA, P/BV, and P/E multiples. On our TP of INR 6,750 FY27E implied EVEBITDA/PB/PE multiples are 17.3x/5.8x/32.3x. Management has indicated double digit volume growth guidance. Slowdown in construction activities due to early and excessive monsoon, sudden large spike in petcoke prices as a result of various global dynamics are risks to our BUY rating.

Q4FY25 Results: Marginally ahead of optimistic expectations

JKCE reported Q4FY25 consolidated Revenue and EBITDA of INR35,812 Mn (+15.3% YoY, 22.2% QoQ) and INR7,648 Mn (+36.6% YoY, +55.4% QoQ) vs CEBPL estimates of INR35,754 Mn and INR7,217 Mn, respectively. In our view, the market expectation of Q4FY25 EBITDA was in range of INR 6,700- 7,300 Mn, so the reported numbers are well ahead of street expectations. Total volume for Q4 stood at 6.1 Mnt (vs CEBPL est. 5.9 Mnt), up 16.1% YoY and 23.2% QoQ.

Realization/t came in at INR5,910/t (-0.7% YoY and -0.8% QoQ), which is slightly lower than CEBPL’s est of INR6,056/t. Total cost/t came at INR4,647/t (-4.7% YoY and -6.2% QoQ). As a result, EBITDA/t came in at INR 1,262/t, which is an expansion of ~INR262/t QoQ, which is well ahead of the market expectations.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131