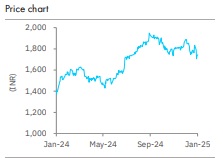

Accumulate Sun Pharmaceuticals Ltd For Target Rs. 1,871 By Elara Capital Ltd

In-line Q3

Sun Pharma’s (SUNP IN) Q3FY25 revenue, EBITDA and adjusted PAT came in 2%, 12% and 11% ahead of our estimates, helped by USD 45mn milestone income from a marketing partner for its specialty product. Excluding the milestone income, Q3 was broadly as estimated. Global specialty business (ex-milestone) continued with its strong growth in high-teens YoY. The US generics did poor, but was compensated by domestic and other businesses. There is no incremental clarity on the launch of Leqselvi (specialty product for alopecia) in the US. We raise our FY25E-27E core EPS by 1-2%. We revise SUNP to Accumulate from Reduce. We retain our TP at INR 1,871.

Specialty business – Growth continues; additional milestone income:

Revenue from global specialty business (excluding milestone income) grew 17% YoY to USD 325mn. Additional milestone of USD 45mn took the specialty revenue to USD 370mn. We believe that Ilumya sales outside of the US were a major contributor to this performance. The management expects Ilumya to continue growing in the US. Other specialty products continued to grow as well, as per management commentary.

Wait for Leqselvi continues:

Launch of SUNP’s new specialty product, Leqselvi (Deuruxolitinib for alopecia areata) is temporarily held up by a patent dispute with Incyte Corp. If SUNP loses the patent litigation, either the launch could be postponed by two years or SUNP may have to enter into a settlement with Incyte Corp, under which some profit may have to be shared with it. We push out the launch to late FY26, in our projections. We estimate that Leqsalvi could be a USD 200mn product in 3-4 years after the launch.

US generics – Poor show continues:

SUNP’s US revenue was down 1% YoY and 8% QoQ. Lower sales of gRevlimid partly explains this, but SUNP’s generics business has remained a laggard versus peers, plagued by manufacturing quality issues at many facilities. We believe it could be 3-4 quarters before all the warning letters / import alerts by the USFDA are lifted and the business course-corrects to growth path. SUNP’s generic launch pipeline is weak as well, compared with peers

India business strong; other EMs improve:

Revenue from the India business grew 14% YoY in Q3. This is commendable given SUNP’s large size and muted growth in the overall market. Growth for the EM formulations business picked up to 12% in Q3, after a disappointing Q2. RoW formulations business (ex-milestone income), however, continued with the poor performance of Q1 and Q2.

Revise to Accumulate; TP maintained at INR 1,871:

We raise FY25E-27E core EPS by 1- 2%. SUNP trades at ~34.5x FY26E and FY27E core P/E. Loss of gRevlimid sales explains the poor FY27E growth. We retain our TP at INR 1,871, at 36.1x FY27E core P/E plus cash per share.

As the stock has corrected, we revise SUNP to Accumulate from Reduce. Extended delay in the US launch of Deuruxolitinib is the key downside risk and favorable legal outcome and accelerated launch of the same, key upside risks.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)