Buy Dalmia Bharat Ltd for the Target Rs.2,570 by Motilal Oswal Financial Services Ltd

Growth visibility improves; volume ramp-up to unlock value

We recently met with Dalmia Bharat’s (DALBHARA) management to understand current industry demand, pricing environment and the company’s growth plans. Management noted that overall cement demand momentum is strong. Regionally, the east is subdued amid weak demand in West Bengal and Jharkhand and slow project execution in Odisha. South and northeast are performing better. On pricing, after a sharp correction in 3Q, recent hikes of INR5-15/bag (trade) and INR10-15/bag (non-trade) have been observed. The company is targeting cost savings of INR150-200/t, with INR45-50/t having already been achieved and a further INR50-100/t expected over the next 12-18 months. The company’s expansion remains firmly on track, with new clinker capacity commissioned in the northeast, and the large-scale expansion in the south region is expected to increase clinker/grinding capacity to 34.3mtpa/61.5mtpa by 1HFY28. Over the past two years, muted volumes, weak profitability, and uncertainty around the JPA acquisition weighed on stock performance. With clarity on expansions, capacity utilization and profitability improvement, there is potential for further re-rating. The stock currently trades at 12x/11x FY27/FY28E EV/EBITDA. We value the stock at 13x FY28E EV/EBITDA to arrive at our TP of INR2,570. Reiterate BUY

Divergent regional trends – East lags, south and northeast drive growth

* Regionally, the east continues to face challenges in cement demand. West Bengal remains weak due to election-related disruptions, while Jharkhand demand has also been soft. Odisha witnessed a weak 1HFY26, largely due to delays in project execution, although the infrastructure pipeline remains large, and execution has yet to meaningfully pick up. Over the last two to three years, cement demand growth in the east has been limited to ~4-5%.

* In contrast, the south is performing materially better, with stronger demand traction and improving market conditions. The northeast has also emerged as a relatively bright spot, with demand trends improving over the last 3-4 years. In northeast, DALBHARA and Star Cement together command over 50% market share in the region. Moreover, budgetary allocation toward infrastructure is higher in the northeast, alongside the emergence of new industries, making it a structurally promising market over the medium term.

* Over FY24-26E, DALBHARA’s estimated volume CAGR is ~3% vs. the industry CAGR of ~5-6%. Consequently, the company’s capacity utilization dropped to ~61-62% vs. ~70% over FY19-24. In the past two years, the company has undergone leadership restructuring and appointed Mr. Navin Tewari as Chief Marketing Officer. In the east region, it has lost market share due to changes in its marketing strategy.

* The company is now focusing on ramping up volume growth in its key markets, actively strengthening its dealer and distribution network by increasing dealer engagements and investing in brand-building. We believe the company’s volume should improve and we estimate a volume CAGR of ~7% over FY26-28. Average capacity utilization remains range-bound at ~60-62% mainly due to the addition of new capacity during that period.

Expansions on track; remains among the top-four cement players in India

* Earlier in 4QFY25, DALBHARA commissioned 2.4mtpa grinding capacity at Lanka, Assam. It has recently commissioned 3.6mtpa clinker capacity at Umrangso, Assam. Now the company has excess clinker capacity, which can be converted into 1.0-1.5mtpa cement in the northeast. It is evaluating options to add additional grinding capacity in the northeast to utilize excess clinker.

* Apart from that, the company announced a strategic expansion in the south region – 1) clinker/grinding capacity of 3.6mtpa/3.0mtpa at its Belgaum, Karnataka plant, along with a 3.0mtpa greenfield grinding unit in Pune, likely to be completed in FY27; and 2) clinker/grinding capacity of 3.6mtpa/6.0mtpa at its Kadapa plant in Andhra Pradesh (alongside a 3mtpa bulk terminal in Chennai to deepen its access to the North Tamil Nadu market), to be completed in 1HFY28. Total estimated capex for these expansions in the south region is ~INR68.1b (capex cost of USD63/t).

* Following these expansions, the company’s clinker/grinding capacity will surge to 34.3mtpa/61.5mtpa by 1HFY28 vs. 27.1mtpa/49.5mtpa currently (registering grinding capacity CAGR of ~12%). Moreover, to diversify its geographic footprint and become a pan-India player, the company is planning to set up facilities in the north and central regions. Within that, it has prioritized a greenfield expansion in Jaisalmer, Rajasthan. While other project-related work is going as per the plans (land acquisitions, EC application, etc.), it is likely to announce expansion in the coming months, after board approvals. Given the company’s expansion plans, we believe it will continue to be among the top-four cement companies in India (in terms of cement capacity).

Cost efforts continuing; price hike sustainability remains vital

* The company is targeting a cost reduction of INR150–200/t, with INR45-50/t having been achieved in the past six quarters, supported by higher RE share, logistics cost optimization and higher clinker conversion ratio. A part of the benefit was offset by the levy of additional mineral tax by Tamil Nadu. Fuel cost is also trending favorably so far, as the company is sourcing domestic petcoke (in its fuel mix), which is cheaper than imported petcoke. It does not expect the recent rise in fuel prices to impact near-term performance, given low-cost inventory.

* It expects further cost savings of INR50-100/t in the next one-and-a-half years by ramping up green power share to 60% by FY27 from 48% currently, improving clinker conversion ratio by producing more blended cement (~80% currently), and increasing alternative fuel share. On logistics side, it has a lower lead distance of 270-280km vs. industry average of ~350km, and it is scaling up direct dispatches, reducing handling costs, improving fleet utilization and streamlining warehousing to reduce overall freight cost/t.

* While cement prices fell in 3QFY26 beyond the GST rate cut, our recent channel checks suggest a price hike of INR5-15/bag in trade segment and INR10-15/bag in non-trade segment across regions. Cement prices remained highly volatile in the company’s core markets (east and south) due to high competitive intensity. The near-term pricing outlook remains difficult to predict; however, the medium term outlook for pricing remains positive, supported by increased consolidation, rising entry barriers, and steady capacity utilization of ~70% at the all-India level.

Valuation and view

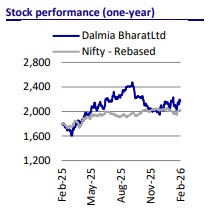

* Over the past two years, muted volume growth and weak profitability, coupled with limited visibility on the expansion roadmap amid the pending JPA cement acquisition, acted as key overhangs on the stock’s performance. While the stock witnessed an initial re-rating following the announced south expansion and exit from the JPA acquisition race, we believe there is a potential for further rerating, driven by improving capacity utilization and a recovery in profitability.

* We estimate a CAGR of 9%/14%/9% in revenue/EBITDA/PAT over FY26-28. We estimate a volume CAGR of ~7% over FY26-28E and EBITDA/t of INR1,079/ INR1,142 in FY27E/FY28E vs. INR1,019 in FY26E (avg. EBITDA/t of INR1,013 over FY21-25). The company’s net debt is estimated to rise to INR37.3b by FY28 from INR15.6b in FY26E. Its net debt-to-EBITDA ratio is estimated at 0.9x vs. 0.5x in FY26E.

* The stock currently trades at 12x/11x FY27/FY28E EV/EBITDA. We value the stock at 13x FY28E EV/EBITDA to arrive at our TP of INR2,570. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412