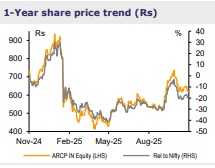

Buy Anant Raj Ltd for the Target Rs.800 By Emkay Global Financial Services Ltd

Data-center expansion progressing well

We reiterate BUY on Anant Raj (ARCP), with an unchanged TP of Rs800. ARCP reported a strong set of results for Q2FY26, with revenue/EBITDA/PAT coming in at Rs6.3bn/Rs1.7bn/Rs1.4bn (+23%/+49%/+31% YoY), respectively. EBITDA margin expanded to 26.6% (+461bps YoY), mainly supported by improved gross margin. The current DC capacity is 28MW, of which 22MW became operational in mid-Q2FY26. We expect the full benefit to start from Q4FY26. Over the next 2 years (FY26-28E), we expect DC capacity to increase to 107MW, which would be met through cash generated from the real-estate business and the recent fund-raise of Rs11bn. The management expects DC business revenue of Rs12bn by FY27 and Rs90bn by FY32, at full occupancy. We have factored in the gradual improvement in occupancy and, hence, expect DC business revenue to increase to Rs13bn in FY28E from Rs455mn in FY25. Overall, we expect ~20% IRR for the DC business by FY45E. Building in the recent fund-raise, we expect the balance sheet to remain net-cash at Rs6.4bn in FY26E.

Data Center – Targeting a 4x jump in capacity by FY28

ARCP’s data center revenue came in at Rs355mn/Rs584mn for Q2/1HFY26, with EBITDA margin of 75%. The company recently (in Aug-25) commissioned new capacity of 22MW at Manesar (15MW) and Panchkula (7MW) – taking the total operational IT load to 28MW. We expect new capacity to contribute meaningfully from Q4FY26 onward, with client onboarding likely in in Q3FY26. The company has recently raised Rs11bn, of which Rs4.4bn would be used in data-center capacity expansion. We expect ARCP to achieve 63MW/107MW capacity by FY27/FY28E. From the long-term perspective, ARCP targets DC capacity of 307MW by FY32, with cloud mix of 25%. We expect capex of up to Rs40bn over FY26-28E.

Progressing well on real-estate launches

ARL received RERA registration for the new phase of The Estate Apartments, which is likely to offer GDV potential of Rs7.5bn; the launch is expected in Q4FY26. Also, The Estate One project (GH-2; 1.1 msf) is in the advanced stage of approvals, and likely to be launched in Q4FY26. Approvals for GH-3 are expected in H2, with launch planned for FY27. With the GH-3 launch now deferred to next year, we adjust the pre-sales estimates and now expect Rs25bn/Rs29bn in FY26E/27E. Accordingly, the project would generate net cash flow of ~Rs16.5bn in FY26-27 which would be used for DC business expansion.

We maintain

BUY For the real estate business, we maintain the NAV premium at 75% on the existing portfolio (ex-Delhi land), which gives a value contribution of Rs410/share (including contribution from rental assets). In the DC business, we build in revenue of Rs2.3bn/Rs7bn/Rs13bn for FY26E/27E/28E, respectively, with EBITDA margin at 80%. Our DC equity value stands at ~Rs132bn, ie Rs367/share. We maintain BUY on the stock.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354