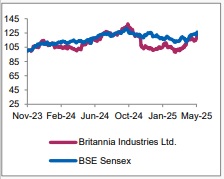

Hold Britannia Industries Ltd for the Target Rs. 5960 by Axis Securities Ltd

Pricing Led Top Line Growth; Maintain HOLD

Est. Vs. Actual for Q4FY25: Revenue – BEAT; EBITDA – BEAT; PAT – BEAT

Changes in Estimates post Q4FY25

FY26E/FY27E: Revenue: 0%/1%; EBITDA: 5%/8%; PAT: 6%/10%

Recommendation Rationale

• Britannia's Q4FY25 results: Britannia delivered a solid Q4FY25 performance, surpassing expectations with 9% YoY revenue growth (vs. est. 7.6%) despite a soft consumption environment. Growth was supported by calibrated price hikes and resilient volume traction. Management reiterated that price hikes were implemented in Q4 to offset inflation and support margins. While some increases may carry into early Q1FY26, further hikes are unlikely unless input costs rise again. Additionally, price cuts are not being considered due to sector-wide inflation. Distribution continues to be a key strength, with the company reaching 29 Lc outlets pan-India and expanding rural coverage by 31,000 outlets in FY25.

• Margin guidance amid commodity inflation: Gross margins declined by 481 bps YoY to 39.3%, impacted by sharp cost inflation in milk, palm oil, cocoa, and wheat. Consequently, EBITDA margins declined by 118 bps to 18.2%, though partially offset by stringent cost efficiency measures, including an 8% YoY reduction in other expenses. Management reaffirmed its focus on maintaining EBITDA margins at current levels while remaining competitive.

• Demand Outlook: The company remains vigilant on commodity cost movements and aggressive regional pricing. It aims to sustain profitable growth through focused investments in innovation, adjacencies, and brand strength, while preserving market leadership.

Sector Outlook: Cautious

Company Outlook & Guidance: As the near-term demand recovery would be gradual, we maintain our HOLD stance in the stock. However, we have increased our FY26/FY27 estimates.

Current Valuation: 48xMar-27 EPS (Earlier Valuation: 45xDec-26 EPS ).

Current TP: Rs 5,960/share (Earlier TP: Rs 5,130/share).

Recommendation: With an upside of 6% from the CMP, we maintain our HOLD stance

Financial Performance

Revenue grew by 9% YoY, reaching Rs 4,376 Cr, driven by price hikes and volume. Gross margins declined by 481 bps to 39.3% due to a steep rise in key commodity prices (milk, palm oil, cocoa). EBITDA margins stood at 18.2%, down by 118 bps, partly offset by higher operating leverage. Adjusted PAT was Rs 560 Cr, up 4% YoY.

Outlook: Near-term challenges persist due to several factors: (1) A subdued demand environment, (2) Underperformance in urban markets, particularly in metros and large cities, (3) Steep commodity inflation, especially in palm oil and other key raw materials, and (4) Rising competition. These headwinds are likely to weigh on Britannia’s topline growth and margins. Consequently, we expect the stock to remain range-bound and maintain our rating to HOLD.

Valuation & Recommendation:

Based on the above thesis, we estimate Revenue/EBITDA/PAT CAGR of 9.5%/10.5%/13.1% over FY24-27E. With an upside of 6% from the CMP, we maintain our stance to HOLD the stock with a revised TP of Rs 5,960/share.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ00016163