Buy Axis Bank Ltd For Target Rs. 1,300 By Emkay Global Financial Services

Axis Bank continues to report weak credit growth, which has now slipped to 9% YoY; this, along with margin contraction (of 6bps QoQ) and higher retail slippages (net at Rs29bn vs Rs22bn in 2Q) led to elevated provisions. However, operational cost too is on the decline QoQ, containing the earnings miss at 4% to Rs63bn/RoA@1.7%. Credit growth moderation was mainly driven by slowdown in the bank’s retail book (incl unsecured loans and corporate book), which is likely to stay soft amid liquidity and asset quality challenges. The mgmt believes unsecured loan stress will remain elevated near term, but seasonal stress in the agri portfolio should ease QoQ. Building in the slower credit growth and higher LLP, partly offset by moderating opex, we cut earnings by 3-9% over FY25-27E. The stock has seen sharp correction recently and trades at relatively lower valuations of 1.3x Dec-26E ABV for a bank still delivering healthy 1.7% RoA/14-16% RoE. Thus, we retain BUY, and cut our TP to Rs1,300 (from Rs1,400), valuing the SA bank at 1.7x Dec-26E ABV and subs at Rs110/sh.

Credit growth, margin slip further

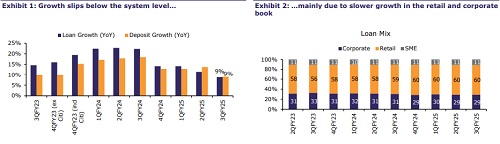

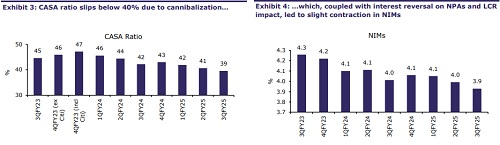

Axis Bank continues to report sluggish growth, well below the system’s, at 9% YoY/1.5% QoQ, due to a marked slowdown in its retail book, including unsecured loans and corporate book. However, SME book growth remains relatively higher at 15% YoY. Deposits growth too moderated further to 9% YoY/1% QoQ, with LDR at around 92.6% and CASA cannibalization continues, leading to fall in CASA ratio to 39.5%. NIM too slipped, by 6bps QoQ to 3.93%, including 3bps QoQ contribution from interest reversal on NPAs and 3bps due to higher LCR (up by 400bps QoQ to 119%). Axis Bank believes FY25 credit growth will be anchored by deposit growth/LDR, which is still a challenge. Thus, we cut our FY25 credit growth estimates further, to 7% from 12% earlier.

Slippages inch-up, but higher write-offs contain the NPAs

Gross slippages inched up QoQ to Rs54bn/2.3% of loans, while the bank continued to pursue an aggressive write-off policy leading to slight increase in GNPA ratio to 1.46%. Though corporate net slippages remain in the negative zone, retail net slippages inched up QoQ to Rs29bn vs Rs22bn in 2Q, which could be partly due to seasonally higher agri slippages and continued elevated unsecured retail slippages, including Cards, PL, and MFI loans. The bank’s specific PCR has moderated further to 76%, but the bank carries contingent provision buffer of Rs50bn/0.55% of loans. The bank claims that its CET 1 ratio (14.6%), including the contingent provision buffer, would be comfortable at 15%.

We retain BUY, and trim our TP to Rs1,300

Factoring in the slower credit growth and higher LLP, partly offset by moderating operational cost, we trim our earnings estimates by 3-9% over FY25-27. However, we retain BUY and cut our TP to Rs1,300 (from Rs1,400 earlier), now valuing the standalone bank at 1.7x Dec-26E ABV and subsidiaries at Rs110 per share. Key risks: Macrodislocation and more than expected stress in unsecured loans leading to slower-thanexpected growth/higher NPAs, and KMP attrition.

Source: Company, Emkay Research

Source: Company, Emkay Research

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354