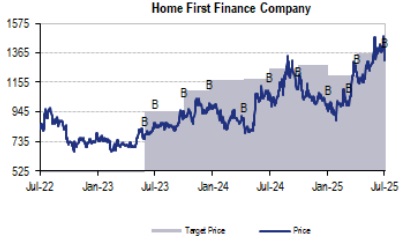

Buy Home First Finance Company Ltd For Target Rs. 1,500 By JM Financial Services

HFFC reported a strong PAT growth of +36%/+14% YoY/QoQ, +8% above JMFe, leading to healthy RoA/RoE of 3.7%/15%. However, seasonal asset quality deterioration was slightly higher than usual as stressed pool (stage 2+3) moved up +44bps QoQ. AUM growth was healthy at +29%/+6% YoY/QoQ while disbursements slowed down -2%/+7% QoQ/YoY. NIMs moved up +33bps QoQ leading to strong NII growth of +33%/+12% YoY/QoQ. Higher other income was partially offset by higher opex leading to PPoP growth of +41%/+16% YoY/QoQ. Credit cost was elevated at 0.36% (+11bps QoQ) as GS3/NS3 moved up +15bps/+17bps QoQ. Management highlighted that the uptick in stress was mainly in Surat/Coimbatore which is expected to improve in next 2 quarters and weaker disbursements was mainly in Apr’25 on account of muted growth in Tamil Nadu/Telangana. However, mgmt guidance for FY26E was maintained: i) ~26-30% AUM growth with disbursements of ~INR 56-58bn, ii) Opex/assets of 2.6-2.7% (vs 2.7% in 1QFY26) and iii) credit costs of 30- 40bps. We maintain BUY with a TP of INR 1,500 (3.2x FY27E BVPS).

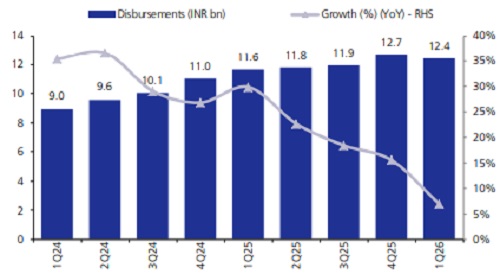

* Sustained growth momentum: AUM demonstrated steady growth, reaching INR 135bn (+29% YoY, +6% QoQ). However disbursements were weak at INR 12.4bn (+7% YoY, - 2% QoQ) mainly as Apr’25 disbursements were weak with muted disbursements from Tamil Nadu and Telangana. Overall, seasonality impact was higher during the quarter, However, management remains confident to do healthy disbursements of INR 56-58bn for FY26 which should lead to 26-30%AUM growth. The growth during the quarter was led by LAP (+45% YoY, +8% QoQ), followed by HL (+26% YoY, +6% QoQ). Shop loans were up +17% YoY, +3% QoQ. We build in AUM CAGR of ~25% over FY25-27E.

* Strong operating performance: PAT stood healthy at INR 1.2bn (+36% YoY, +14% QoQ) which was +8% above our estimates. This was driven by strong NII growth of +33% YoY, +12% QoQ as NIMs moved up +33bps QoQ. Spreads improved by +5bps QoQ led by +27bps QoQ increase in yield partially offset by +22bps QoQ increase in CoFs at 8.4% (vs its guidance of 8.5%). Operating profit came in at INR 1.7bn (8% above our estimates) mainly led by 14% increase in other income. Credit costs inched up by +11bps QoQ to 36bps. Mgmt. remains confident in their ability to sustain spreads within 5-5.25% on a steady state. 60% of the borrowings of the company are bank borrowings (Pvt+PSU) out of which ~20% is repo linked where company has started benefiting while MCLR linked borrowings will be repriced over next 2 quarters. Company also received credit rating upgrade from AA- to AA which will lead to further cost tailwinds. We expect EPS CAGR of ~28% over FY25-27E.

* Seasonal deterioration in asset quality: GS3/NS3 moved up +15bps/+17bps QoQ to 1.8%/1.4% largely due to seasonality while PCR declined 314bps to 22.0%. Stage 2 also moved up 29bps QoQ to 1.6% indicating early delinquencies. 1+ DPD was up +94bps QoQ to 5.4%. Management indicated that the stress was observed largely in Surat and Coimbatore which has already strted showing improvements. We revised our credit cost estimates +10bps for FY26 and expect avg credit costs of ~36bps over FY26-27E in line with management guidance of 30-40 bps

* Valuation and view: Though the stress was elevated during the quarter, we believe that the credit rating upgrade followed by rate cuts will result in healthy decline in CoFs to offer strong margin tailwinds which will offset an incremental credit costs over the near term. While recovery in the asset quality is expected soon, we revised our credit cost estimate upward by +10bps for FY26E. As mgmt guidance for FY26E was maintained: i) ~26-30% AUM growth with disbursements of ~INR 56-58bn, ii) Opex/assets of 2.6-2.7% (vs 2.7% in 1QFY26) and iii) credit costs of 30-40bps, we do not anticipate any major headwinds for the company given that the company operates in mainly secured nature of business. We maintain BUY with a TP of INR 1,500 (3.2x FY27E BVPS).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361