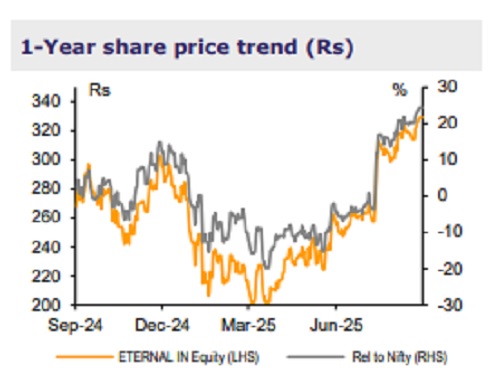

Buy Eternal Ltd for the Target Rs.330 by Emkay Global Financial Services Ltd

Amazon Now, the quick commerce (QCom) business of Amazon, has now expanded to Mumbai, after Bengaluru and Delhi. While the footprint remains small compared to incumbents’ – ~100 dark stores versus 1,544 for Blinkit and 1,062 for Swiggy, Amazon has the capital as well as the ambition to scale it up. However, we believe that incumbents are better placed – creating almost an entirely new supply chain for its QCom business will be a challenge for Amazon, given that incumbents have an advantage of being top-of-the mind recall apps for a large pool of customers. More competition is a feature of the land grab phase, in which adjacent players enter the market which drives market expansion and growth. While excessive competition will weigh on profitability, we expect consumer stickiness to help incumbents retain customers. Once industry growth slows down, we expect a consolidation phase to follow, which will result in sub-scale players folding operations and driving profitability. Blinkit is executing well in the QCom space. We retain BUY on Eternal with a target price of Rs330.

Amazon changing gear in QCom

Amazon is expanding its quick-commerce service—Amazon Now—to Mumbai, after pilots in Bengaluru (Dec-24) and expansion to Delhi (Jul-25). The company has already opened ~100 dark stores across select catchments to support ~10-minute delivery. The management says demand has exceeded expectations, with orders growing ~25% MoM, and prime customers’ order frequency tripling once they start using Amazon Now. Amazon Now sits inside the core Amazon app alongside Pay, Fresh, Bazaar, MX player, and Medical. While prior leadership treated QCom as a limited pilot, the new leadership has green-lit a scaled entry, based on pilot results.

Increasing competition a feature of the ‘land grab’ phase

After Flipkart and Reliance, Amazon is also entering the QCom business, which is currently dominated by Blinkit, Instamart, and Zepto. While this signals increased competition, it also demonstrates that modern trade and ecommerce players are seeing a real challenge posed by QCom. Increasing competitive intensity by entry of adjacent players is a feature of the land grab phase in any upcoming industry. A land grab phase typically expands the markets, and brings in innovation and efficiency. This phase will be followed by a consolidation phase, in which fringe players will look to exit once the industry growth rate slows down. Blinkit is executing well, with a significantly large scale, in terms of dark stores and consumer base. The company also has best unit economics leading to significantly better EBITDA margin versus peers. With Rs188.6bn cash, Eternal has enough reserve for marketing and dark store rollout. We retain BUY on the stock with DCF-based target price of Rs330.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH00000035