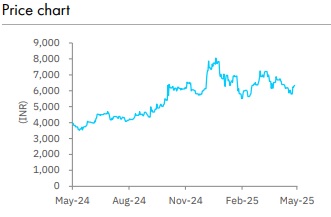

Buy Amber Enterprises Ltd for Target Rs. 8,290 by Elara Capitals

RAC slows down but overall outlook positive

Q4 was a decent quarter for Amber Enterprises (AMBER IN), mainly led by non-room air conditioner and electronics segments, despite lower-than-expected growth in the room air conditioner (RAC) segment. The management has guided for 30-40% topline growth in FY26 along with margin improvement – Margin target for the electronics segment is 10-12% in the next two years. AMBER expects to incur a capex of INR 30bn in the next five years for Printed Circuit Board (PCB) facilities, and INR 5bn towards railways and consumer durables segments to expand capacity. We upgrade AMBER to Buy (from Accumulate) with TP raised to INR 8,290 (from INR 7,840), on 52x March FY27E P/E. AMBER is in the process of becoming a diversified EMS company led by strong sectoral tailwinds and large capex towards highmargin PCB, which should prop future revenue visibility.

RAC – Slowdown led by early monsoons: The consumer durables segment (mainly comprising RACs) grew 27% YoY (lower-than-expected) in Q4FY25 due to delayed summers and early rains impacting demand. However, in FY25, RAC grew a robust 49% YoY, while non RAC components grew 31% YoY. AMBER enjoys a market share of 26-27% in RAC manufacturing as of FY25. It remains positive on RACs and expects to outpace industry growth by 10-12% given good offtake in April and May. AMBER expects to maintain doubledigit growth in this segment. The CAC category also crossed INR 2bn in turnover in FY25, led by an expanded customer base.

Electronics – On strong footing led by sectoral tailwinds: Electronics grew 74% YoY in Q4 and 77% YoY in FY25, led by strong sectoral tailwinds – Import substitution boosted by the government imposing anti-dumping duty up to six layer of PCBs. AMBER plans to apply for the components PLI. It expects to incur a capex of INR 30bn (INR 25bn for Korea circuits) in five years as part of the components PLI, of which 60-65% will be repaid by the government as part of the PLI. This investment is expected to have an asset turn of 2x+ due to government incentive, with 18-20% EBITDA margin. AMBER expects revenue from the PCB segment to reach INR 25bn by FY28. It also supplied 28,000+ washing machines in the year as part of its Resojet JV, which is still incurring losses (may break-even in FY26).

Railways – Decline continues but expect growth in FY26: The Railways segment declined 6% YoY in FY25 due to delay in metro and Vande Bharat projects. However, AMBER expects slight growth in FY26 as Vande Bharat projects are likely to see execution, with huge rampup in FY27. AMBER maintained its guidance of doubling revenue from Sidwal in two years. It is also increasing its product portfolio through the JV with Yujin, with trials expected in Q3FY26. The orderbook visibility is INR 20bn+.

Upgrade to Buy with higher TP of INR 8,290: We raise FY26E EPS by 3% but lower FY27E EPS by 2% on higher other expenses due to commissioning of new capex. We introduce FY28E. We upgrade AMBER to Buy with a higher TP of INR 8,290 (from INR 7,840) on 52x (unchanged) March FY27E P/E. AMBER is in the process of becoming a diversified EMS company with strong sectoral tailwinds and large capex towards high-margin PCB, which will provide future revenue visibility. Expect an earnings CAGR of 35% in FY25-28E, with average ROE of 18% in FY26E-28E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933