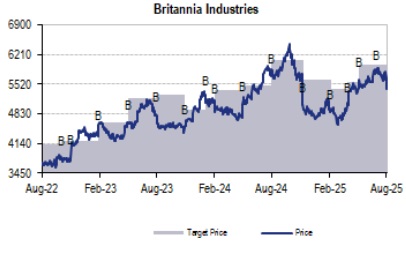

Buy Britannia Industries Ltd For Target Rs. 6,100 By JM Financial Services

Britannia June-Q earnings print was operationally below expectations. Revenue growth was inline although construct was different vs. what we envisaged – Price/mix growth was higher while volume growth at 2% (lower vs. our est. of 3% & vs. 4Q levels) was a disappointment, considering most of the staples companies have seen sequential uptick in volumes in the quarter. Gross margin delivery was below est. as price hikes were not commensurate to input cost inflation, which along with higher staff cost resulted in c.5-6% miss on EBITDA/PAT. Management expects revenue momentum to sustain (although still more price/mix led as volume recovery will be gradual) which along with benign RM led margin improvement should aid overall earnings growth in our view (we are factoring c.12% earnings CAGR over FY25-28E). Our earnings estimates remain largely unchanged; pace of recovery in volume & GM will be key monitorable. We roll forward, maintain BUY with revised TP of INR 6,100 (50x Sep’27 EPS). Any sharp dips should be used as opportunity to add.

* Inline revenue led by higher realisations as volume growth delivery was below estimate:

Britannia's 1QFY26 consolidated sales (excl. other op income) grew 9.8% yoy to INR 45.3bn (broadly inline). Volumes grew c.2% (lower vs. our expectation of +3%) while price-mix growth was higher at c.8% (JMFe: +6%), as price increases were actioned to counter inflation. Management attributed volume impact to grammage reduction in price pointed packs (c.60% of business comes from INR 10/15 SKU) while pack growth was 12%. It expects volume trajectory to gradually improve & volume-value gap of 6-8% to sustain for next 2-3 quarters. Adjacent categories continued to perform well - Croissant grew in mid 20s, Rusk, Wafers and Milkshakes grew in double digits while growth in Cake has been in single digit). In terms of regional performance, Hindi belt saw highdouble-digit growth while east region performance was impacted due to distribution restructuring.

* Weak gross margin and higher-than-expected staff cost drove earnings miss:

Consol. gross margin contracted by 260bps yoy (flat qoq) to 39.2% (JMfe:40.3%) – function of inflationary trends in key RM commodities (palm oil/cocoa) on yoy basis and lack of commensurate price hike. Management stated that impact of inflation is now largely covered by adequate prices hikes and no further upward pricing action is necessitated. Going forward, with RM moderating (benefit of palm oil moderation will be seen in Q2), it expects sequential uptick in gross margins. Staff costs remained at elevated levels and grew by 19.8% yoy, due to additional charge on revaluation of SAR (INR c.520mn negative impact in 1Q). This was partially offset by savings in other overheads (-2.8% yoy), as company restricted marketing spends to IPL & digital for Top 4 brands (we note that base quarter had higher than budgeted A&P spends). Resultant EBITDA remained flattish at INR 7.6bn with margin contraction of 155bps to 16.7% (below our estimate of 17.8%). Management remains confident on sustaining or improving EBITDA margins vs. FY25 levels.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361