Buy JK Cement Ltd For Target Rs. 7,300 By Emkay Global Financial Services Ltd

Robust quarter, robust momentum

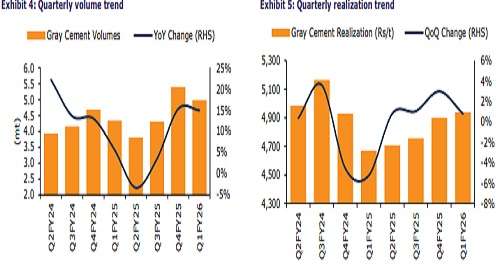

JK Cement (JKCE) reported standalone EBITDA of Rs6.75bn (up 41% YoY, albeit down 9% QoQ), beating our estimate (Rs5.9bn). Gray cement volumes were up ~15% YoY, despite the early monsoons, implying continued market share gains in core regions, incl the Bihar market. Volume growth was robust, coupled with mild pricing gains, as gray cement realization was up 0.8% QoQ (~Rs40/t). Realization gains with operating leverage benefits offset the inflation in variable costs, resulting in blended EBITDA/t of Rs1,247 (Emkay: Rs1,160), which is up 23% YoY and flat QoQ. JKCE is on track to commission the 4mtpa Panna clinker line-2 and 6mtpa grinding units (3mtpa each in Central India and Bihar) by Dec-25.

Enthused by JKCE’s strong volume growth and the industry’s pricing resilience in Q2FY25TD, we raise FY26E/27E EBITDA by ~9% each and introduce FY28 estimates. We value JKCE at 17x (unchanged) EV/EBITDA on Q1FY28E EBITDA (rolling forward basis) and arrive at revised up target price of Rs7,300 (earlier Rs6,375; up 14.5%); maintain BUY. Key risks: Decline in gray cement realization/demand or sharp rise in fuel costs.

Robust quarter

JKCE’s standalone EBITDA at Rs6.75bn (up 41% YoY, albeit down 9% QoQ) was above our estimate (Rs5.9bn). Gray cement volumes were up ~15% YoY (down ~8% QoQ) despite the monsoons arriving early in JKCE’s core regions, implying continued market share gains for the company. Strong volume growth did not deter realization gains, as gray cement realization was up 0.8% QoQ. Meanwhile, standalone non-cement revenue was up 50%/12% YoY/QoQ to ~Rs2bn, indicating buoyancy in paint revenue. Blended unit RM + power & fuel cost was down ~4% YoY, although it was up 6% QoQ (Rs120/t) due to consumption of high-cost fuel inventory during Q1FY26 (blended fuel consumption cost increased by Rs0.12/mn cal QoQ to Rs1.53/mn cal). Operating leverage benefits, coupled with mild realization gains, offset the fuel cost inflation, ensuring that unit profitability remained flat QoQ at Rs1,247 (Rs1,265 in Q4FY25) and was up 23% YoY. The difference between consolidated and standalone EBITDA stood at a positive Rs139mn (vs Rs284mn in Q4FY25 and Rs72mn in Q1FY25), with EBITDA margin at ~7%.

On track to achieve 30/50mtpa by FY26/30, respectively

During Q1FY26, JKCE increased its grinding capacity at Ujjain by 0.5mtpa via the debottlenecking process, taking the total installed capacity to ~25.3mtpa. The company is in the process of commissioning 6mtpa (3mtpa each in Central India and Bihar) grinding capacities by Dec-25, thereby increasing total capacity to >30mtpa. We assume the company will announce fresh capex plans in ensuing quarters, in its bid to reach the 50mtpa target. JKCE is likely to log ~12% volume CAGR over FY25-28E (above the estimated high single-digit industry growth).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354