Hold Mold-Tek Packaging For the Target Rs. 600 By the Axis Securites

Recommendation Rationale

Revenue growth driven by volumes and realisation: During the quarter, while volumes increased by 7.5%, overall revenue grew by 15.25%, indicating an improvement in average realisations. The volume growth was primarily driven by Food & FMCG-Packs (+12.02%) and Paints-Packs (+16.53%). The realisation improvement was supported by higher raw material prices as well as an increase in selling prices. Management expects realisations to improve further as higher-priced pharma products contribute more to the top line.

Margins recovery still awaited: EBITDA/Kg for the quarter stood at Rs 36.7/Kg, remaining below the company’s targeted levels. Delays in capacity ramp-up and additional expenses related to newer capacities continued to impact EBITDA margins during the quarter. While management expects EBITDA/Kg to improve as capacity utilisation increases (targeting Rs 40/Kg by FY26), it may still remain below Rs 38 for Q4FY25. Additionally, depreciation and interest expenses related to recent investments are further impacting margins at the PAT level. Going forward, improving capacity utilisation will be key to enhancing profitability on a per-unit basis

Sector Outlook: Neutra

Company Outlook & Guidance: The company’s volume growth rate is expected to improve gradually over the next few quarters as new capacities and products in FF, Paint, and Pharma Packaging start contributing significantly. While volume growth of ~8-9% is expected in FY25, strong momentum (double-digit) is anticipated from FY26 onwards. This growth is expected to be driven by Pharma capacities and an anticipated 40-50% increase in volumes from Aditya Birla Group. Additionally, the company is relying on higher utilisation and an improved product mix to achieve its target EBITDA/Kg of Rs 40 by FY26.

Current Valuation: 18x FY27E (Earlier: 22x FY27E)

Current TP: Rs 600/share (Earlier: Rs 785/share)

Recommendation: We maintain our HOLD rating on the stock.

Financial Performance: During Q3FY25, Mold-Tek Packaging posted a YoY revenue growth of 15%, broadly in line with our expectations. Volumes increased by 7.5% YoY. The company reported an EBITDA of Rs 34 Cr (up 12% YoY and 1% QoQ) but missed estimates by 7%. EBITDA per kg in Q3FY25 declined to Rs 36.72 per kg from Rs 39.64 per kg in Q2FY25. PAT stood at Rs 14 Cr, down 4% YoY and 2% QoQ, primarily due to significantly higher depreciation and finance costs associated with investments exceeding Rs 250 Cr made over the past two years.

Outlook: While we remain optimistic about Mold-Tek Packaging’s increasing contribution from the Pharma segment and customer additions, the margin improvement may be slower than expected. The company has made significant capacity additions, and the associated costs may continue to impact margins until a corresponding volume increase materialises. However, the company continues to gain momentum in Pharma and has been adding new clients, which is expected to drive volume growth. Additionally, we anticipate a steady improvement in realisation per kg going forward.

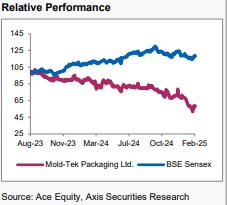

Valuation & Recommendation: We have revised our FY25 and FY26E estimates downwards to account for the delay in margin improvement. Accordingly, we now value the stock at 18x FY27E earnings (down from 25x FY26E earnings), resulting in a revised target price of Rs 600/share, implying an upside of 8% from the current market price (CMP). We maintain our HOLD rating on the stock.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633