Buy Pricol Ltd For Target Rs. 575 By Emkay Global Financial Services Ltd

Targets 3x revenue by FY30; rare earth crunch to hit near term

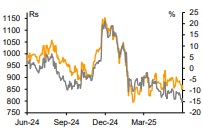

We met with Vikram Mohan (MD) and the senior management of Pricol, to delve into its business strategy/growth outlook; we also visited its R&D center and manufacturing plant. KTAs: 1) Pricol targets Rs80bn revenue by FY30 (Rs27bn in FY25), with ~12-13% EBITDAM ex-P3L (core business) and ~10% for P3L, while sustaining 20% RoCE. 2) Targets global #1 spot in 2W DIS by FY30 with 45-50% market share (#2, 37% now), while outpacing the 2W industry by 5- 10% aided by recent inroads in leading 2W Japanese OEMs like Honda, Suzuki; has also made requisite investment in manpower, R&D; targets 2x content per vehicle to Rs5k by FY30. 3) After 3Y of development, Pricol targets sharp rampup in disc-breaks (confirmed orders from OEMs) and is also developing CBS, ABS. 4) At P3L, aims to double revenue in 3Y (incl via inorganic), with 10% margin (7% in FY25). 5) Leveraging supplier consolidation, Pricol targets 30% domestic share in all 2W handlebar aggregates by FY30 via technical collaboration/licensing, with in-house development. 6) Industry fears potential ~30-50% OEM production cuts in Jul-Aug (5-10% cuts in Jun) on rare-earth magnet issue. We favor Pricol, on further improvement in its competitive positioning in a fast-premiumizing product category (ie clusters), apart from optionalities around breakthrough in PVs/expansion into other components backed by order wins (eg disc brakes), while sustaining +20% return ratios. Our estimates are unchanged (though rare earth magnet-led potential production cuts are a risk); retain BUY, TP of Rs575 (24x FY27E PER).

DIS: Aims for #1 global position backed by order wins with Honda, Suzuki

Strong R&D focus (~3-4% of sales; 50% of its engineering staff engaged in R&D) coupled with high vertical integration in products/processes (eg complete in-house manufacturing of tools, machines; in-house testing, including software) has driven Pricol’s robust competitive positioning (2nd largest player globally with ~37% market share, including over 40%/80% in 2Ws/CVs in India). It now aims for global leadership by FY30 with 45- 50% market share, aided by recent major inroads into Japanese OEMs (Honda, Suzuki; supply from Oct-25, Yamaha; audits done successfully), with major revenue accretion from FY28. Further, leveraging the ongoing supplier consolidation, it aims for 30% domestic share in all 2W handlebar aggregates (throttles, brake panels, switches, locks) by FY30, with kit value doubling to over Rs5k; it is pursuing tech transfer/licensing with foreign players (no JVs, to protect value), alongside in-house development.

ACFMS: Sharp ramp-up in disc brakes ahead

Pricol has greater focus on ACFMS, buoyed by robust product/process development capabilities to maintain frugal cost structures. On disc brakes, after 3Y of development, Pricol targets sharp ramp-up, backed by confirmed OEM orders; it is also developing combi brake system (CBS) and anti-lock brake system (ABS) – expects major topline traction from the 2 ventures after ~24M. On fuel pumps, Pricol has invested in developing more variants, and targets transitioning from assembly to full-scale manufacturing amid enhanced ICE visibility for 2Ws, with slower than earlier-expected EV penetration.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354