Buy Lodha Developers Ltd For Target Rs. 1,480 By JM Financial Services

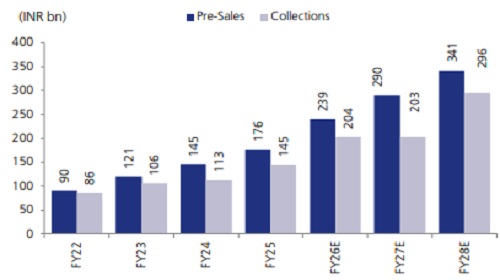

Lodha Developers reported inline pre-sales of INR 44.4bn (+10% YoY. -8% QoQ, 3% lower than JMFe) aided by INR 83bn worth of new launches across three cities, which accounted for c.33% of pre-sales. Bengaluru witnessed the highest growth with pre-sales of INR 9.8bn (up 8x YoY), surpassing its full-year FY25 figures. The company had the strongest quarter in terms of business development (BD) as it added five projects with a total GDV of INR 227bn. It has also identified NCR as its fourth focused market, with the first launch planned in FY27E. Despite the growing narrative on IT slowdown, the management highlighted that it continues to witness sustainable demand even during non-launch periods. We believe Lodha remains well placed to withstand temporary headwinds (if any) given the well diversified and growing presence in three of the top five markets in India. We maintain BUY with an unchanged TP of INR 1,480.

* Minor miss on pre-sales: Lodha reported bookings of INR 44.4bn (+10% YoY. -8% QoQ), slightly lower than our estimate of INR 46bn. Bengaluru witnessed the highest growth with pre-sales of INR 9.8bn (up 8x YoY) aided by healthy response to the new launches. Other key markets like South & Central Mumbai (INR 10n, +13% YoY. -31% QoQ) and Extended Eastern Suburbs (INR 9.5bn, +150% YoY, +51% QoQ) accounted for 23%/21% share respectively.

* Launch pipeline remains strong: In 1QFY26, Lodha launched 3.9msf across all three cities with GDV of INR 83bn. The company plans to launch INR 170bn (13.3msf) worth of inventory in the next 3 quarters (majorly in 2H) and remains confident of achieving its presales guidance of INR 210bn. Additionally, it also has an inventory of INR c. 330bn in the on-going and completed portfolio.

* Strong show on business development: In 1QFY26, Lodha added five new projects – 3 in MMR (2 in South Central and 1 in Western suburb) and 1 each in Pune (Kharadi) and Bengaluru (Devanahalli) with a total GDV of INR 227bn. Despite its limited presence in Bengaluru, the company was successful in adding a fairly large land parcel (70 acres) in one of the prominent micro-markets in the city. With these acquisitions, it has achieved c. 90% of full year guidance of INR 250bn. Lodha has identified NCR as its fourth focused market with the first launch planned in FY27E.

* Net debt marginally up due to record BD: Collections came in at INR 25bn (+8% YoY, - 37% QoQ) and it reported OCF of INR 10bn (+45% YoY, -59% QoQ). We note that 1Q has always been weakest in terms of cash flows given the seasonality. The outflow on BD was relatively high at INR 17bn given the record project additions. This led to an increase in net debt to INR 51bn (vs. INR 40bn in 4QFY25) and net D/E was stable at 0.25x.

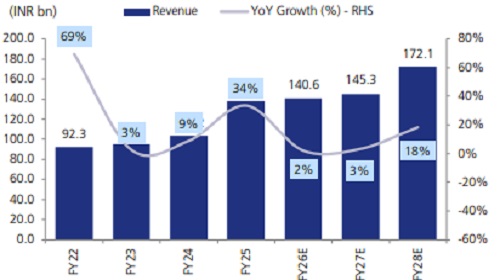

* Reported financials: Revenue for the quarter came in at INR 34.9bn (+23% YoY, -17% QoQ) while EBITDA was INR 9.8bn (+30% YoY, -19% QoQ) with margin of 28% (+160bps YoY, -70bps QoQ). The embedded margin for the bookings done in the quarter stood at 33%.

* Maintain ‘BUY’ with TP of INR 1,480: We believe Lodha remains well placed to withstand temporary headwinds (if any) given the well diversified and growing presence in three of the top five markets in India. We maintain BUY with an unchanged TP of INR 1,480.

Con-call Highlights

* The overall urban slowdown hasn’t impacted residential demand as is evident from a strong bookings run-rate of INR 2.7bn in a non-launch week – a key metric the company tracks to measure the strength of demand. The run-rate is up meaningfully compared to last year and will soon reach INR 3bn by end of FY26. While there is some slowdown in IT, the GCCs employment is only growing.

* Expect c. 55% of annual bookings guidance to be achieved in 2H, given the strong launch pipeline planned for the last 2 quarters.

* Since entering Bengaluru (FY24), the company has achieved cumulative bookings of INR 190bn, and it now has five projects in the city (vs. two in FY24). During 1QFY26, it signed a large project (70 acres) with a total GDV of INR 84bn, which showcases the strong brand acceptance of Lodha amongst the land owners in the market.

* Just like it did in Bengaluru, the company will go through a pilot phase in NCR during which the focus will be on building a strong local team and make inroads in the value chain.

* The NGT matter, which had impacted approvals in Mumbai, is scheduled to be heard in the Supreme Court in 2Q and a positive development could enable the company to scale up supply and comfortably achieve its pre-sales target.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361