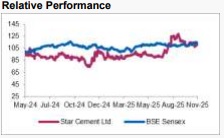

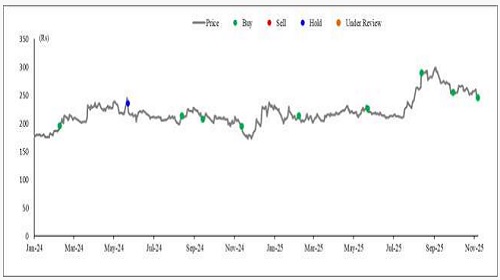

Buy Star Cement Ltd For the Target Rs.335 by Axis Securities Ltd

Beat On All Fronts; Outlook Remains Positive

Est. Vs. Actual for Q2FY26: Revenue – BEAT; EBITDA Margin – BEAT; PAT – BEAT

Change in Estimates post Q2FY26 (Abs)

FY26E/FY27E: Revenue: 1%/-1%; EBITDA: 15%/12%; PAT: 23%/15%

Recommendation Rationale

* Capacity Expansion Progressing Well: The Silchar Grinding Unit is expected to be commissioned by Q4FY26. These expansions will increase SCL’s total capacity to 9.7 mtpa from the existing 7.7 mtpa, providing substantial growth potential. The company is projected to grow its volume at a CAGR of 12% over FY25-27E.

* Strong Q2FY26 Performance: The company reported a strong consolidated net profit of Rs 72 Cr in Q2FY26, marking a robust 1,069% YoY increase from Rs 6 Cr in Q2FY25. Consolidated revenue was up 26% YoY to Rs 811 Cr, driven by higher cement volumes and improved margins. Furthermore, consolidated EBITDA surged 99% YoY to Rs 190 Cr, with the EBITDA per tonne for the cement division rising by 66% YoY to Rs 1,624. In this backdrop, we expect the company to report an EBITDA margin in the range of 22-23% and EBITDA/tonne growth of 11% CAGR over FY24-27E. This will be driven by higher volume growth and cement prices.

* Higher Cement Demand to Support Growth: Cement demand in East and North-East India is expected to see healthy growth over FY25-28, driven primarily by government-led infrastructure projects and a significant push for housing. The overall demand in the East is projected to grow at a compound annual growth rate (CAGR) of 8-9% during this period. The North-East, despite its weak infrastructural base, is poised for strong demand growth, having previously seen a CAGR of 7.5-8.5%.

Sector Outlook: Positive

Company Outlook & Guidance: The company has guided for 12-15% volume growth in FY26. Current prices are similar to Q2FY26 exit prices in North-East India and are marginally lower in East India. Prices are expected to be determined by market forces depending on demand. Both the East and North-East markets are showing strong traction in terms of Cement demand.

Current Valuation: 13.5x FY27E EV/EBITDA (Earlier Valuation: 13.5x FY27E EV/EBITDA)

Current TP: Rs 335/share (Earlier TP: Rs 325/share)

Recommendation: We maintain our BUY rating on the stock..

Alternative BUY Ideas from our Sector Coverage: UltraTech Cement (TP: Rs 13,900/Share), Dalmia Bharat (TP: Rs 2,550/Share), Ambuja Cement (TP: Rs 705/share), Shree Cement (TP: Rs 31,655/share), ACC (TP: Rs 2,390/share).

Financial Performance

.SCL reported a strong set of numbers for Q2FY26, driven by higher volumes, improved realisations, and lower cement production costs YoY. Volume, revenue, EBITDA, and PAT grew by 20%, 26%, 99%, and 1169%, respectively—beating expectations across the board. The company delivered an EBITDA margin of 23.4%, a sharp improvement from 14.9% in the previous year and ahead of estimates. Quarterly volumes reached 1.17 MnTPA, reflecting 20% YoY growth, supported by the ramp-up of new capacity and better EBITDA per tonne of Rs 1,624—up 66% YoY —surpassing expectations of Rs 1,492. Blended realisation per tonne rose to Rs 6,925, marking a 6% YoY increase. Cost per tonne declined to Rs 5,301, down 5% YoY, driven by lower cost.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)