Hold Avenue Supermarts Target Rs 3,923 - Prabhudas Liladhar Capital Ltd

Hyper competition, Rich valuations limit upside

Quick Pointers:

? High competitive intensity in FMCG impacted Gross margin while higher operational costs impacted profitability

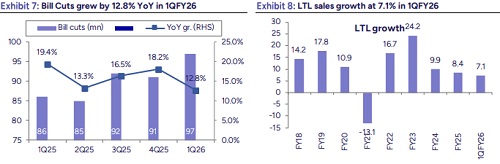

? LFL at 7.1%, Bill cuts/store/day declines 1.1% while Av Bill value up 3.1% despite deflation in FMCG

? GM&A share at 24.7% for 1QFY26 up by 210bps vs 22.26% in FY25

We cut our FY26/FY27 EPS estimates by 1.0%/1.9%, respectively, as we expect margin pressures to persist due to 1) Continued high competitive intensity driven by a consumer shift toward e-commerce and quick commerce platforms and 2) Accelerated store expansion in a subdued demand environment, softer gross margins, increased spending on customer service, and rising store-level wages, especially in metro areas.

D’Mart’s Q1 results missed estimates, as intense competition and higher overheads weighed on margins. Operational metrics remained stable in Q1, with sales per store and sales per square foot growing 1.9%/1.5% YoY. The cost of retail increased by 50 basis points on higher overheads. GMA proportion stabilized with 24.7% contribution in 1Q vs 24.89% in Q1FY25. D’Mart might see competition from Ecom/ QC in non-apparel GMA as they are trying to increase their presence in higher margin non-grocery segments.

D’Mart has opened 9 stores in 1QFY26, and we expect a further pick up in store openings to 60/65 in FY26/FY27. We believe the drag in the performance of FMCG products is temporary and should bounce back with easing inflation over the next 1-2 quarters. With high margins in base quarters over by 2Q26, 2H26 should report double-digit profit growth. We estimate 9.3% EPS growth in FY26 and 12.9% CAGR over FY25-27. We cut DCF based target price to Rs3923 (4063 earlier). We expect back ended returns given heightened competition in Food and Grocery retail. Maintain Hold.

Consol Revenues grew by 16.3% YoY to Rs163.6bn. Gross margins contracted by 28bps YoY to 15.3% (PLe:15.3%). EBITDA grew by 6.4% YoY to Rs13bn (PLe:Rs13.5bn). Margins contracted by 74bps YoY to 7.9%. (PLe:8.3%). Cost of Retail expanded by 46bps YoY to 7.4% due to high manpower cost inflation and full impact of stores opened in 4Q25. Adj PAT declined by 0.1% YoY to Rs7.7bn (PLe:Rs8.0bn). LFL (>2 years old stores) growth came at 7.1% YoY Sales/store grew by 1.9% to Rs380mn, while sales/ft increased by 1.5% YoY to Rs8779. Bill cuts came at 97mn while bills/store/day declined 1.1% to 2513. Average bill value increased by 3.1% which seems positive in a deflationary scenario

High competitive intensity impacted margins: In Q1, revenue was impacted by 100–150 basis points due to significant deflation across several staples and nonfood products. Gross margins were also impacted, as the FMCG space continued to experience rising competitive intensity. We believe margins are likely to remain under pressure in the near term, driven by 1) sustained competitive intensity in the FMCG sector and 2) higher overheads and wages to support growth.

Adds 9 stores in 1Q, store size higher QoQ: D’Mart added 9 stores (1 st UP store in Agra) in 1QFY26 vs 6 stores in 1Q25 taking the total store count to 424 with retail business area of 17.6mn sq. ft vs 17.2mn sqft in 4QFY25. The average area/ new store is 44.4k in Q1FY26 versus 39.2k sq ft in 4Q25 and 50k in 1Q25.

Share of GM&A stabilized: Share of Foods/Non FMCG/ GM&A came at 55.6%/19.67%/24.73% in Q1FY26 vs 54.81%/20.3%/24.89% in Q1FY25. Gen Merchandise share has stabilized, however pressure persist, and we believe loss in GM&A is structural in nature and QC shift towards nonfood and grocery will further add to competition and growth challenges.

Above views are of the author and not of the website kindly read disclaimer