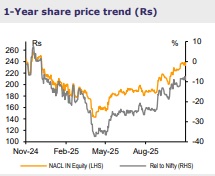

Buy National Aluminium Co Ltd for the Target Rs.270 By Emkay Global Financial Services Ltd

Robust Q2; lean-and-clean play on aluminium strength

We upgrade NACL to BUY from Add and revise our TP by ~13% to Rs270 (vs Rs240 earlier), which is premised on five factors: 1) net cash balance sheet allows it to run a hedge-free exposure, which helps in playing the aluminium cycle with limited consideration to company-specific constraints; 2) 50% of alumina is sold through long-term contracts that are typically priced at 14-16% of LME, essentially making the alumina exposure directionally linked to LME; 3) the business has delivered structural improvement in the cost base and is generating USD150/t alumina and USD1,200/t aluminium margins; 4) consensus estimates are too low and are due for a capitulation; 5) valuations have turned attractive on earnings upgrades. However, the commissioning timeline for the 1mt alumina project remains a key monitorable, given persistent delays in the past. NACL delivered a strong Q2 with EBITDA of Rs19.3bn (+29% QoQ; +28% vs Emkay; +30% vs consensus), led by robust alumina performance supported by lower caustic soda costs and higher volume.

Strong Q2 performance

NACL delivered strong Q2 results, with standalone EBITDA of Rs19.3bn (+29% QoQ; +28% vs Emkay; +30% vs consensus); the beat was led by the alumina segment (up 19.8% QoQ), which saw better-than-expected volumes, supported by lower alumina costs from reduced caustic soda consumption and cost. As a result, alumina EBITDA/t increased to USD149 in Q2 (up 17.8% QoQ). Aluminium segment profitability was also healthy, at Rs13.0bn of EBITDA, up 29.0% QoQ, aided by 7.1% QoQ increase in average aluminium prices during 2Q. NACL’s operating performance remained healthy in Q2—in terms of production volumes and cost profile, with EBITDA margin of 44.9% in Q2 vs 39.2% in Q1. The company announced interim dividend of Rs4/share.

Key takeaways from the earnings call

1) Alumina Project: NACL’s alumina refinery project is ~80% complete and on track for a Jun-26 commissioning, with Rs45bn spent and Rs6-7bn more to be incurred by March. The Pottangi mine is also slated to start by then. The refinery will add ~500kt output in FY27, deliver USD100–110/t steady-state margin, and operate with higher efficiency and lower manpower. 2) Q2 performance: Was volume-led, aided by sustainably lower alumina costs from reduced caustic-soda consumption and cost. Alumina margins stood at ~USD150/t, with ~50% spot sales and term contracts at USD350/t. 3) Q3 outlook: The outlook for Q3 is stable, with continued benefits from lower caustic-soda cost and steady alumina margin. The mgmt expects cost efficiencies to sustain, supported by captive coal availability and operational discipline. Employee costs are expected to decline to 15% (from 18%) of total the base, with productivity gains. 4) Others: Captive coal output was ~2mt in H1, meeting part of the 8.3mt requirement, with the rest sourced from MCL linkages. Landed coal cost stands at Rs1,600-1,700/t for both, captive and linkages, and no e-auction purchases were made.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

2.jpg)