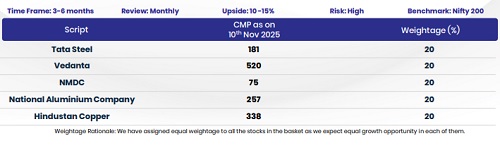

Basketonomix (BTX) : Metal Focus 5 Basket by Motilal Oswal Wealth Management

* Metal prices are gaining momentum amid weakening dollar, easing trade tensions between USChina and recent economic stimulus announced by China.

* China has implemented 45mt production cap and withdrawal of export rebates on aluminum resulting in tightening supply & prices climbing up 7–8% in Oct’25. This coupled with robust demand from clean energy and infrastructure sectors is expected to sustain market firmness ahead.

* According to media reports, Finance Ministry of India is proposing safeguard duty on steel at rates of 12%/11.5%/11% over the next three years. Meanwhile, US has included copper and silver in its critical metals list, signaling that global economy is entering into a new copper-silver supercycle.

* Tata Steel: TATA Steel stands to gain from improving steel price realizations, enhanced operating efficiencies and a strong domestic demand environment, while the safeguard duty implementation will further boost realizations in its Indian operations. Strong operating cash flow of INR 957 billion enables INR 160 billion annual expansion without increasing leverage, ensuring balance sheet discipline.

* Vedanta: Vedanta continues to demonstrate operational resilience across its metals and mining portfolio, supported by strategic expansions and cost optimization initiatives. In 2QFY26, the company reported EBITDA of INR114b (+16% YoY), driven by higher LME prices, improved premiums, and forex gains, with the aluminum segment outperforming expectations and Hindustan Zinc maintaining strong margins. Mgmt. highlighted ongoing capex, including Lanjigarh Train-2, BALCO smelter ramp-up, alongside disciplined capex & deleveraging plans, underpin a stronger 2H operational outlook.

* NMDC: NMDC reported a strong 2QFY26 performance with revenue up 30% YoY, driven by higher realizations despite softer volumes. Going forward, volumes are expected to rise steadily to ~51mt in FY27 and 54mt in FY28, aided by EC enhancements and stable realizations. NMDC’s ongoing capex toward evacuation and capacity projects is set to lift capacity to ~100mt by FY29-30. We are positive, given stable realization, healthy volume-led growth and strong OCF.

* National Aluminum Company: NALCO delivered a strong 2QFY26 performance, EBITDA at Rs.19.3b (+24% YoY), led by robust alumina volumes and favorable aluminum prices. Management guided FY26 alumina sales of 1.2–1.28mt and aluminum sales of 470kt. A Rs.300b capex plan through FY30 could significantly enhance production capacity. Strong fundamentals, zero debt, and a robust demand outlook for aluminum in India, underpin our strong outlook for NALCO.

* Hindustan Copper: Hindustan Copper is well-positioned to benefit from rising copper prices, which will enhance realization & boost EBITDA margins. Global copper market is facing tightening supply alongside surging demand from infrastructure, EVs and clean-energy deployment. With strategic capacity expansion underway & favorable commodity tailwinds, Hindustan Copper offers a compelling opportunity.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412