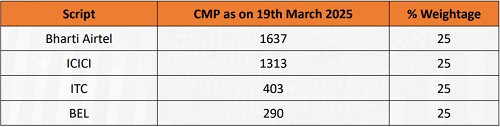

Smart Basket : FirstStep Bluechip Basket - Motilal Oswal Wealth Management

* This basket caters to investors who seek a balance between stable long-term growth and the safety of investing in leading blue-chip stocks.

* We have curated a basket of four fundamentally strong companies which are industry leaders, having a competitive edge and a healthy balance sheet.

* The constituent companies are diversifed across leading sectors like banking, consumption, telecom, capital goods and defence

Duration : 1-2 Years

* Bharti Airtel’s strong free cash flow (FCF) generation, driven by tariff hikes in the India wireless segment, has significantly strengthened its financial position. With capex intensity moderating and the full impact of tariff increases flowing through, the company is expected to generate INR 1.3 trillion in FCF over FY25-27. Having largely repaid high-cost debt, Bharti now has leverage under control, making capital allocation the key monitorable factor that will likely drive stock performance in the medium term.

* ICICI Bank is expanding its digital ecosystem and managing rising unsecured loan delinquencies. It maintains a stable deposit base, with a CASA ratio of 39%, ensuring liquidity strength. We estimate ~17% loan CAGR over FY24-27E. With steady RoA/RoE projections of 2.2%/16.8% for FY27 along with stable NIMs and investment in technology, ICICI Bank remains a top pick for its resilient performance and growth potential.

* ITC’s core business of cigarettes has shown steady performance. With stable taxes on cigarettes, we anticipate sustainable growth in this business. In the FMCG space, ITC enjoys industry-leading growth over peers due to its strong category presence (large unorganized mix, under-penetrated etc).

* Bharat Electronics is well-positioned to benefit from defense electronics opportunities, with key orders expected from QRSAM, MRSAM, next-generation corvettes, and P75/P75I. We forecast a 19% CAGR in revenue over FY24-27, driven by increased market share and indigenized offerings.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)