Accumulate Indraprastha Gas Ltd For Target Rs. 210 By Elara Capital

Weak volume growth continues

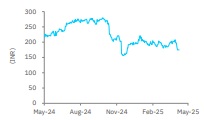

Indraprastha Gas (IGL IN) has corrected 3% in the past six months vs the Nifty Mid-Cap Index, which was down 4%, due to overhang of falling domestic administered-price-mechanism (APM) gas allocation, partly offset by the allocation of costlier new-well-gas (NWG) and reallocation of APM back to the city gas distribution (CGD) sector by the government. During FY26E, we expect PAT to grow +20% YoY due to the effect of delay in compressed natural gas (CNG) price hike amid rising gas cost and INR weakening. However, we remain cautious on the CGD sector as margin pressure is likely to remerge due to fall in APM gas supply and rising dependence on oil-linked NWG gas. We raise our TP to INR 210 due to normalization of EBITDA/scm margin with reduction in gas cost on INR strengthening in Q1FY26 and subdued crude oil prices at below USD 70/bb) that would keep oil-linked gas cost, such as NWG, high-pressure & high temperature (HPHT) and contracted LNG. We reiterate Reduce.

QoQ weak EBITDA recovery post APM reallocation: Q4FY25 adjusted PAT stood at INR 2.6bn vs our estimates of INR 3.0bn, down 31% YoY, on account of 30% decline in EBITDA/scm margin (although EBITDA/scm up 7% QoQ), partly offset by weak volume growth of 5% YoY. EBITDA at INR 3.8bn was in line with our estimates of INR 3.7bn, down 27% YoY. EBITDA grew 5% QoQ. Reported PAT was higher at INR 3.5bn as IGL reported reversal of an earlier INR 1.14bn provision regarding trade margin dispute with oil marketing companies (OMC).

Slight growth in adjusted EBITDA: Reported EBITDA/scm margin at INR 4.6/scm was in line with our expectations, which fell 30% YoY due to lower APM gas allocation and offset by higher priced spot LNG, HPHT and NWG gas, which resulted in a 11% jump in gas procurement cost to INR 36/scm while Q4 blended realization was up by a mere 3% YoY and up 4% QoQ.

Volume growth guidance at 10%; margin guidance tweaked: Q4 volume growth was subdued at 5% YoY to 9.2mmscmd vs our estimates of 9.5mmscmd versus 11-17% YoY growth during pre-COVID quarters of Q1FY17-Q3FY20. CNG volume growth was at 4% YoY to 6.7mmscmd while industrial PNG volume was up 7% YoY to 1.2mmscmd. The company’s growth plans took a hit, due to the sudden cut in APM allocation. Management has set a target of 10% volume growth in FY26. It says EBITDA/scm margin is likely to be INR 6-7/scm for the next 1-2 quarters and reiterated INR 7-8/scm guidance for long term.

Reiterate Reduce with a higher TP of INR 210: We retain FY26 EPS growth estimates of 30% due to base effect of subdued FY25 EPS, down 16% YoY. We assume EBITDA/scm will normalize during FY26-27 to ~INR 7.0/scm. We introduce FY28E EPS at INR 15.8, ascribing 11% YoY growth, assuming 8% gas volume growth and INR 7.3/scm EBITDA/scm. We raise our TP to INR 210 from INR 191 and reiterate Reduce. We expect APM gas allocation to drop to ~25% over next 2-3 years, due to an 8% YoY decline rate in ONGC APM gas production and +15% industry CNG volume. Hence, margin pressure on CNG segment would emerge, especially during rising crude oil price environment, as after 2-3 years 75% of gas for CNG would be linked to crude oil. Our DCF-based long-term EBITDA/scm margin is INR 7.3 (from INR 7.0), with a volume 8.0%CAGR (from 8.5%) during FY25-29E and 11.6% WACC (unchanged).

Please refer disclaimer at Report

SEBI Registration number is INH000000933