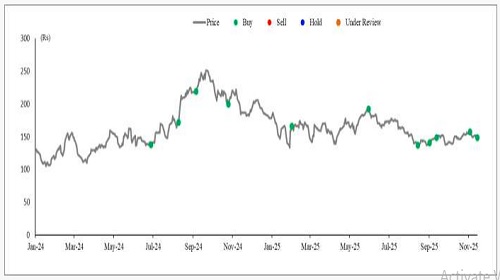

Buy Inox Wind Ltd For Target Rs. 190 - Axis Securities Ltd

Q2 Largely In Line with Consensus; H2FY26 Execution Under Focus

Est. Vs. Actual for Q2FY26: Revenue - BEAT; EBITDA - BEAT; PAT - BEAT

Change in Estimates post Q2FY26

FY26E/FY27E: Revenue: 0%/0%; EBITDA: 0%/0%, PAT: -22%/-4%

Recommendation Rationale

* Largely In Line Q2: EBITDA came in at Rs 228 Cr (up 32%/24% YoY/QoQ), in line with consensus and ahead of our estimates, driven by stronger-than-expected execution at 202 GW (vs. our estimate at 190 GW). EBITDA margin stood at 20% ahead of the 18-19% guidance.

* Strong Orderbook and Sustained Visibility: Orderbook stands at 3,235 MW (marginally up from 3,108 MW in Q1FY26), driven by 380 MW of inflows vs. 348 MW supplies in H1FY26. It received order inflows of 329 MW in Q2. The orderbook ensures 18-24 months of execution visibility and consists of 1.4 GW of equipment-supply and 1.8 GW of turnkey orders. Inox is securing long-term 1 GW+ of recurring annual orders through its Group IPP, which has hybrid RE installation plans of 3 GW+ annually, which provide visibility for 500-700 MW of annual orders over the next several years and the balance from other companies, where it is in the final stages of closing multiple framework agreements. These partnerships/framework agreements should ensure order stability.

* Execution Pick-up in H2FY26 will be Critical: Execution stood a 202 MW, up 44%/38% YoY/QoQ (6% beat). In H1FY26, execution stood at 348 MW (~30% of the 1,200 MW full-year FY26 target), requiring ~70%, i.e. 852 MW, to be executed in H2FY26 (Historically, ~65-70% of execution is skewed towards H2). Management reiterated its confidence to achieve the 1,200 MW guidance for FY26, citing its new Nacelle manufacturing facility in Kalyangarh has gone live, Cranes are being deployed across sites, and transformer manufacturing is being ramped up.

* IGESL: Inox Green is on track to become India's largest RE O&M company, with its portfolio now at ~12.5 GW (10 GW wind, 2.5 GW solar) following the acquisition of 6.5 GW of wind assets. These numbers will consolidate in FY27, expectedly driving a manifold increase in profitability compared to FY26. The company targets a 17 GW O&M portfolio within the next two years.

Sector Outlook: Positive

Company Outlook & Guidance: Management expressed confidence in achieving its execution guidance of 1.2/2 GW for FY26/FY27. Capex guidance for FY26 stands at Rs 200 Cr.

Current Valuation: 29x (from 30x) Sep’27E EPS (Roll forward from Mar’27)

Current TP: Rs 190/share (Unchanged)

Recommendation: We maintain our BUY recommendation on the stock.

Financial Performance: Inox Wind’s Q2FY26 EBITDA stood in line with consensus. Revenue stood at Rs 1,119 Cr, up 53%/35% YoY/QoQ, missing consensus by 11%. The company's EBITDA stood at Rs 228 Cr, up 32%/24% YoY/QoQ, in line with consensus. EBITDA margin stood at 20%, down 327 bps/188 bps YoY/QoQ but ahead of the guidance range of 18-19%. PAT stood at Rs 121 Cr, up 34%/24% YoY/QoQ, 9% largely in line with the consensus.

Outlook: The company’s strong orderbook and favourable wind sector outlook provide long-term revenue visibility. However, with a steep 70% balance expected execution, maintaining execution discipline will remain a key monitorable.

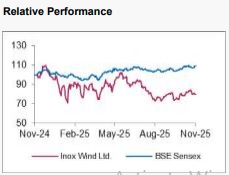

Valuation & Recommendation: We assign a target P/E multiple of 29x (From 30x) to our Sep’27 EPS estimate (roll forward from Mar’27). After adjusting for the minority stake in Inox Green Energy Services Ltd and Resco Global (~8%), we arrive at a TP of Rs 190/share (unchanged). We maintain our BUY rating on the stock, with a potential upside of 28% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)