Buy Zensar Technologies Ltd for the Target Rs. 1,130 by Choice Institutional Equities

Business overview:

ZENT is a leading technology solutions company which provides innovative digital solutions to help clients achieve their business goals. Its core philosophy is ‘Experience-led Everything’ and is committed to conceptualsing, designing, engineering, marketing & managing digital solutions and experiences for over 145 leading enterprises. Headquartered in Pune, India, ZENT is a RPG Group company, build lasting relationships with large customers, such as Cisco, National Grid, Fujitsu, Marks & Spencer, Danaher Corporation, Electronic Arts & Logitech. The company’s headcount stands at 10,500, in more than 30 locations worldwide, including Milpitas, Seattle, Princeton, Cape Town, London, Zurich, Singapore & Mexico City.

What gives ZENT a competitive edge over its mid-cap peers?

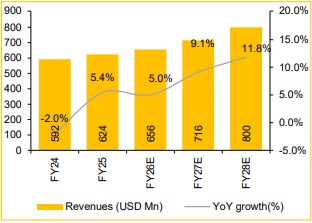

* ZENT’s growth is propelled by strategic initiatives & differentiated services. It’s focussed offering — Advanced Engineering, Data Engineering & Analytics, Experience Services & Cloud Infrastructure & Security — grew 8.2% YoY in FY25, surpassing overall growth of 5.4%. These services, tailored to suit large clients, are driving double-digit growth in non-TMT verticals.

* Strong cash position augurs well for strategic acquisitions & investments – ZENT’s strong cash position of USD 315.7 Mn (Q1FY26), with USD 29 Mn dividend pending, enables strategic M&As & future investments. Past acquisitions, such as M3bi (2021) & BridgeView Lifesciences (2025) enhanced capabilities in Data Analytics & Healthcare (Veeva systems), reflecting a prudent, innovation-driven capital allocation strategy.

* Large deal wins, driven by a strong sales incentive plan & internal platform, yield 60–65% net new wins & lower client concentration risk. Emphasis on AI-led, innovative deals over vendor consolidation further enhance the company’s market position & competitiveness.

* ZENT aims to be an AI-first organisation, with 30% of its pipeline AI-driven. Its AI playbook includes offering, such as AI Amber, AI Engineering Buddy (in partnership with Microsoft) & The Vinci AIOps platform. Its advanced Agentic RAG solution enables action-oriented Agentic AI capabilities, while ZenLabs drives R&D to drive innovation for costefficient tech solutions.

Why invest in ZENT ?

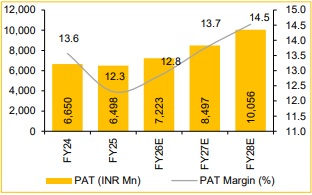

ZENT's performance in H1FY26E is likely to face pressure due to tariff-related headwinds, particularly in the Manufacturing & Consumer Services (MCS) vertical. However, with macro conditions expected to improve in H2FY26E, driven by anticipated Fed rate cuts, ZENT is well-positioned to benefit from a rebound in technology spending. The company is focusing on AI-led, innovative deals over vendor consolidation, distinguishing itself from peers. Its GenAI accelerator, Zen’s AI, is gaining traction, contributing to a strong pipeline — 30% of active deals are AI-driven, accounting for 20% of TCV. In Q1FY26, TCV grew 11.7% YoY to USD 172 Mn, with longer deal tenures and higher ACVs. Vertical-wise, Telecom, BFSI & Healthcare saw sequential growth, while MCS declined, but is expected to rebound in Q2FY26E. Regional outlook is mixed, with Europe set to recover & Africa seeing positive signs under new leadership. ZENT holds a robust cash balance of USD 315.7 Mn, supporting future M&A & strategic investments. Thus, we believe ZENT remains well-placed for long-term growth as we project Revenue/EBITDA/PAT to expand at a CAGR of 8.6%/ 11.9%/ 15.6%, respectively, over FY25-FY28E.

Valuation:

We currently have a ‘BUY’ rating on the stock, with a Target Price of INR 1,130.

Key risks:

Delayed strategic acquisition may hinder potential growth story: Strong cash reserves position ZENT well for strategic M&As amid global uncertainty. ZENT remains cautious, targeting margin & EPS-accretive deals, but any prolonged delay could impact its profitability & long-term growth potential.

Non-TMT client concentration risk: Although client concentration is improving, reliance on large non-TMT clients for double-digit growth poses a risk if key accounts reduce spending or shift priorities away from ZENT's core offering.

Slower TCV conversion: Amidst global macro-economic challenges, there is a possibility of delay in clients spending, thereby slowing down the actual revenue conversions from TCV won, which, we believe, could be a key risk factor to the company’s growth & profitability in FY26E.

Revenue expected to expand at 8.6% CAGR (FY25-28E)

PAT expected to expand at 15.6% CAGR over FY25-28E

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131