Buy ACME Solar Ltd for the Target Rs. 385 by Ashika Institutional Equities Research

Strong Project Pipeline, De-risked Biz Model and Policy Thrust Bode Well; Initiate with BUY

Key Triggers

* India’s Renewable Energy (RE) sector is witnessing strong momentum with annual capacity addition of ~30GW. The country aims 500GW non-fossil fuel capacity by 2030, aided by favourable policy and regulatory environment.

* ACME operates ~2.9GW of capacity (mostly solar) with an underconstruction pipeline of ~4.1GW. It targets 10GW by 2030 and has secured land and grid connectivity for full pipeline.

* Nearly all projects are backed by 25-year fixed-tariff PPAs with central/state bodies. Notably, the share of central off-takers has been steadily rising.

* ACME’s portfolio enjoys long-term cash flows visibility, giving it a natural edge in a rising cost environment.

* With ~Rs77bn refinanced at better rate, ACME has shown prudent financial management. Further, Rs165bn debt is sanctioned for under-construction capacity. Its proactive refinancing boosts FCF and aids growth capital needs.

Valuation & Outlook

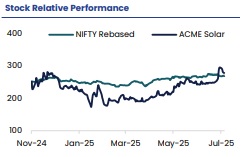

ACME Solar aims to expand its operational capacity from ~2.9GW currently to ~4.9GW by FY27. We believe its 10GW target by FY30 seems to be conservative, given its strong execution track record and expanding pipeline. Its strategy of locking 25-year PPAs is driving better cash flow visibility and reducing receivable days. This de-risked business model is likely to aid robust earnings momentum, with EBITDA expected to clock ~66% CAGR over FY25-27E. Notably, CROCE, currently in the 14–15% range, is likely to improve to 18-20% over the next 2 years, aided by scale from upcoming capacity and better working capital cycles. Unlike previous power sector rallies, the current policy thrust clearly favours RE, and places ACME well to in the new energy landscape. Given its strong project pipeline, predictable cash flows and alignment with government priorities, we initiate coverage on ACME Solar with BUY and a Target Price of Rs385, valuing the stock at 12.5x of FY27E EV/EBITDA.

Above views are of the author and not of the website kindly read disclaimer